VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

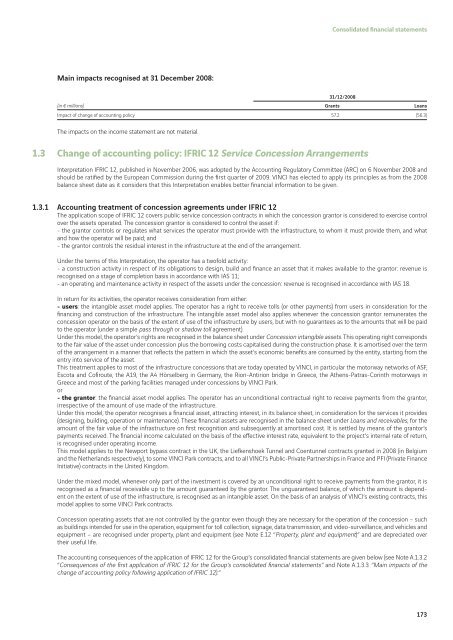

Main impacts recognised at 31 December <strong>2008</strong>:<br />

Consolidated fi nancial statements<br />

31/12/<strong>2008</strong><br />

(in € millions) Grants Loans<br />

Impact of change of accounting policy 57.2 (56.3)<br />

The impacts on the income statement are not material.<br />

1.3 Change of accounting policy: IFRIC 12 Service Concession Arrangements<br />

Interpretation IFRIC 12, published in November 2006, was adopted by the Accounting Regulatory Committee (ARC) on 6 November <strong>2008</strong> and<br />

should be ratifi ed by the European Commission during the fi rst quarter of 2009. <strong>VINCI</strong> has elected to apply its principles as from the <strong>2008</strong><br />

balance sheet date as it considers that this Interpretation enables better fi nancial information to be given.<br />

1.3.1 Accounting treatment of concession agreements under IFRIC 12<br />

The application scope of IFRIC 12 covers public service concession contracts in which the concession grantor is considered to exercise control<br />

over the assets operated. The concession grantor is considered to control the asset if:<br />

- the grantor controls or regulates what services the operator must provide with the infrastructure, to whom it must provide them, and what<br />

and how the operator will be paid; and<br />

- the grantor controls the residual interest in the infrastructure at the end of the arrangement.<br />

Under the terms of this Interpretation, the operator has a twofold activity:<br />

- a construction activity in respect of its obligations to design, build and fi nance an asset that it makes available to the grantor: revenue is<br />

recognised on a stage of completion basis in accordance with IAS 11;<br />

- an operating and maintenance activity in respect of the assets under the concession: revenue is recognised in accordance with IAS 18.<br />

In return for its activities, the operator receives consideration from either:<br />

- users: the intangible asset model applies. The operator has a right to receive tolls (or other payments) from users in consideration for the<br />

fi nancing and construction of the infrastructure. The intangible asset model also applies whenever the concession grantor remunerates the<br />

concession operator on the basis of the extent of use of the infrastructure by users, but with no guarantees as to the amounts that will be paid<br />

to the operator (under a simple pass through or shadow toll agreement).<br />

Under this model, the operator’s rights are recognised in the balance sheet under Concession intangible assets. This operating right corresponds<br />

to the fair value of the asset under concession plus the borrowing costs capitalised during the construction phase. It is amortised over the term<br />

of the arrangement in a manner that refl ects the pattern in which the asset’s economic benefi ts are consumed by the entity, starting from the<br />

entry into service of the asset.<br />

This treatment applies to most of the infrastructure concessions that are today operated by <strong>VINCI</strong>, in particular the motorway networks of ASF,<br />

Escota and Cofi route, the A19, the A4 Hörselberg in Germany, the Rion-Antirion bridge in Greece, the Athens-Patras-Corinth motorways in<br />

Greece and most of the parking facilities managed under concessions by <strong>VINCI</strong> Park.<br />

or<br />

- the grantor: the fi nancial asset model applies. The operator has an unconditional contractual right to receive payments from the grantor,<br />

irrespective of the amount of use made of the infrastructure.<br />

Under this model, the operator recognises a fi nancial asset, attracting interest, in its balance sheet, in consideration for the services it provides<br />

(designing, building, operation or maintenance). These fi nancial assets are recognised in the balance sheet under Loans and receivables, for the<br />

amount of the fair value of the infrastructure on fi rst recognition and subsequently at amortised cost. It is settled by means of the grantor’s<br />

payments received. The fi nancial income calculated on the basis of the eff ective interest rate, equivalent to the project’s internal rate of return,<br />

is recognised under operating income.<br />

This model applies to the Newport bypass contract in the UK, the Liefk enshoek Tunnel and Coentunnel contracts granted in <strong>2008</strong> (in Belgium<br />

and the Netherlands respectively), to some <strong>VINCI</strong> Park contracts, and to all <strong>VINCI</strong>’s Public-Private Partnerships in France and PFI (Private Finance<br />

Initiative) contracts in the United Kingdom.<br />

Under the mixed model, whenever only part of the investment is covered by an unconditional right to receive payments from the grantor, it is<br />

recognised as a fi nancial receivable up to the amount guaranteed by the grantor. The unguaranteed balance, of which the amount is dependent<br />

on the extent of use of the infrastructure, is recognised as an intangible asset. On the basis of an analysis of <strong>VINCI</strong>’s existing contracts, this<br />

model applies to some <strong>VINCI</strong> Park contracts.<br />

Concession operating assets that are not controlled by the grantor even though they are necessary for the operation of the concession – such<br />

as buildings intended for use in the operation, equipment for toll collection, signage, data transmission, and video-surveillance, and vehicles and<br />

equipment – are recognised under property, plant and equipment (see Note E.12 “Property, plant and equipment)” and are depreciated over<br />

their useful life.<br />

The accounting consequences of the application of IFRIC 12 for the Group’s consolidated fi nancial statements are given below (see Note A.1.3.2<br />

“Consequences of the fi rst application of IFRIC 12 for the Group’s consolidated fi nancial statements” and Note A.1.3.3 “Main impacts of the<br />

change of accounting policy following application of IFRIC 12).”<br />

173