VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

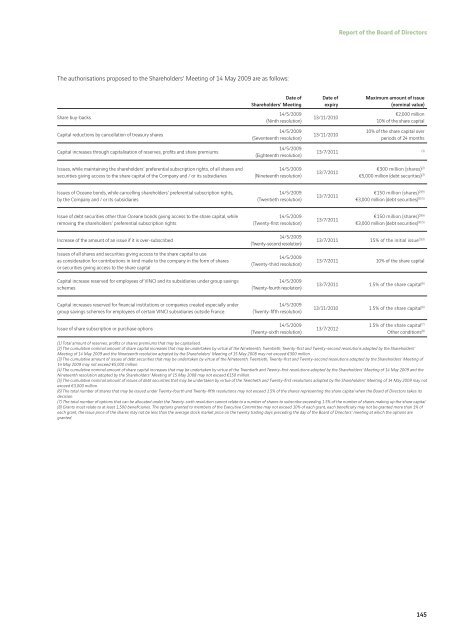

The authorisations proposed to the Shareholders’ Meeting of 14 May 2009 are as follows:<br />

Share buy-backs<br />

Capital reductions by cancellation of treasury shares<br />

Capital increases through capitalisation of reserves, profi ts and share premiums<br />

Issues, while maintaining the shareholders’ preferential subscription rights, of all shares and<br />

securities giving access to the share capital of the Company and / or its subsidiaries<br />

Issues of Oceane bonds, while cancelling shareholders’ preferential subscription rights,<br />

by the Company and / or its subsidiaries<br />

Issue of debt securities other than Oceane bonds giving access to the share capital, while<br />

removing the shareholders’ preferential subscription rights<br />

Increase of the amount of an issue if it is over-subscribed<br />

Issues of all shares and securities giving access to the share capital to use<br />

as consideration for contributions in kind made to the company in the form of shares<br />

or securities giving access to the share capital<br />

Capital increase reserved for employees of <strong>VINCI</strong> and its subsidiaries under group savings<br />

schemes<br />

Capital increases reserved for fi nancial institutions or companies created especially under<br />

group savings schemes for employees of certain <strong>VINCI</strong> subsidiaries outside France.<br />

Issue of share subscription or purchase options<br />

Date of<br />

Shareholders’ Meeting<br />

14/5/2009<br />

(Ninth resolution)<br />

14/5/2009<br />

(Seventeenth resolution)<br />

14/5/2009<br />

(Eighteenth resolution)<br />

14/5/2009<br />

(Nineteenth resolution)<br />

14/5/2009<br />

(Twentieth resolution)<br />

14/5/2009<br />

(Twenty-fi rst resolution)<br />

14/5/2009<br />

(Twenty-second resolution)<br />

14/5/2009<br />

(Twenty-third resolution)<br />

14/5/2009<br />

(Twenty-fourth resolution)<br />

14/5/2009<br />

(Twenty-fi fth resolution)<br />

14/5/2009<br />

(Twenty-sixth resolution)<br />

Date of<br />

expiry<br />

13/11/2010<br />

13/11/2010<br />

13/7/2011<br />

13/7/2011<br />

13/7/2011<br />

13/7/2011<br />

Report of the Board of Directors<br />

Maximum amount of issue<br />

(nominal value)<br />

€2,000 million<br />

10% of the share capital<br />

10% of the share capital over<br />

periods of 24 months<br />

€300 million (shares) (2)<br />

€5,000 million (debt securities) (3)<br />

€150 million (shares) (2)(4)<br />

(3) (5)<br />

€3,000 million (debt securities)<br />

€150 million (shares) (2)(4)<br />

(3) (5)<br />

€3,000 million (debt securities)<br />

13/7/2011 15% of the initial issue (2)(3)<br />

13/7/2011 10% of the share capital<br />

13/7/2011 1.5% of the share capital (6)<br />

13/11/2010 1.5% of the share capital (6)<br />

13/7/2012<br />

1.5% of the share capital (7)<br />

Other conditions (8)<br />

(1) Total amount of reserves, profi ts or shares premiums that may be capitalised.<br />

(2) The cumulative nominal amount of share capital increases that may be undertaken by virtue of the Nineteenth, Twentieth, Twenty-fi rst and Twenty-second resolutions adopted by the Shareholders’<br />

Meeting of 14 May 2009 and the Nineteenth resolution adopted by the Shareholders’ Meeting of 15 May <strong>2008</strong> may not exceed €300 million.<br />

(3) The cumulative amount of issues of debt securities that may be undertaken by virtue of the Nineteenth, Twentieth, Twenty-fi rst and Twenty-second resolutions adopted by the Shareholders’ Meeting of<br />

14 May 2009 may not exceed €5,000 million.<br />

(4) The cumulative nominal amount of share capital increases that may be undertaken by virtue of the Twentieth and Twenty-fi rst resolutions adopted by the Shareholders’ Meeting of 14 May 2009 and the<br />

Nineteenth resolution adopted by the Shareholders’ Meeting of 15 May <strong>2008</strong> may not exceed €150 million.<br />

(5) The cumulative nominal amount of issues of debt securities that may be undertaken by virtue of the Twentieth and Twenty-fi rst resolutions adopted by the Shareholders’ Meeting of 14 May 2009 may not<br />

exceed €3,000 million.<br />

(6) The total number of shares that may be issued under Twenty-fourth and Twenty-fi fth resolutions may not exceed 1.5% of the shares representing the share capital when the Board of Directors takes its<br />

decision.<br />

(7) The total number of options that can be allocated under the Twenty-sixth resolution cannot relate to a number of shares to subscribe exceeding 1.5% of the number of shares making up the share capital.<br />

(8) Grants must relate to at least 1,500 benefi ciaries. The options granted to members of the Executive Committee may not exceed 10% of each grant, each benefi ciary may not be granted more than 1% of<br />

each grant, the issue price of the shares may not be less than the average stock market price on the twenty trading days preceding the day of the Board of Directors’ meeting at which the options are<br />

granted.<br />

(1)<br />

145