VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

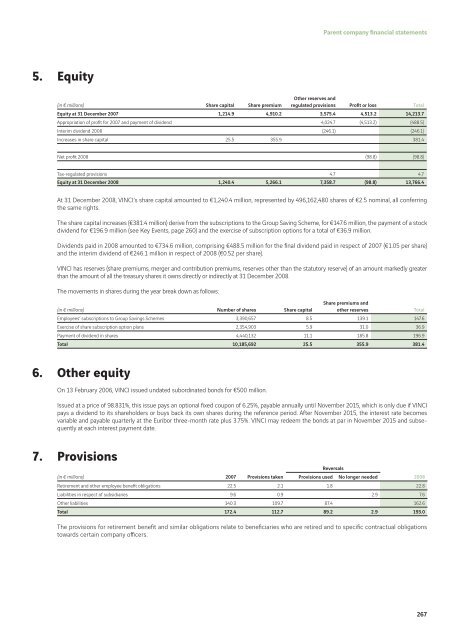

5. Equity<br />

(in € millions) Share capital Share premium<br />

Parent company fi nancial statements<br />

Other reserves and<br />

regulated provisions Profi t or loss Total<br />

Equity at 31 December 2007 1,214.9 4,910.2 3,575.4 4,513.2 14,213.7<br />

Appropriation of profi t for 2007 and payment of dividend 4,024.7 (4,513.2) (488.5)<br />

Interim dividend <strong>2008</strong> (246.1) (246.1)<br />

Increases in share capital 25.5 355.9 381.4<br />

Net profi t <strong>2008</strong> (98.8) (98.8)<br />

Tax-regulated provisions 4.7 4.7<br />

Equity at 31 December <strong>2008</strong> 1,240.4 5,266.1 7,358.7 (98.8) 13,766.4<br />

At 31 December <strong>2008</strong>, <strong>VINCI</strong>’s share capital amounted to €1,240.4 million, represented by 496,162,480 shares of €2.5 nominal, all conferring<br />

the same rights.<br />

The share capital increases (€381.4 million) derive from the subscriptions to the Group Saving Scheme, for €147.6 million, the payment of a stock<br />

dividend for €196.9 million (see Key Events, page 260) and the exercise of subscription options for a total of €36.9 million.<br />

Dividends paid in <strong>2008</strong> amounted to €734.6 million, comprising €488.5 million for the fi nal dividend paid in respect of 2007 (€1.05 per share)<br />

and the interim dividend of €246.1 million in respect of <strong>2008</strong> (€0.52 per share).<br />

<strong>VINCI</strong> has reserves (share premiums, merger and contribution premiums, reserves other than the statutory reserve) of an amount markedly greater<br />

than the amount of all the treasury shares it owns directly or indirectly at 31 December <strong>2008</strong>.<br />

The movements in shares during the year break down as follows:<br />

(in € millions) Number of shares Share capital<br />

Share premiums and<br />

other reserves Total<br />

Employees’ subscriptions to Group Savings Schemes 3,390,657 8.5 139.1 147.6<br />

Exercise of share subscription option plans 2,354,903 5.9 31.0 36.9<br />

Payment of dividend in shares 4,440,132 11.1 185.8 196.9<br />

Total 10,185,692 25.5 355.9 381.4<br />

6. Other equity<br />

On 13 February 2006, <strong>VINCI</strong> issued undated subordinated bonds for €500 million.<br />

Issued at a price of 98.831%, this issue pays an optional fi xed coupon of 6.25%, payable <strong>annual</strong>ly until November 2015, which is only due if <strong>VINCI</strong><br />

pays a dividend to its shareholders or buys back its own shares during the reference period. After November 2015, the interest rate becomes<br />

variable and payable quarterly at the Euribor three-month rate plus 3.75%. <strong>VINCI</strong> may redeem the bonds at par in November 2015 and subsequently<br />

at each interest payment date.<br />

7. Provisions<br />

Reversals<br />

(in € millions) 2007 Provisions taken Provisions used No longer needed <strong>2008</strong><br />

Retirement and other employee benefi t obligations 22.5 2.1 1.8 22.8<br />

Liabilities in respect of subsidiaries 9.6 0.9 2.9 7.6<br />

Other liabilities 140.3 109.7 87.4 162.6<br />

Total 172.4 112.7 89.2 2.9 193.0<br />

The provisions for retirement benefi t and similar obligations relate to benefi ciaries who are retired and to specifi c contractual obligations<br />

towards certain company offi cers.<br />

267