VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Report of the Board of Directors<br />

When it presented its <strong>2008</strong> earnings, <strong>VINCI</strong> did not continue to refer to this 2006-2009 plan, which was established on the basis of assumptions<br />

made in a diff erent economic context, except for the 2009 targets for Ebitda margins on revenue for ASF (67%) and Cofi route (69%), which were<br />

confi rmed under the assumption of stabilisation of toll revenues between <strong>2008</strong> and 2009. Realisation of this assumption remains dependent on<br />

traffi c trends in 2009 as a whole.<br />

2.2 Trends 2009<br />

There has been no material change in the Group’s fi nancial and commercial position since 31 December <strong>2008</strong>.<br />

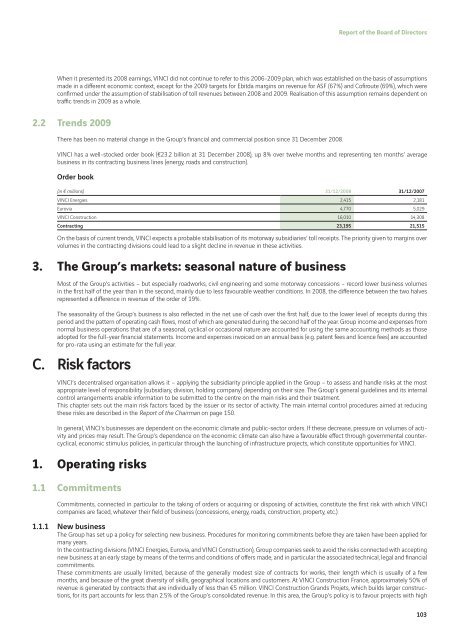

<strong>VINCI</strong> has a well-stocked order book (€23.2 billion at 31 December <strong>2008</strong>), up 8% over twelve months and representing ten months’ average<br />

business in its contracting business lines (energy, roads and construction).<br />

Order book<br />

(in € millions) 31/12/<strong>2008</strong> 31/12/2007<br />

<strong>VINCI</strong> Energies 2,415 2,181<br />

Eurovia 4,770 5,029<br />

<strong>VINCI</strong> Construction 16,010 14,308<br />

Contracting 23,195 21,515<br />

On the basis of current trends, <strong>VINCI</strong> expects a probable stabilisation of its motorway subsidiaries’ toll receipts. The priority given to margins over<br />

volumes in the contracting divisions could lead to a slight decline in revenue in these activities.<br />

3. The Group’s markets: seasonal nature of business<br />

Most of the Group’s activities – but especially roadworks, civil engineering and some motorway concessions – record lower business volumes<br />

in the fi rst half of the year than in the second, mainly due to less favourable weather conditions. In <strong>2008</strong>, the diff erence between the two halves<br />

represented a diff erence in revenue of the order of 19%.<br />

The seasonality of the Group’s business is also refl ected in the net use of cash over the fi rst half, due to the lower level of receipts during this<br />

period and the pattern of operating cash fl ows, most of which are generated during the second half of the year. Group income and expenses from<br />

normal business operations that are of a seasonal, cyclical or occasional nature are accounted for using the same accounting methods as those<br />

adopted for the full-year fi nancial statements. Income and expenses invoiced on an <strong>annual</strong> basis (e.g. patent fees and licence fees) are accounted<br />

for pro-rata using an estimate for the full year.<br />

C. Risk factors<br />

<strong>VINCI</strong>’s decentralised organisation allows it – applying the subsidiarity principle applied in the Group – to assess and handle risks at the most<br />

appropriate level of responsibility (subsidiary, division, holding company) depending on their size. The Group’s general guidelines and its internal<br />

control arrangements enable information to be submitted to the centre on the main risks and their treatment.<br />

This chapter sets out the main risk factors faced by the issuer or its sector of activity. The main internal control procedures aimed at reducing<br />

these risks are described in the Report of the Chairman on page 150.<br />

In general, <strong>VINCI</strong>’s businesses are dependent on the economic climate and public-sector orders. If these decrease, pressure on volumes of activity<br />

and prices may result. The Group’s dependence on the economic climate can also have a favourable eff ect through governmental countercyclical,<br />

economic stimulus policies, in particular through the launching of infrastructure projects, which constitute opportunities for <strong>VINCI</strong>.<br />

1. Operating risks<br />

1.1 Commitments<br />

Commitments, connected in particular to the taking of orders or acquiring or disposing of activities, constitute the fi rst risk with which <strong>VINCI</strong><br />

companies are faced, whatever their fi eld of business (concessions, energy, roads, construction, property, etc.).<br />

1.1.1 New business<br />

The Group has set up a policy for selecting new business. Procedures for monitoring commitments before they are taken have been applied for<br />

many years.<br />

In the contracting divisions (<strong>VINCI</strong> Energies, Eurovia, and <strong>VINCI</strong> Construction), Group companies seek to avoid the risks connected with accepting<br />

new business at an early stage by means of the terms and conditions of off ers made, and in particular the associated technical, legal and fi nancial<br />

commitments.<br />

These commitments are usually limited, because of the generally modest size of contracts for works, their length which is usually of a few<br />

months, and because of the great diversity of skills, geographical locations and customers. At <strong>VINCI</strong> Construction France, approximately 50% of<br />

revenue is generated by contracts that are individually of less than €5 million. <strong>VINCI</strong> Construction Grands Projets, which builds larger constructions,<br />

for its part accounts for less than 2.5% of the Group’s consolidated revenue. In this area, the Group’s policy is to favour projects with high<br />

103