VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated fi nancial statements<br />

Operating profi t, after taking account of share-based payment expenses, goodwill impairment losses and the profi t or loss of associates, amounted<br />

to €3,275.9 million at 31 December <strong>2008</strong> (9.8% of revenue excluding revenue from construction of new infrastructure) compared with<br />

€3,010.7 million at 31 December 2007 (9.9% of revenue excluding revenue from construction of new infrastructure), an increase of 8.8%. This<br />

change includes the positive eff ects of non-recurrent items for €85 million, principally the impact of the negotiations about medical expense<br />

insurance at ASF and Escota for €120 million (see Note E.20.2 “Other non-current provisions”).<br />

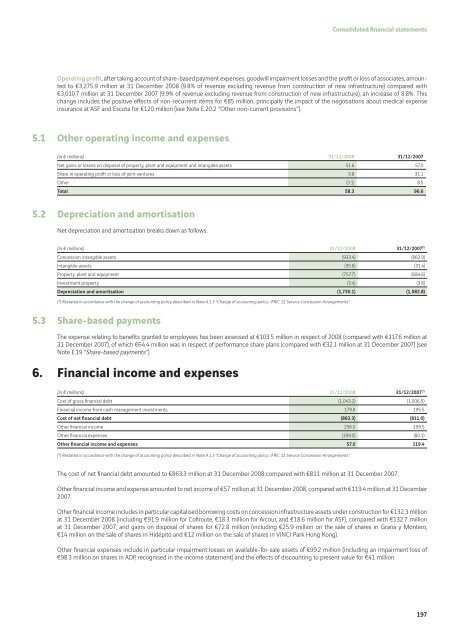

5.1 Other operating income and expenses<br />

(in € millions) 31/12/<strong>2008</strong> 31/12/2007<br />

Net gains or losses on disposal of property, plant and equipment and intangible assets 51.6 57.0<br />

Share in operating profi t or loss of joint ventures 9.8 31.1<br />

Other (3.1) 8.5<br />

Total 58.3 96.6<br />

5.2 Depreciation and amortisation<br />

Net depreciation and amortisation breaks down as follows:<br />

(in € millions) 31/12/<strong>2008</strong> 31/12/2007 (*)<br />

Concession intangible assets (933.4) (862.9)<br />

Intangible assets (35.6) (31.4)<br />

Property, plant and equipment (757.7) (684.6)<br />

Investment property (3.4) (3.8)<br />

Depreciation and amortisation (1,730.1) (1,582.8)<br />

(*) Restated in accordance with the change of accounting policy described in Note A.1.3 “Change of accounting policy: IFRIC 12 Service Concession Arrangements”.<br />

5.3 Share-based payments<br />

The expense relating to benefi ts granted to employees has been assessed at €103.5 million in respect of <strong>2008</strong> (compared with €117.6 million at<br />

31 December 2007), of which €64.4 million was in respect of performance share plans (compared with €32.1 million at 31 December 2007) (see<br />

Note E.19 “Share-based payments”).<br />

6. Financial income and expenses<br />

(in € millions) 31/12/<strong>2008</strong> 31/12/2007 (*)<br />

Cost of gross fi nancial debt (1,043.2) (1,006.5)<br />

Financial income from cash management investments 179.8 195.5<br />

Cost of net fi nancial debt (863.3) (811.0)<br />

Other fi nancial income 256.0 199.5<br />

Other fi nancial expenses (199.0) (80.1)<br />

Other fi nancial income and expenses 57.0 119.4<br />

(*) Restated in accordance with the change of accounting policy described in Note A.1.3 “Change of accounting policy: IFRIC 12 Service Concession Arrangements”.<br />

The cost of net fi nancial debt amounted to €863.3 million at 31 December <strong>2008</strong> compared with €811 million at 31 December 2007.<br />

Other fi nancial income and expense amounted to net income of €57 million at 31 December <strong>2008</strong>, compared with €119.4 million at 31 December<br />

2007.<br />

Other fi nancial income includes in particular capitalised borrowing costs on concession infrastructure assets under construction for €132.3 million<br />

at 31 December <strong>2008</strong> (including €91.9 million for Cofi route, €18.3 million for Arcour, and €18.6 million for ASF), compared with €132.7 million<br />

at 31 December 2007, and gains on disposal of shares for €72.8 million (including €25.9 million on the sale of shares in Grana y Montero,<br />

€14 million on the sale of shares in Hídépitö and €12 million on the sale of shares in <strong>VINCI</strong> Park Hong Kong).<br />

Other fi nancial expenses include in particular impairment losses on available-for-sale assets of €99.2 million (including an impairment loss of<br />

€98.3 million on shares in ADP, recognised in the income statement) and the eff ects of discounting to present value for €41 million.<br />

197