VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated fi nancial statements<br />

23.4 Credit risk and counterparty risk<br />

<strong>VINCI</strong> is exposed to credit risk in the event of default by customers. It is exposed to counterparty risk in respect of its investments of cash, commitments<br />

received, acquisition of negotiable debt securities, marketable securities, and unused authorised credit facilities, fi nancial receivables<br />

and derivative fi nancial instruments.<br />

The Group has set up procedures to manage and limit credit risk and counterparty risk.<br />

Trade receivables<br />

It should be noted that nearly 40% of consolidated revenue is generated with public sector, or quasi-public sector, customers. Moreover, <strong>VINCI</strong><br />

considers that the concentration of counterparty risk connected with trade receivables is limited because of the large number of customers and<br />

the fact that they are widely scattered across France and abroad. In foreign countries and in developing countries, the risk of non-payment is<br />

generally covered by an appropriate insurance policy (Coface, documentary credit, etc.). Trade receivables are broken down in Note E.21.2 “Trade<br />

receivables”.<br />

Financial instruments<br />

Financial instruments are set up with fi nancial institutions meeting the Group’s credit rating criteria. The Group has also set up a system of<br />

counterparty limits to manage its counterparty risk. This system allocates maximum risk amounts by counterparty, defi ned by taking account of<br />

their credit ratings as published by Standard & Poor’s, Moody’s and Fitch IBCA. These limits are regularly monitored and updated by the Group<br />

Finance Department at Treasury Committee meetings on the basis of a quarterly, consolidated <strong>report</strong>.<br />

The Group Finance Department also distributes instructions to the subsidiaries laying down the authorised limits by counterparty and the list<br />

of authorised UCITS.<br />

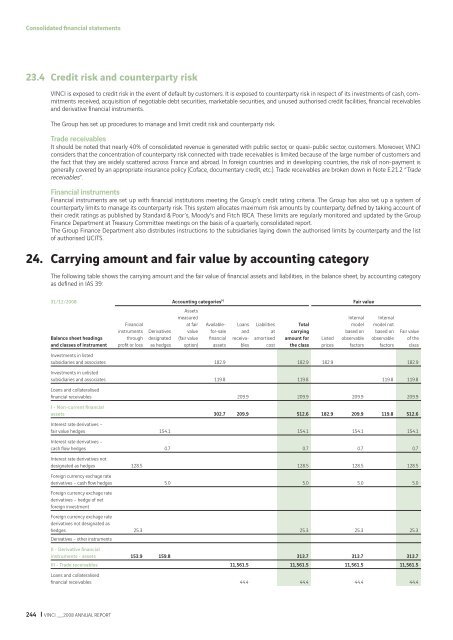

24. Carrying amount and fair value by accounting category<br />

The following table shows the carrying amount and the fair value of fi nancial assets and liabilities, in the balance sheet, by accounting category<br />

as defi ned in IAS 39:<br />

31/12/<strong>2008</strong> Accounting categories (*) Fair value<br />

Balance sheet headings<br />

and classes of instrument<br />

244 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT<br />

Financial<br />

instruments<br />

through<br />

profi t or loss<br />

Derivatives<br />

designated<br />

as hedges<br />

Assets<br />

measured<br />

at fair<br />

value<br />

(fair value<br />

option)<br />

Availablefor-sale<br />

fi nancial<br />

assets<br />

Loans<br />

and<br />

receivables<br />

Liabilities<br />

at<br />

amortised<br />

cost<br />

Total<br />

carrying<br />

amount for<br />

the class<br />

Listed<br />

prices<br />

Internal<br />

model<br />

based on<br />

observable<br />

factors<br />

Internal<br />

model not<br />

based on<br />

observable<br />

factors<br />

Fair value<br />

of the<br />

class<br />

Investments in listed<br />

subsidiaries and associates 182.9 182.9 182.9 182.9<br />

Investments in unlisted<br />

subsidiaries and associates 119.8 119.8 119.8 119.8<br />

Loans and collateralised<br />

fi nancial receivables 209.9 209.9 209.9 209.9<br />

I - Non-current fi nancial<br />

assets 302.7 209.9 512.6 182.9 209.9 119.8 512.6<br />

Interest rate derivatives –<br />

fair value hedges 154.1 154.1 154.1 154.1<br />

Interest rate derivatives –<br />

cash fl ow hedges 0.7 0.7 0.7 0.7<br />

Interest rate derivatives not<br />

designated as hedges 128.5 128.5 128.5 128.5<br />

Foreign currency exchage rate<br />

derivatives – cash fl ow hedges 5.0 5.0 5.0 5.0<br />

Foreign currency exchage rate<br />

derivatives – hedge of net<br />

foreign investment<br />

Foreign currency exchage rate<br />

derivatives not designated as<br />

hedges<br />

Derivatives – other instruments<br />

25.3 25.3 25.3 25.3<br />

II - Derivative fi nancial<br />

instruments - assets 153.9 159.8 313.7 313.7 313.7<br />

III - Trade receivables 11,561.5 11,561.5 11,561.5 11,561.5<br />

Loans and collateralised<br />

fi nancial receivables 44.4 44.4 44.4 44.4