VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated fi nancial statements<br />

17. Construction contracts (contracting divisions)<br />

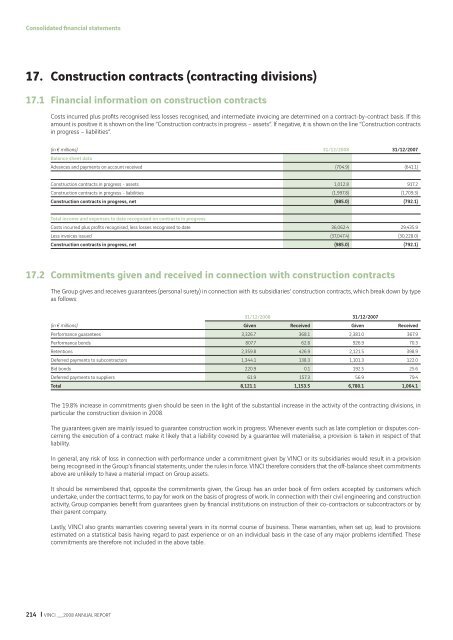

17.1 Financial information on construction contracts<br />

Costs incurred plus profi ts recognised less losses recognised, and intermediate invoicing are determined on a contract-by-contract basis. If this<br />

amount is positive it is shown on the line “Construction contracts in progress – assets”. If negative, it is shown on the line “Construction contracts<br />

in progress – liabilities”.<br />

(in € millions) 31/12/<strong>2008</strong> 31/12/2007<br />

Balance sheet data<br />

Advances and payments on account received (704.9) (641.1)<br />

Construction contracts in progress - assets 1,012.8 917.2<br />

Construction contracts in progress - liabilities (1,997.8) (1,709.3)<br />

Construction contracts in progress, net (985.0) (792.1)<br />

Total income and expenses to date recognised on contracts in progress<br />

Costs incurred plus profi ts recognised, less losses recognised to date 36,062.4 29,435.9<br />

Less invoices issued (37,047.4) (30,228.0)<br />

Construction contracts in progress, net (985.0) (792.1)<br />

17.2 Commitments given and received in connection with construction contracts<br />

The Group gives and receives guarantees (personal surety) in connection with its subsidiaries’ construction contracts, which break down by type<br />

as follows:<br />

31/12/<strong>2008</strong> 31/12/2007<br />

(in € millions) Given Received Given Received<br />

Performance guarantees 3,326.7 368.1 2,381.0 367.9<br />

Performance bonds 807.7 62.8 926.9 70.3<br />

Retentions 2,359.8 426.9 2,121.5 398.9<br />

Deferred payments to subcontractors 1,344.1 138.3 1,101.3 122.0<br />

Bid bonds 220.9 0.1 192.5 25.6<br />

Deferred payments to suppliers 61.9 157.3 56.9 79.4<br />

Total 8,121.1 1,153.5 6,780.1 1,064.1<br />

The 19.8% increase in commitments given should be seen in the light of the substantial increase in the activity of the contracting divisions, in<br />

particular the construction division in <strong>2008</strong>.<br />

The guarantees given are mainly issued to guarantee construction work in progress. Whenever events such as late completion or disputes concerning<br />

the execution of a contract make it likely that a liability covered by a guarantee will materialise, a provision is taken in respect of that<br />

liability.<br />

In general, any risk of loss in connection with performance under a commitment given by <strong>VINCI</strong> or its subsidiaries would result in a provision<br />

being recognised in the Group’s fi nancial statements, under the rules in force. <strong>VINCI</strong> therefore considers that the off -balance sheet commitments<br />

above are unlikely to have a material impact on Group assets.<br />

It should be remembered that, opposite the commitments given, the Group has an order book of fi rm orders accepted by customers which<br />

undertake, under the contract terms, to pay for work on the basis of progress of work. In connection with their civil engineering and construction<br />

activity, Group companies benefi t from guarantees given by fi nancial institutions on instruction of their co-contractors or subcontractors or by<br />

their parent company.<br />

Lastly, <strong>VINCI</strong> also grants warranties covering several years in its normal course of business. These warranties, when set up, lead to provisions<br />

estimated on a statistical basis having regard to past experience or on an individual basis in the case of any major problems identifi ed. These<br />

commitments are therefore not included in the above table.<br />

214 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT