VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated fi nancial statements<br />

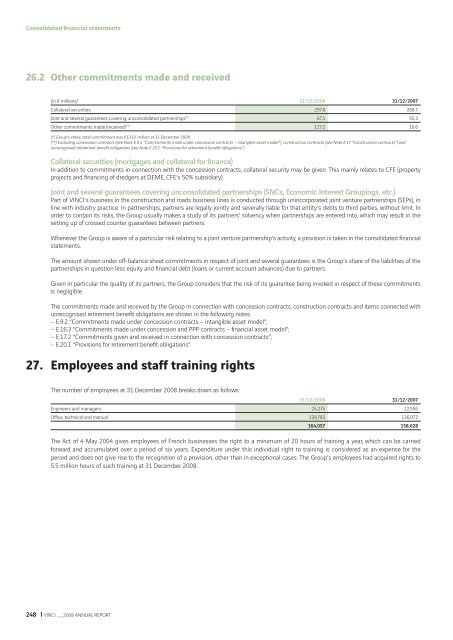

26.2 Other commitments made and received<br />

(in € millions) 31/12/<strong>2008</strong> 31/12/2007<br />

Collateral securities 297.8 268.7<br />

Joint and several guarantees covering unconsolidated partnerships (*) 67.1 55.3<br />

Other commitments made (received) (**) 127.2 16.6<br />

(*) Group’s share, total commitment was €131.6 million at 31 December <strong>2008</strong>.<br />

(**) Excluding concession contracts (see Note E.9.2 “Commitments made under concession contracts – intangible asset model”), construction contracts (see Note E.17 “Construction contracts”) and<br />

unrecognised retirement benefi t obligations (see Note E.20.1 “Provisions for retirement benefi t obligations”).<br />

Collateral securities (mortgages and collateral for fi nance)<br />

In addition to commitments in connection with the concession contracts, collateral security may be given. This mainly relates to CFE (property<br />

projects and fi nancing of dredgers at DEME, CFE’s 50% subsidiary).<br />

Joint and several guarantees covering unconsolidated partnerships (SNCs, Economic Interest Groupings, etc.)<br />

Part of <strong>VINCI</strong>’s business in the construction and roads business lines is conducted through unincorporated joint venture partnerships (SEPs), in<br />

line with industry practice. In partnerships, partners are legally jointly and severally liable for that entity’s debts to third parties, without limit. In<br />

order to contain its risks, the Group usually makes a study of its partners’ solvency when partnerships are entered into, which may result in the<br />

setting up of crossed counter guarantees between partners.<br />

Whenever the Group is aware of a particular risk relating to a joint venture partnership’s activity, a provision is taken in the consolidated fi nancial<br />

statements.<br />

The amount shown under off -balance sheet commitments in respect of joint and several guarantees is the Group’s share of the liabilities of the<br />

partnerships in question less equity and fi nancial debt (loans or current account advances) due to partners.<br />

Given in particular the quality of its partners, the Group considers that the risk of its guarantee being invoked in respect of these commitments<br />

is negligible.<br />

The commitments made and received by the Group in connection with concession contracts, construction contracts and items connected with<br />

unrecognised retirement benefi t obligations are shown in the following notes:<br />

– E.9.2 “Commitments made under concession contracts – intangible asset model”;<br />

– E.16.3 “Commitments made under concession and PPP contracts – fi nancial asset model”;<br />

– E.17.2 “Commitments given and received in connection with concession contracts”;<br />

– E.20.1 “Provisions for retirement benefi t obligations”.<br />

27. Employees and staff training rights<br />

The number of employees at 31 December <strong>2008</strong> breaks down as follows:<br />

31/12/<strong>2008</strong> 31/12/2007<br />

Engineers and managers 24,274 22,556<br />

Offi ce, technical and manual 139,783 136,072<br />

164,057 158,628<br />

The Act of 4 May 2004 gives employees of French businesses the right to a minimum of 20 hours of training a year, which can be carried<br />

forward and accumulated over a period of six years. Expenditure under this individual right to training is considered as an expense for the<br />

period and does not give rise to the recognition of a provision, other than in exceptional cases. The Group’s employees had acquired rights to<br />

5.5 million hours of such training at 31 December <strong>2008</strong>.<br />

248 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT