VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated fi nancial statements<br />

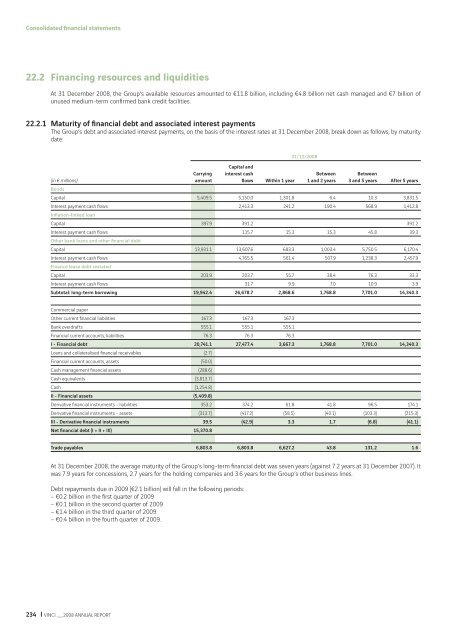

22.2 Financing resources and liquidities<br />

At 31 December <strong>2008</strong>, the Group’s available resources amounted to €11.8 billion, including €4.8 billion net cash managed and €7 billion of<br />

unused medium-term confi rmed bank credit facilities.<br />

22.2.1 Maturity of fi nancial debt and associated interest payments<br />

The Group’s debt and associated interest payments, on the basis of the interest rates at 31 December <strong>2008</strong>, break down as follows, by maturity<br />

date:<br />

234 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT<br />

31/12/<strong>2008</strong><br />

Carrying<br />

Capital and<br />

interest cash<br />

Between Between<br />

(in € millions)<br />

Bonds<br />

amount<br />

fl ows Within 1 year 1 and 2 years 3 and 5 years After 5 years<br />

Capital 5,409.5 5,150.0 1,301.8 6.4 10.3 3,831.5<br />

Interest payment cash fl ows<br />

Infl ation-linked loan<br />

2,413.3 241.2 190.4 568.9 1,412.8<br />

Capital 397.9 391.2 391.2<br />

Interest payment cash fl ows<br />

Other bank loans and other fi nancial debt<br />

115.7 15.3 15.3 45.8 39.3<br />

Capital 13,931.1 13,607.6 683.3 1,003.4 5,750.5 6,170.4<br />

Interest payment cash fl ows<br />

Finance lease debt restated<br />

4,765.5 561.4 507.9 1,238.3 2,457.9<br />

Capital 203.9 203.7 55.7 38.4 76.3 33.3<br />

Interest payment cash fl ows 31.7 9.9 7.0 10.9 3.9<br />

Subtotal: long-term borrowing 19,942.4 26,678.7 2,868.6 1,768.8 7,701.0 14,340.3<br />

Commercial paper<br />

Other current fi nancial liabilities 167.3 167.3 167.3<br />

Bank overdrafts 555.1 555.1 555.1<br />

Financial current accounts, liabilities 76.3 76.3 76.3<br />

I - Financial debt 20,741.1 27,477.4 3,667.3 1,768.8 7,701.0 14,340.3<br />

Loans and collateralised fi nancial receivables (2.7)<br />

Financial current accounts, assets (50.0)<br />

Cash management fi nancial assets (288.6)<br />

Cash equivalents (3,813.7)<br />

Cash (1,254.8)<br />

II - Financial assets (5,409.8)<br />

Derivative fi nancial instruments - liabilities 353.2 374.2 61.8 41.8 96.5 174.1<br />

Derivative fi nancial instruments - assets (313.7) (417.2) (58.5) (40.1) (103.3) (215.3)<br />

III - Derivative fi nancial instruments 39.5 (42.9) 3.3 1.7 (6.8) (41.1)<br />

Net fi nancial debt (I + II + III) 15,370.8<br />

Trade payables 6,803.8 6,803.8 6,627.2 43.8 131.2 1.6<br />

At 31 December <strong>2008</strong>, the average maturity of the Group’s long-term fi nancial debt was seven years (against 7.2 years at 31 December 2007). It<br />

was 7.9 years for concessions, 2.7 years for the holding companies and 3.6 years for the Group’s other business lines.<br />

Debt repayments due in 2009 (€2.1 billion) will fall in the following periods:<br />

– €0.2 billion in the fi rst quarter of 2009<br />

– €0.1 billion in the second quarter of 2009<br />

– €1.4 billion in the third quarter of 2009<br />

– €0.4 billion in the fourth quarter of 2009.