VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

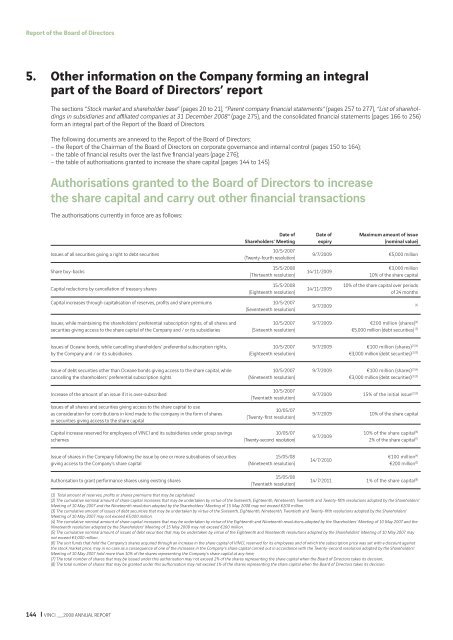

Report of the Board of Directors<br />

5. Other information on the Company forming an integral<br />

part of the Board of Directors’ <strong>report</strong><br />

The sections “Stock market and shareholder base” (pages 20 to 21), “Parent company fi nancial statements” (pages 257 to 277), “List of shareholdings<br />

in subsidiaries and affi liated companies at 31 December <strong>2008</strong>” (page 275), and the consolidated fi nancial statements (pages 166 to 256)<br />

form an integral part of the Report of the Board of Directors.<br />

The following documents are annexed to the Report of the Board of Directors:<br />

– the Report of the Chairman of the Board of Directors on corporate governance and internal control (pages 150 to 164);<br />

– the table of fi nancial results over the last fi ve fi nancial years (page 276);<br />

– the table of authorisations granted to increase the share capital (pages 144 to 145).<br />

Authorisations granted to the Board of Directors to increase<br />

the share capital and carry out other fi nancial transactions<br />

The authorisations currently in force are as follows:<br />

Issues of all securities giving a right to debt securities<br />

Share buy-backs<br />

Capital reductions by cancellation of treasury shares<br />

144 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT<br />

Date of<br />

Shareholders’ Meeting<br />

10/5/2007<br />

(Twenty-fourth resolution)<br />

15/5/<strong>2008</strong><br />

(Thirteenth resolution)<br />

15/5/<strong>2008</strong><br />

(Eighteenth resolution)<br />

Capital increases through capitalisation of reserves, profi ts and share premiums 10/5/2007<br />

(Seventeenth resolution)<br />

Issues, while maintaining the shareholders’ preferential subscription rights, of all shares and<br />

securities giving access to the share capital of the Company and / or its subsidiaries<br />

Issues of Oceane bonds, while cancelling shareholders’ preferential subscription rights,<br />

by the Company and / or its subsidiaries<br />

Issue of debt securities other than Oceane bonds giving access to the share capital, while<br />

cancelling the shareholders’ preferential subscription rights<br />

Increase of the amount of an issue if it is over-subscribed<br />

Issues of all shares and securities giving access to the share capital to use<br />

as consideration for contributions in kind made to the company in the form of shares<br />

or securities giving access to the share capital<br />

Capital increase reserved for employees of <strong>VINCI</strong> and its subsidiaries under group savings<br />

schemes<br />

Issue of shares in the Company following the issue by one or more subsidiaries of securities<br />

giving access to the Company’s share capital<br />

Authorisation to grant performance shares using existing shares<br />

10/5/2007<br />

(Sixteenth resolution)<br />

10/5/2007<br />

(Eighteenth resolution)<br />

10/5/2007<br />

(Nineteenth resolution)<br />

10/5/2007<br />

(Twentieth resolution)<br />

10/05/07<br />

(Twenty-fi rst resolution)<br />

10/05/07<br />

(Twenty-second resolution)<br />

15/05/08<br />

(Nineteenth resolution)<br />

15/05/08<br />

(Twentieth resolution)<br />

Date of<br />

expiry<br />

Maximum amount of issue<br />

(nominal value)<br />

9/7/2009 €5,000 million<br />

14/11/2009<br />

14/11/2009<br />

9/7/2009<br />

€3,000 million<br />

10% of the share capital<br />

10% of the share capital over periods<br />

of 24 months<br />

9/7/2009 €200 million (shares) (2)<br />

€5,000 million (debt securities) (3)<br />

(2) (4)<br />

9/7/2009 €100 million (shares)<br />

(3) (5)<br />

€3,000 million (debt securities)<br />

(2) (4)<br />

9/7/2009 €100 million (shares)<br />

(3) (5)<br />

€3,000 million (debt securities)<br />

(2) (3)<br />

9/7/2009 15% of the initial issue<br />

9/7/2009 10% of the share capital<br />

9/7/2009<br />

14/7/2010<br />

(1)<br />

10% of the share capital (6)<br />

2% of the share capital (7)<br />

€100 million (4)<br />

€200 million (2)<br />

14/7/2011 1% of the share capital (8)<br />

(1) Total amount of reserves, profi ts or shares premiums that may be capitalised.<br />

(2) The cumulative nominal amount of share capital increases that may be undertaken by virtue of the Sixteenth, Eighteenth, Nineteenth, Twentieth and Twenty-fi fth resolutions adopted by the Shareholders’<br />

Meeting of 10 May 2007 and the Nineteenth resolution adopted by the Shareholders’ Meeting of 15 May <strong>2008</strong> may not exceed €200 million.<br />

(3) The cumulative amount of issues of debt securities that may be undertaken by virtue of the Sixteenth, Eighteenth, Nineteenth, Twentieth and Twenty-fi fth resolutions adopted by the Shareholders’<br />

Meeting of 10 May 2007 may not exceed €5,000 million.<br />

(4) The cumulative nominal amount of share capital increases that may be undertaken by virtue of the Eighteenth and Nineteenth resolutions adopted by the Shareholders’ Meeting of 10 May 2007 and the<br />

Nineteenth resolution adopted by the Shareholders’ Meeting of 15 May <strong>2008</strong> may not exceed €100 million.<br />

(5) The cumulative nominal amount of issues of debt securities that may be undertaken by virtue of the Eighteenth and Nineteenth resolutions adopted by the Shareholders’ Meeting of 10 May 2007 may<br />

not exceed €3,000 million.<br />

(6) The unit funds that hold the Company’s shares acquired through an increase in the share capital of <strong>VINCI</strong>, reserved for its employees and of which the subscription price was set with a discount against<br />

the stock market price, may in no case as a consequence of one of the increases in the Company’s share capital carried out in accordance with the Twenty-second resolution adopted by the Shareholders’<br />

Meeting of 10 May 2007 hold more than 10% of the shares representing the Company’s share capital at any time;<br />

(7) The total number of shares that may be issued under this authorisation may not exceed 2% of the shares representing the share capital when the Board of Directors takes its decision;<br />

(8) The total number of shares that may be granted under this authorisation may not exceed 1% of the shares representing the share capital when the Board of Directors takes its decision.