VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated fi nancial statements<br />

13. Impairment tests on goodwill and other non-financial assets<br />

In accordance with IAS 36 Impairment of Assets, goodwill and other non-fi nancial assets have been tested for goodwill at 31 December <strong>2008</strong>.<br />

The value in use of cash-generating units is determined on the basis of activity (concession, construction, energy and roads) and country, by<br />

discounting the forecasted operating cash fl ows before tax (operating profi t plus depreciation and amortisation plus non-current provisions less<br />

operating investments less change in operating WCR), at the rates below.<br />

In the case of concessions, forecasted cash fl ows are determined across the length of contracts by applying a variable discount rate, determined<br />

for each period depending on the debt to equity ratio.<br />

For the other cash-generating units, forecasted cash fl ows are generally determined on the basis of the latest three-year plans available. For<br />

periods beyond the three-year period, cash fl ows are extrapolated until the fi fth year, generally using a growth rate based on management’s<br />

assessment of the outlook for the entity under consideration.<br />

Beyond the fi fth year, the terminal value is determined by capitalising cash fl ows to infi nity.<br />

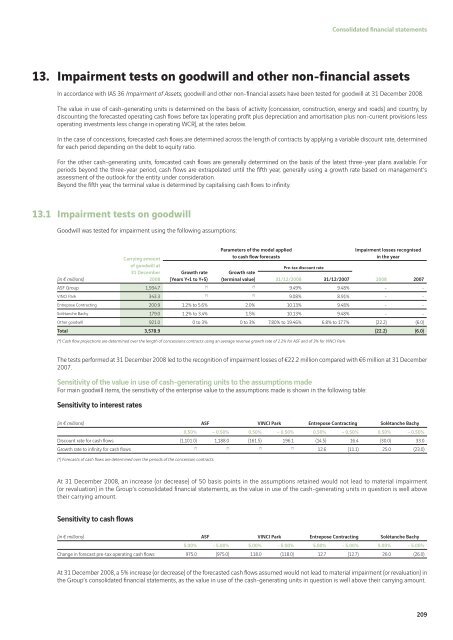

13.1 Impairment tests on goodwill<br />

Goodwill was tested for impairment using the following assumptions:<br />

Parameters of the model applied<br />

Impairment losses recognised<br />

Carrying amount<br />

to cash fl ow forecasts<br />

in the year<br />

of goodwill at<br />

31 December Growth rate Growth rate<br />

Pre-tax discount rate<br />

(in € millions)<br />

<strong>2008</strong> (Years Y+1 to Y+5) (terminal value) 31/12/<strong>2008</strong> 31/12/2007<br />

<strong>2008</strong> 2007<br />

ASF Group 1,934.7 (*) (*) 9.49% 9.48% - -<br />

<strong>VINCI</strong> Park 343.3 (*) (*) 9.08% 8.91% - -<br />

Entrepose Contracting 200.9 1.2% to 5.6% 2.0% 10.13% 9.48% - -<br />

Solétanche Bachy 179.0 1.2% to 3.4% 1.5% 10.13% 9.48% - -<br />

Other goodwill 921.0 0 to 3% 0 to 3% 7.80% to 19.46% 6.8% to 17.7% (22.2) (6.0)<br />

Total 3,578.9 (22.2) (6.0)<br />

(*) Cash fl ow projections are determined over the length of concessions contracts using an average revenue growth rate of 2.2% for ASF and of 3% for <strong>VINCI</strong> Park.<br />

The tests performed at 31 December <strong>2008</strong> led to the recognition of impairment losses of €22.2 million compared with €6 million at 31 December<br />

2007.<br />

Sensitivity of the value in use of cash-generating units to the assumptions made<br />

For main goodwill items, the sensitivity of the enterprise value to the assumptions made is shown in the following table:<br />

Sensitivity to interest rates<br />

(in € millions) ASF <strong>VINCI</strong> Park Entrepose Contracting Solétanche Bachy<br />

0.50% – 0.50% 0.50% – 0.50% 0.50% – 0.50% 0.50% – 0.50%<br />

Discount rate for cash fl ows (1,101.0) 1,188.0 (161.5) 196.1 (14.5) 16.4 (30.0) 33.0<br />

Growth rate to infi nity for cash fl ows (*) (*) (*) (*) 12.6 (11.1) 25.0 (23.0)<br />

(*) Forecasts of cash fl ows are determined over the periods of the concession contracts.<br />

At 31 December <strong>2008</strong>, an increase (or decrease) of 50 basis points in the assumptions retained would not lead to material impairment<br />

(or revaluation) in the Group’s consolidated fi nancial statements, as the value in use of the cash-generating units in question is well above<br />

their carrying amount.<br />

Sensitivity to cash fl ows<br />

(in € millions) ASF <strong>VINCI</strong> Park Entrepose Contracting Solétanche Bachy<br />

5.00% - 5.00% 5.00% - 5.00% 5.00% - 5.00% 5.00% - 5.00%<br />

Change in forecast pre-tax operating cash fl ows 975.0 (975.0) 118.0 (118.0) 12.7 (12.7) 26.0 (26.0)<br />

At 31 December <strong>2008</strong>, a 5% increase (or decrease) of the forecasted cash fl ows assumed would not lead to material impairment (or revaluation) in<br />

the Group’s consolidated fi nancial statements, as the value in use of the cash-generating units in question is well above their carrying amount.<br />

209