VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated fi nancial statements<br />

ASF has a syndicated bank credit facility of €1 billion maturing in 2012, subject to various fi nancial covenants, (see Note 22.2.5 Financial<br />

covenants). On 18 December 2006, ASF agreed a new sven-year credit line with a bank syndicate for €2 billion. At 31 December <strong>2008</strong>, these<br />

lines were used for €218 million.<br />

Cofi route has a confi rmed bank credit facility of €1 billion, expiring in 2011. This facility is not subject to fi nancial covenants and was not in use<br />

at 31 December <strong>2008</strong>.<br />

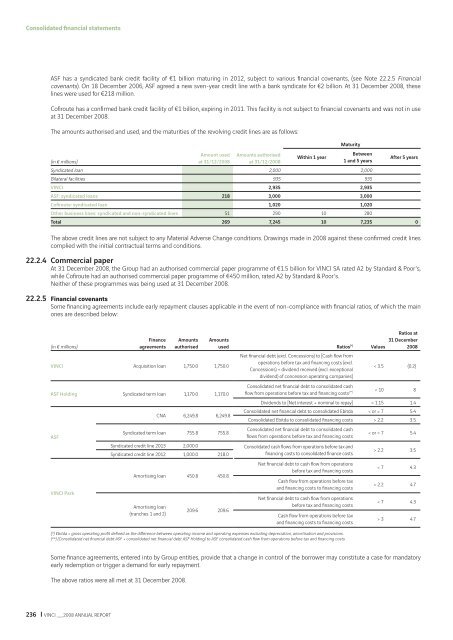

The amounts authorised and used, and the maturities of the revolving credit lines are as follows:<br />

(in € millions)<br />

Amount used<br />

at 31/12/<strong>2008</strong><br />

Amounts authorised<br />

at 31/12/<strong>2008</strong><br />

Within 1 year<br />

Maturity<br />

Between<br />

1 and 5 years<br />

After 5 years<br />

Syndicated loan 2,000 2,000<br />

Bilateral facilities 935 935<br />

<strong>VINCI</strong> 2,935 2,935<br />

ASF: syndicated loans 218 3,000 3,000<br />

Cofi route: syndicated loan 1,020 1,020<br />

Other business lines: syndicated and non-syndicated lines 51 290 10 280<br />

Total 269 7,245 10 7,235 0<br />

The above credit lines are not subject to any Material Adverse Change conditions. Drawings made in <strong>2008</strong> against these confi rmed credit lines<br />

complied with the initial contractual terms and conditions.<br />

22.2.4 Commercial paper<br />

At 31 December <strong>2008</strong>, the Group had an authorised commercial paper programme of €1.5 billion for <strong>VINCI</strong> SA rated A2 by Standard & Poor’s,<br />

while Cofi route had an authorised commercial paper programme of €450 million, rated A2 by Standard & Poor’s.<br />

Neither of these programmes was being used at 31 December <strong>2008</strong>.<br />

22.2.5 Financial covenants<br />

Some fi nancing agreements include early repayment clauses applicable in the event of non-compliance with fi nancial ratios, of which the main<br />

ones are described below:<br />

(in € millions)<br />

236 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT<br />

Finance<br />

agreements<br />

Amounts<br />

authorised<br />

<strong>VINCI</strong> Acquisition loan 1,750.0 1,750.0<br />

ASF Holding Syndicated term loan 1,170.0 1,170.0<br />

ASF<br />

<strong>VINCI</strong> Park<br />

CNA 6,249.8 6,249.8<br />

Syndicated term loan 755.8 755.8<br />

Amounts<br />

used Ratios (*) Values<br />

Net fi nancial debt (excl. Concessions) to [Cash fl ow from<br />

operations before tax and fi nancing costs (excl.<br />

Concessions) + dividend received (excl. exceptional<br />

dividend) of concession operating companies]<br />

Ratios at<br />

31 December<br />

<strong>2008</strong><br />

< 3.5 (0.2)<br />

Consolidated net fi nancial debt to consolidated cash<br />

fl ow from operations before tax and fi nancing costs (**) < 10 8<br />

Dividends to [Net interest + nominal to repay] > 1.15 1.4<br />

Consolidated net fi nancial debt to consolidated Ebitda < or = 7 5.4<br />

Consolidated Ebitda to consolidated fi nancing costs > 2.2 3.5<br />

Consolidated net fi nancial debt to consolidated cash<br />

fl ows from operations before tax and fi nancing costs<br />

< or = 7 5.4<br />

Syndicated credit line 2013 2,000.0 Consolidated cash fl ows from operations before tax and<br />

Syndicated credit line 2012 1,000.0 218.0<br />

fi nancing costs to consolidated fi nance costs<br />

Net fi nancial debt to cash fl ow from operations<br />

before tax and fi nancing costs<br />

Amortising loan 450.8 450.8<br />

Cash fl ow from operations before tax<br />

and fi nancing costs to fi nancing costs<br />

Amortising loan<br />

(tranches 1 and 2)<br />

209.6 209.6<br />

Net fi nancial debt to cash fl ow from operations<br />

before tax and fi nancing costs<br />

Cash fl ow from operations before tax<br />

and fi nancing costs to fi nancing costs<br />

(*) Ebitda = gross operating profi t defi ned as the diff erence between operating income and operating expenses excluding depreciation, amortisation and provisions.<br />

(**) (Consolidated net fi nancial debt ASF + consolidated net fi nancial debt ASF Holding) to ASF consolidated cash fl ow from operations before tax and fi nancing costs<br />

> 2.2 3.5<br />

< 7 4.3<br />

> 2.2 4.7<br />

< 7 4.3<br />

> 3 4.7<br />

Some fi nance agreements, entered into by Group entities, provide that a change in control of the borrower may constitute a case for mandatory<br />

early redemption or trigger a demand for early repayment.<br />

The above ratios were all met at 31 December <strong>2008</strong>.