VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

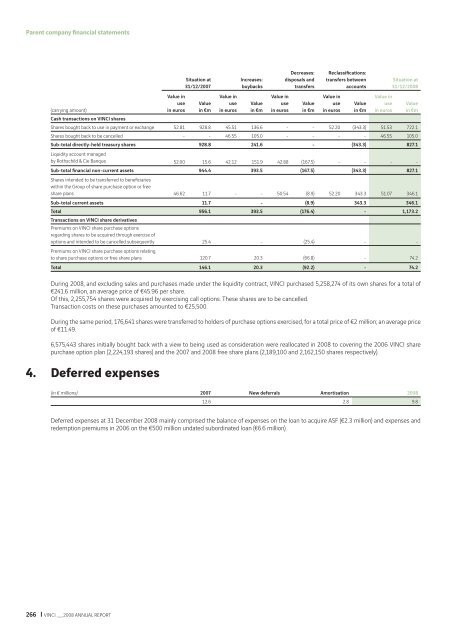

Parent company fi nancial statements<br />

(carrying amount)<br />

Cash transactions on <strong>VINCI</strong> shares<br />

266 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT<br />

Value in<br />

use<br />

in euros<br />

Situation at<br />

31/12/2007<br />

Value<br />

in €m<br />

Value in<br />

use<br />

in euros<br />

Increases:<br />

buybacks<br />

Value<br />

in €m<br />

Value in<br />

use<br />

in euros<br />

Decreases:<br />

disposals and<br />

transfers<br />

Value<br />

in €m<br />

Reclassifi cations:<br />

transfers between<br />

accounts<br />

Value in<br />

use<br />

in euros<br />

Value<br />

in €m<br />

Value in<br />

use<br />

in euros<br />

Situation at<br />

31/12/<strong>2008</strong><br />

Shares bought back to use in payment or exchange 52.81 928.8 45.51 136.6 - - 52.20 (343.3) 51.53 722.1<br />

Shares bought back to be cancelled - - 46.55 105.0 - - - - 46.55 105.0<br />

Sub-total directly-held treasury shares<br />

Liquidity account managed<br />

928.8 241.6 - (343.3) 827.1<br />

by Rothschild & Cie Banque 52.00 15.6 42.12 151.9 42.88 (167.5) - - - -<br />

Sub-total fi nancial non-current assets<br />

Shares intended to be transferred to benefi ciaries<br />

within the Group of share purchase option or free<br />

944.4 393.5 (167.5) (343.3) 827.1<br />

share plans 46.62 11.7 - - 50.54 (8.9) 52.20 343.3 51.07 346.1<br />

Sub-total current assets 11.7 - (8.9) 343.3 346.1<br />

Total<br />

Transactions on <strong>VINCI</strong> share derivatives<br />

Premiums on <strong>VINCI</strong> share purchase options<br />

regarding shares to be acquired through exercise of<br />

956.1 393.5 (176.4) - 1,173.2<br />

options and intended to be cancelled subsequently<br />

Premiums on <strong>VINCI</strong> share purchase options relating<br />

25.4 - (25.4) - -<br />

to share purchase options or free share plans 120.7 20.3 (66.8) - 74.2<br />

Total 146.1 20.3 (92.2) - 74.2<br />

During <strong>2008</strong>, and excluding sales and purchases made under the liquidity contract, <strong>VINCI</strong> purchased 5,258,274 of its own shares for a total of<br />

€241.6 million, an average price of €45.96 per share.<br />

Of this, 2,255,754 shares were acquired by exercising call options. These shares are to be cancelled.<br />

Transaction costs on these purchases amounted to €25,500.<br />

During the same period, 176,641 shares were transferred to holders of purchase options exercised, for a total price of €2 million; an average price<br />

of €11.49.<br />

6,575,443 shares initially bought back with a view to being used as consideration were reallocated in <strong>2008</strong> to covering the 2006 <strong>VINCI</strong> share<br />

purchase option plan (2,224,193 shares) and the 2007 and <strong>2008</strong> free share plans (2,189,100 and 2,162,150 shares respectively).<br />

4. Deferred expenses<br />

(in € millions) 2007 New deferrals Amortisation <strong>2008</strong><br />

12.6 2.8 9.8<br />

Deferred expenses at 31 December <strong>2008</strong> mainly comprised the balance of expenses on the loan to acquire ASF (€2.3 million) and expenses and<br />

redemption premiums in 2006 on the €500 million undated subordinated loan (€6.6 million).<br />

Value<br />

in €m