VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

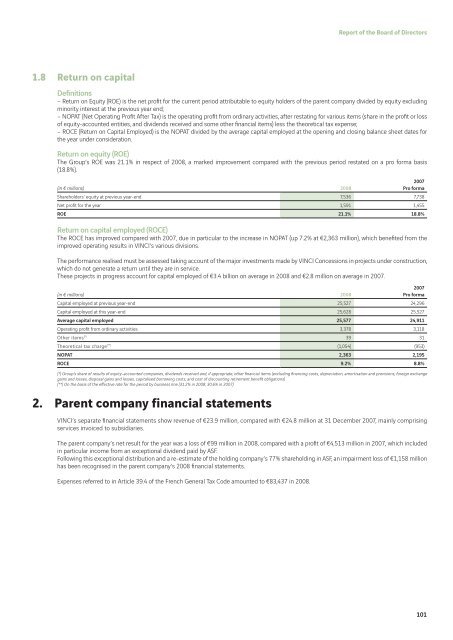

1.8 Return on capital<br />

Defi nitions<br />

– Return on Equity (ROE) is the net profi t for the current period attributable to equity holders of the parent company divided by equity excluding<br />

minority interest at the previous year end;<br />

– NOPAT (Net Operating Profi t After Tax) is the operating profi t from ordinary activities, after restating for various items (share in the profi t or loss<br />

of equity-accounted entities, and dividends received and some other fi nancial items) less the theoretical tax expense;<br />

– ROCE (Return on Capital Employed) is the NOPAT divided by the average capital employed at the opening and closing balance sheet dates for<br />

the year under consideration.<br />

Return on equity (ROE)<br />

The Group’s ROE was 21.1% in respect of <strong>2008</strong>, a marked improvement compared with the previous period restated on a pro forma basis<br />

(18.8%).<br />

(in € millions) <strong>2008</strong><br />

2007<br />

Pro forma<br />

Shareholders’ equity at previous year-end 7,536 7,738<br />

Net profi t for the year 1,591 1,455<br />

ROE 21.1% 18.8%<br />

Return on capital employed (ROCE)<br />

The ROCE has improved compared with 2007, due in particular to the increase in NOPAT (up 7.2% at €2,363 million), which benefi ted from the<br />

improved operating results in <strong>VINCI</strong>’s various divisions.<br />

The performance realised must be assessed taking account of the major investments made by <strong>VINCI</strong> Concessions in projects under construction,<br />

which do not generate a return until they are in service.<br />

These projects in progress account for capital employed of €3.4 billion on average in <strong>2008</strong> and €2.8 million on average in 2007.<br />

(in € millions) <strong>2008</strong><br />

2007<br />

Pro forma<br />

Capital employed at previous year-end 25,527 24,296<br />

Capital employed at this year-end 25,628 25,527<br />

Average capital employed 25,577 24,911<br />

Operating profi t from ordinary activities 3,378 3,118<br />

Other items (*) 39 31<br />

Theoretical tax charge (**) (1,054) (953)<br />

NOPAT 2,363 2,195<br />

ROCE 9.2% 8.8%<br />

(*) Group’s share of results of equity-accounted companies, dividends received and, if appropriate, other fi nancial items (excluding fi nancing costs, depreciation, amortisation and provisions, foreign exchange<br />

gains and losses, disposal gains and losses, capitalised borrowing costs, and cost of discounting retirement benefi t obligations)<br />

(**) On the basis of the eff ective rate for the period by business line (31.2% in <strong>2008</strong>; 30.6% in 2007)<br />

2. Parent company financial statements<br />

<strong>VINCI</strong>’s separate fi nancial statements show revenue of €23.9 million, compared with €24.8 million at 31 December 2007, mainly comprising<br />

services invoiced to subsidiaries.<br />

The parent company’s net result for the year was a loss of €99 million in <strong>2008</strong>, compared with a profi t of €4,513 million in 2007, which included<br />

in particular income from an exceptional dividend paid by ASF.<br />

Following this exceptional distribution and a re-estimate of the holding company’s 77% shareholding in ASF, an impairment loss of €1,158 million<br />

has been recognised in the parent company’s <strong>2008</strong> fi nancial statements.<br />

Expenses referred to in Article 39.4 of the French General Tax Code amounted to €83,437 in <strong>2008</strong>.<br />

Report of the Board of Directors<br />

101