VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated fi nancial statements<br />

19.2 Performance shares<br />

On 11 December 2007, <strong>VINCI</strong>’s Board of Directors granted, with eff ect from 2 January <strong>2008</strong>, 2,165,700 existing performance shares to some<br />

eligible employees and company offi cers, bringing the number of performance share plans in place in <strong>VINCI</strong> to two.<br />

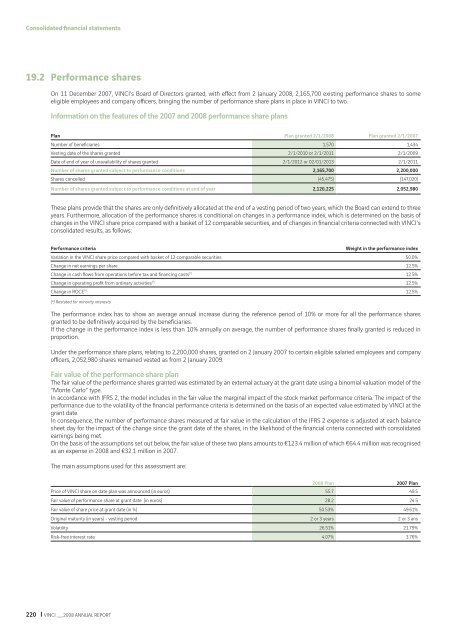

Information on the features of the 2007 and <strong>2008</strong> performance share plans<br />

Plan Plan granted 2/1/<strong>2008</strong> Plan granted 2/1/2007<br />

Number of benefi ciaries 1,570 1,434<br />

Vesting date of the shares granted 2/1/2010 or 2/1/2011 2/1/2009<br />

Date of end of year of unavailability of shares granted 2/1/2012 or 02/01/2013 2/1/2011<br />

Number of shares granted subject to performance conditions 2,165,700 2,200,000<br />

Shares cancelled (45,475) (147,020)<br />

Number of shares granted subject to performance conditions at end of year 2,120,225 2,052,980<br />

These plans provide that the shares are only defi nitively allocated at the end of a vesting period of two years, which the Board can extend to three<br />

years. Furthermore, allocation of the performance shares is conditional on changes in a performance index, which is determined on the basis of<br />

changes in the <strong>VINCI</strong> share price compared with a basket of 12 comparable securities, and of changes in fi nancial criteria connected with <strong>VINCI</strong>’s<br />

consolidated results, as follows:<br />

Performance criteria Weight in the performance index<br />

Variation in the <strong>VINCI</strong> share price compared with basket of 12 comparable securities 50.0%<br />

Change in net earnings per share 12.5%<br />

Change in cash fl ows from operations before tax and fi nancing costs (*) 12.5%<br />

Change in operating profi t from ordinary activities (*) 12.5%<br />

Change in ROCE (*) 12.5%<br />

(*) Restated for minority interests<br />

The performance index has to show an average <strong>annual</strong> increase during the reference period of 10% or more for all the performance shares<br />

granted to be defi nitively acquired by the benefi ciaries.<br />

If the change in the performance index is less than 10% <strong>annual</strong>ly on average, the number of performance shares fi nally granted is reduced in<br />

proportion.<br />

Under the performance share plans, relating to 2,200,000 shares, granted on 2 January 2007 to certain eligible salaried employees and company<br />

offi cers, 2,052,980 shares remained vested as from 2 January 2009.<br />

Fair value of the performance share plan<br />

The fair value of the performance shares granted was estimated by an external actuary at the grant date using a binomial valuation model of the<br />

“Monte Carlo” type.<br />

In accordance with IFRS 2, the model includes in the fair value the marginal impact of the stock market performance criteria. The impact of the<br />

performance due to the volatility of the fi nancial performance criteria is determined on the basis of an expected value estimated by <strong>VINCI</strong> at the<br />

grant date.<br />

In consequence, the number of performance shares measured at fair value in the calculation of the IFRS 2 expense is adjusted at each balance<br />

sheet day for the impact of the change since the grant date of the shares, in the likelihood of the fi nancial criteria connected with consolidated<br />

earnings being met.<br />

On the basis of the assumptions set out below, the fair value of these two plans amounts to €123.4 million of which €64.4 million was recognised<br />

as an expense in <strong>2008</strong> and €32.1 million in 2007.<br />

The main assumptions used for this assessment are:<br />

<strong>2008</strong> Plan 2007 Plan<br />

Price of <strong>VINCI</strong> share on date plan was announced (in euros) 55.7 49.5<br />

Fair value of performance share at grant date (in euros) 28.2 24.5<br />

Fair value of share price at grant date (in %) 50.53% 49.61%<br />

Original maturity (in years) - vesting period 2 or 3 years 2 or 3 ans<br />

Volatility 26.51% 21.79%<br />

Risk-free interest rate 4.07% 3.76%<br />

220 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT