VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Report of the Board of Directors<br />

Voting rights<br />

The diff erence between the breakdown of shareholdings and voting rights is due to the absence of voting rights attached to treasury shares.<br />

Breaching of shareholding thresholds<br />

According to the declarations received by the Company of breaches of the legal threshold of 5%, or the threshold of 1% provided for in the corporate<br />

statutes, of the share capital or voting rights, the shareholders identifi ed as holding more than 1% of the share capital or voting rights, other<br />

than those shown in the table above, are as follows:<br />

- Artisan Partners (2.0% of the share capital, declared on 4 September <strong>2008</strong>);<br />

- Edmond de Rothschild Asset Management (1.1% of the share capital, declared on 16 June <strong>2008</strong>);<br />

- Crédit Agricole Asset Management (2% of the share capital, declared on 11 June <strong>2008</strong>).<br />

Moreover, Carlo Tassara International has declared in its declaration dated:<br />

- 4 April <strong>2008</strong>, having breached the threshold of 3% of the share capital;<br />

- 19 December <strong>2008</strong>, having fallen below several thresholds to hold 0.4% of <strong>VINCI</strong>’s share capital.<br />

Shareholder agreements<br />

To the best of the Company’s knowledge, with the exception of the concerted action of Financière Pinault with Artémis, Artémis 12 and Victoris,<br />

which it controls, declared on 8 June 2007, there are no shareholder agreements or groups of shareholders acting as partners.<br />

Registered shareholders<br />

At 31 December <strong>2008</strong>, the Company had 1,111 shareholders whose registration is managed by the Company and 1,565 shareholders whose<br />

registration is managed by a fi nancial institution. At that date, 1,052,378 shares whose registration is managed by the Company, and 328,552<br />

shares whose registration is managed by a fi nancial institution were pledged.<br />

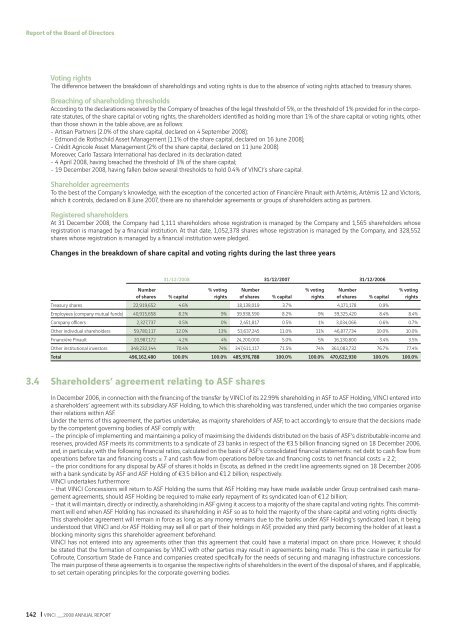

Changes in the breakdown of share capital and voting rights during the last three years<br />

142 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT<br />

Number<br />

of shares % capital<br />

31/12/<strong>2008</strong> 31/12/2007 31/12/2006<br />

% voting<br />

rights<br />

Number<br />

of shares % capital<br />

% voting<br />

rights<br />

Number<br />

of shares % capital<br />

% voting<br />

rights<br />

Treasury shares 22,919,652 4.6% 18,138,019 3.7% 4,171,178 0.9%<br />

Employees (company mutual funds) 40,915,658 8.2% 9% 39,938,590 8.2% 9% 39,325,420 8.4% 8.4%<br />

Company offi cers 2,327,737 0.5% 0% 2,451,817 0.5% 1% 3,034,066 0.6% 0.7%<br />

Other individual shareholders 59,780,117 12.0% 13% 53,637,245 11.0% 11% 46,877,734 10.0% 10.0%<br />

Financière Pinault 20,987,172 4.2% 4% 24,200,000 5.0% 5% 16,130,800 3.4% 3.5%<br />

Other institutional investors 349,232,144 70.4% 74% 347,611,117 71.5% 74% 361,083,732 76.7% 77.4%<br />

Total 496,162,480 100.0% 100.0% 485,976,788 100.0% 100.0% 470,622,930 100.0% 100.0%<br />

3.4 Shareholders’ agreement relating to ASF shares<br />

In December 2006, in connection with the fi nancing of the transfer by <strong>VINCI</strong> of its 22.99% shareholding in ASF to ASF Holding, <strong>VINCI</strong> entered into<br />

a shareholders’ agreement with its subsidiary ASF Holding, to which this shareholding was transferred, under which the two companies organise<br />

their relations within ASF.<br />

Under the terms of this agreement, the parties undertake, as majority shareholders of ASF, to act accordingly to ensure that the decisions made<br />

by the competent governing bodies of ASF comply with:<br />

– the principle of implementing and maintaining a policy of maximising the dividends distributed on the basis of ASF’s distributable income and<br />

reserves, provided ASF meets its commitments to a syndicate of 23 banks in respect of the €3.5 billion fi nancing signed on 18 December 2006,<br />

and, in particular, with the following fi nancial ratios, calculated on the basis of ASF’s consolidated fi nancial statements: net debt to cash fl ow from<br />

operations before tax and fi nancing costs ≤ 7 and cash fl ow from operations before tax and fi nancing costs to net fi nancial costs ≥ 2.2;<br />

– the prior conditions for any disposal by ASF of shares it holds in Escota, as defi ned in the credit line agreements signed on 18 December 2006<br />

with a bank syndicate by ASF and ASF Holding of €3.5 billion and €1.2 billion, respectively.<br />

<strong>VINCI</strong> undertakes furthermore:<br />

– that <strong>VINCI</strong> Concessions will return to ASF Holding the sums that ASF Holding may have made available under Group centralised cash management<br />

agreements, should ASF Holding be required to make early repayment of its syndicated loan of €1.2 billion;<br />

– that it will maintain, directly or indirectly, a shareholding in ASF giving it access to a majority of the share capital and voting rights. This commitment<br />

will end when ASF Holding has increased its shareholding in ASF so as to hold the majority of the share capital and voting rights directly.<br />

This shareholder agreement will remain in force as long as any money remains due to the banks under ASF Holding’s syndicated loan, it being<br />

understood that <strong>VINCI</strong> and /or ASF Holding may sell all or part of their holdings in ASF, provided any third party becoming the holder of at least a<br />

blocking minority signs this shareholder agreement beforehand.<br />

<strong>VINCI</strong> has not entered into any agreements other than this agreement that could have a material impact on share price. However, it should<br />

be stated that the formation of companies by <strong>VINCI</strong> with other parties may result in agreements being made. This is the case in particular for<br />

Cofi route, Consortium Stade de France and companies created specifi cally for the needs of securing and managing infrastructure concessions.<br />

The main purpose of these agreements is to organise the respective rights of shareholders in the event of the disposal of shares, and if applicable,<br />

to set certain operating principles for the corporate governing bodies.