VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Parent company fi nancial statements<br />

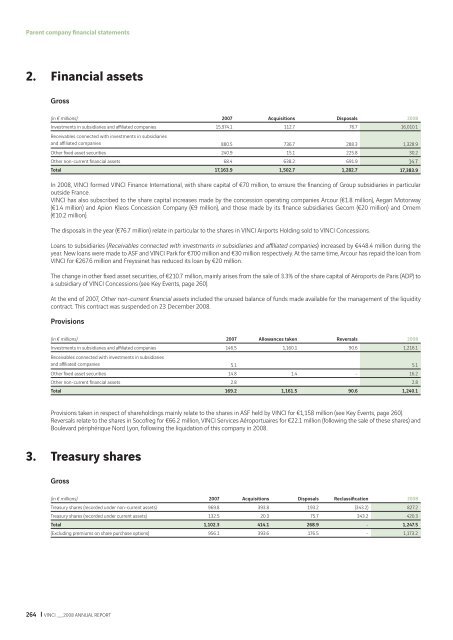

2. Financial assets<br />

Gross<br />

(in € millions) 2007 Acquisitions Disposals <strong>2008</strong><br />

Investments in subsidiaries and affi liated companies 15,974.1 112.7 76.7 16,010.1<br />

Receivables connected with investments in subsidiaries<br />

and affi liated companies 880.5 736.7 288.3 1,328.9<br />

Other fi xed asset securities 240.9 15.1 225.8 30.2<br />

Other non-current fi nancial assets 68.4 638.2 691.9 14.7<br />

Total 17,163.9 1,502.7 1,282.7 17,383.9<br />

In <strong>2008</strong>, <strong>VINCI</strong> formed <strong>VINCI</strong> Finance International, with share capital of €70 million, to ensure the fi nancing of Group subsidiaries in particular<br />

outside France.<br />

<strong>VINCI</strong> has also subscribed to the share capital increases made by the concession operating companies Arcour (€1.8 million), Aegan Motorway<br />

(€1.4 million) and Apion Kleos Concession Company (€9 million), and those made by its fi nance subsidiaries Gecom (€20 million) and Ornem<br />

(€10.2 million).<br />

The disposals in the year (€76.7 million) relate in particular to the shares in <strong>VINCI</strong> Airports Holding sold to <strong>VINCI</strong> Concessions.<br />

Loans to subsidiaries (Receivables connected with investments in subsidiaries and affi liated companies) increased by €448.4 million during the<br />

year. New loans were made to ASF and <strong>VINCI</strong> Park for €700 million and €30 million respectively. At the same time, Arcour has repaid the loan from<br />

<strong>VINCI</strong> for €267.6 million and Freyssinet has reduced its loan by €20 million.<br />

The change in other fi xed asset securities, of €210.7 million, mainly arises from the sale of 3.3% of the share capital of Aéroports de Paris (ADP) to<br />

a subsidiary of <strong>VINCI</strong> Concessions (see Key Events, page 260).<br />

At the end of 2007, Other non-current fi nancial assets included the unused balance of funds made available for the management of the liquidity<br />

contract. This contract was suspended on 23 December <strong>2008</strong>.<br />

Provisions<br />

(in € millions) 2007 Allowances taken Reversals <strong>2008</strong><br />

Investments in subsidiaries and affi liated companies<br />

Receivables connected with investments in subsidiaries<br />

146.5 1,160.1 90.6 1,216.1<br />

and affi liated companies 5.1 5.1<br />

Other fi xed asset securities 14.8 1.4 - 16.2<br />

Other non-current fi nancial assets 2.8 2.8<br />

Total 169.2 1,161.5 90.6 1,240.1<br />

Provisions taken in respect of shareholdings mainly relate to the shares in ASF held by <strong>VINCI</strong> for €1,158 million (see Key Events, page 260).<br />

Reversals relate to the shares in Socofreg for €66.2 million, <strong>VINCI</strong> Services Aéroportuaires for €22.1 million (following the sale of these shares) and<br />

Boulevard périphérique Nord Lyon, following the liquidation of this company in <strong>2008</strong>.<br />

3. Treasury shares<br />

Gross<br />

(in € millions) 2007 Acquisitions Disposals Reclassifi cation <strong>2008</strong><br />

Treasury shares (recorded under non-current assets) 969.8 393.8 193.2 (343.2) 827.2<br />

Treasury shares (recorded under current assets) 132.5 20.3 75.7 343.2 420.3<br />

Total 1,102.3 414.1 268.9 - 1,247.5<br />

(Excluding premiums on share purchase options) 956.1 393.6 176.5 - 1,173.2<br />

264 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT