VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

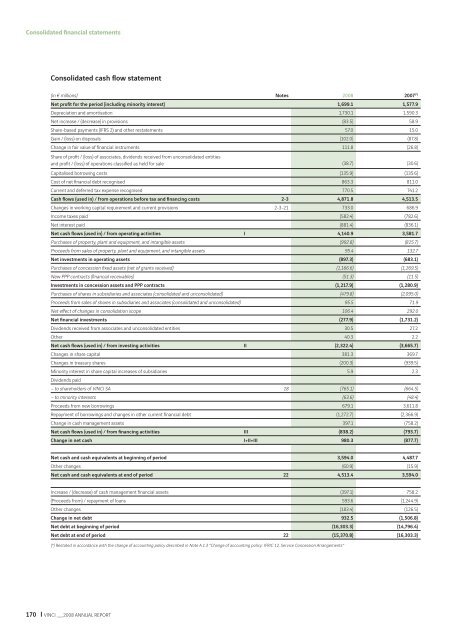

Consolidated fi nancial statements<br />

Consolidated cash fl ow statement<br />

(in € millions) Notes <strong>2008</strong> 2007 (*)<br />

Net profi t for the period (including minority interest) 1,699.1 1,577.9<br />

Depreciation and amortisation 1,730.1 1,590.3<br />

Net increase / (decrease) in provisions (83.5) 58.9<br />

Share-based payments (IFRS 2) and other restatements 57.0 15.0<br />

Gain / (loss) on disposals (102.0) (87.8)<br />

Change in fair value of fi nancial instruments 111.8 (26.8)<br />

Share of profi t / (loss) of associates, dividends received from unconsolidated entities<br />

and profi t / (loss) of operations classifi ed as held for sale<br />

(38.7) (30.6)<br />

Capitalised borrowing costs (135.9) (135.6)<br />

Cost of net fi nancial debt recognised 863.3 811.0<br />

Current and deferred tax expense recognised 770.5 741.2<br />

Cash fl ows (used in) / from operations before tax and fi nancing costs 2-3 4,871.8 4,513.5<br />

Changes in working capital requirement and current provisions 2-3-21 733.0 686.9<br />

Income taxes paid (582.4) (782.6)<br />

Net interest paid (881.4) (836.1)<br />

Net cash fl ows (used in) / from operating activities I 4,140.9 3,581.7<br />

Purchases of property, plant and equipment, and intangible assets (992.8) (815.7)<br />

Proceeds from sales of property, plant and equipment, and intangible assets 95.4 132.7<br />

Net investments in operating assets (897.3) (683.1)<br />

Purchases of concession fi xed assets (net of grants received) (1,166.6) (1,269.5)<br />

New PPP contracts (fi nancial receivables) (51.3) (11.5)<br />

Investments in concession assets and PPP contracts (1,217.9) (1,280.9)<br />

Purchases of shares in subsidiaries and associates (consolidated and unconsolidated) (479.8) (2,095.0)<br />

Proceeds from sales of shares in subsidiaries and associates (consolidated and unconsolidated) 95.5 71.9<br />

Net eff ect of changes in consolidation scope 106.4 292.0<br />

Net fi nancial investments (277.9) (1,731.2)<br />

Dividends received from associates and unconsolidated entities 30.5 27.2<br />

Other 40.3 2.2<br />

Net cash fl ows (used in) / from investing activities II (2,322.4) (3,665.7)<br />

Changes in share capital 381.3 369.7<br />

Changes in treasury shares (200.3) (939.5)<br />

Minority interest in share capital increases of subsidiaries<br />

Dividends paid<br />

5.9 2.3<br />

– to shareholders of <strong>VINCI</strong> SA 18 (765.1) (664.5)<br />

– to minority interests (63.6) (48.4)<br />

Proceeds from new borrowings 679.1 3,611.8<br />

Repayment of borrowings and changes in other current fi nancial debt (1,272.7) (2,366.9)<br />

Change in cash management assets 397.1 (758.2)<br />

Net cash fl ows (used in) / from fi nancing activities III (838.2) (793.7)<br />

Change in net cash I+II+III 980.3 (877.7)<br />

Net cash and cash equivalents at beginning of period 3,594.0 4,487.7<br />

Other changes (60.9) (15.9)<br />

Net cash and cash equivalents at end of period 22 4,513.4 3,594.0<br />

Increase / (decrease) of cash management fi nancial assets (397.1) 758.2<br />

(Proceeds from) / repayment of loans 593.6 (1,244.9)<br />

Other changes (183.4) (126.5)<br />

Change in net debt 932.5 (1,506.8)<br />

Net debt at beginning of period (16,303.3) (14,796.4)<br />

Net debt at end of period 22 (15,370.8) (16,303.3)<br />

(*) Restated in accordance with the change of accounting policy described in Note A.1.3 “Change of accounting policy: IFRIC 12, Service Concession Arrangements”<br />

170 <strong>VINCI</strong> __ <strong>2008</strong> ANNUAL REPORT