VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated fi nancial statements<br />

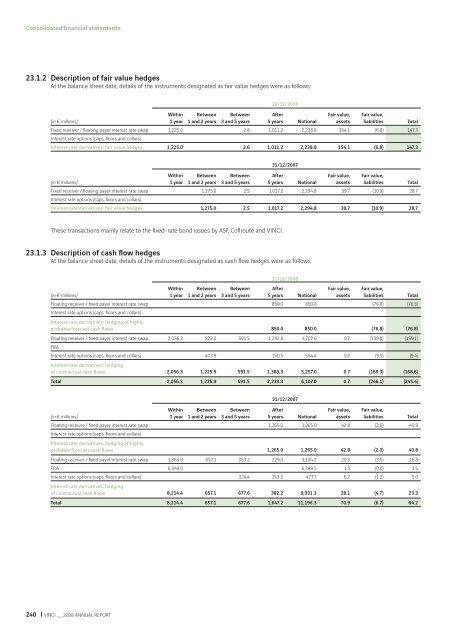

23.1.2 Description of fair value hedges<br />

At the balance sheet date, details of the instruments designated as fair value hedges were as follows:<br />

(in € millions)<br />

240 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT<br />

Within<br />

1 year<br />

Between<br />

1 and 2 years<br />

Between<br />

3 and 5 years<br />

31/12/<strong>2008</strong><br />

After<br />

5 years Notional<br />

Fair value,<br />

assets<br />

Fair value,<br />

liabilities Total<br />

Fixed receiver / fl oating payer interest rate swap 1,225.0 2.6 1,011.2 2,238.8 154.1 (6.8) 147.3<br />

Interest rate options (caps, fl oors and collars)<br />

Interest rate derivatives: fair value hedges 1,225.0 2.6 1,011.2 2,238.8<br />

31/12/2007<br />

154.1 (6.8) 147.3<br />

Within Between Between After<br />

Fair value, Fair value,<br />

(in € millions)<br />

1 year 1 and 2 years 3 and 5 years 5 years Notional assets liabilities Total<br />

Fixed receiver / fl oating payer interest rate swap<br />

Interest rate options (caps, fl oors and collars)<br />

1,275.0 2.5 1,017.2 2,294.8 39.7 (10.9) 28.7<br />

Interest rate derivatives: fair value hedges 1,275.0 2.5 1,017.2 2,294.8 39.7 (10.9) 28.7<br />

These transactions mainly relate to the fi xed-rate bond issues by ASF, Cofi route and <strong>VINCI</strong>.<br />

23.1.3 Description of cash fl ow hedges<br />

At the balance sheet date, details of the instruments designated as cash fl ow hedges were as follows:<br />

Within Between Between<br />

31/12/<strong>2008</strong><br />

After<br />

Fair value, Fair value,<br />

(in € millions)<br />

1 year 1 and 2 years 3 and 5 years 5 years Notional assets liabilities Total<br />

Floating receiver / fi xed payer interest rate swap<br />

Interest rate options (caps, fl oors and collars)<br />

Interest rate derivatives: hedging of highly<br />

850.0 850.0 (76.8) (76.8)<br />

probable forecast cash fl ows 850.0 850.0<br />

(76.8) (76.8)<br />

Floating receiver / fi xed payer interest rate swap<br />

FRA<br />

2,056.3 822.0 591.5 1,232.8 4,702.6 0.7 (159.8) (159.1)<br />

Interest rate options (caps, fl oors and collars)<br />

Interest rate derivatives: hedging<br />

403.9 150.5 554.4 0.0 (9.5) (9.4)<br />

of contractual cash fl ows 2,056.3 1,225.9 591.5 1,383.3 5,257.0<br />

0.7 (169.3) (168.6)<br />

Total 2,056.3 1,225.9 591.5 2,233.3 6,107.0 0.7 (246.1) (245.4)<br />

31/12/2007<br />

Within Between Between After<br />

Fair value, Fair value,<br />

(in € millions)<br />

1 year 1 and 2 years 3 and 5 years 5 years Notional assets liabilities Total<br />

Floating receiver / fi xed payer interest rate swap<br />

Interest rate options (caps, fl oors and collars)<br />

Interest rate derivatives: hedging of highly<br />

1,265.0 1,265.0 42.8 (2.0) 40.8<br />

probable forecast cash fl ows 1,265.0 1,265.0 42.8 (2.0) 40.8<br />

Floating receiver / fi xed payer interest rate swap 1,864.9 657.1 353.2 229.0 3,104.2 20.3 (3.5) 16.8<br />

FRA 6,349.5 6,349.5 1.5 (0.0) 1.5<br />

Interest rate options (caps, fl oors and collars)<br />

Interest rate derivatives: hedging<br />

324.4 153.2 477.7 6.2 (1.2) 5.0<br />

of contractual cash fl ows 8,214.4 657.1 677.6 382.2 9,931.3 28.1 (4.7) 23.3<br />

Total 8,214.4 657.1 677.6 1,647.2 11,196.3 70.9 (6.7) 64.2