VINCI - 2008 annual report

VINCI - 2008 annual report

VINCI - 2008 annual report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Consolidated fi nancial statements<br />

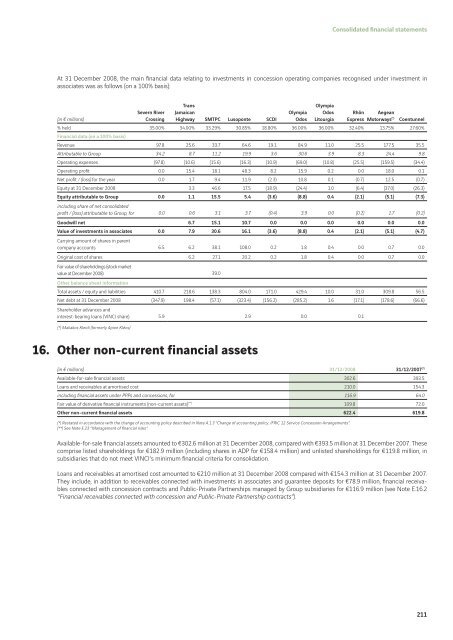

At 31 December <strong>2008</strong>, the main fi nancial data relating to investments in concession operating companies recognised under investment in<br />

associates was as follows (on a 100% basis):<br />

Trans<br />

Olympia<br />

Severn River Jamaican<br />

Olympia Odos Rhôn Aegean<br />

(in € millions)<br />

Crossing Highway SMTPC Lusoponte SCDI Odos Litourgia Express Motorways (*) Coentunnel<br />

% held<br />

Financial data (on a 100% basis)<br />

35.00% 34.00% 33.29% 30.85% 18.80% 36.00% 36.00% 32.40% 13.75% 27.60%<br />

Revenue 97.8 25.6 33.7 64.6 19.1 84.9 11.0 25.5 177.5 35.5<br />

Attributable to Group 34.2 8.7 11.2 19.9 3.6 30.6 3.9 8.3 24.4 9.8<br />

Operating expenses (97.8) (10.6) (15.6) (16.3) (10.9) (69.0) (10.8) (25.5) (159.5) (34.4)<br />

Operating profi t 0.0 15.4 18.1 48.3 8.2 15.9 0.2 0.0 18.0 0.1<br />

Net profi t / (loss) for the year 0.0 1.7 9.4 11.9 (2.3) 10.8 0.1 (0.7) 12.5 (0.7)<br />

Equity at 31 December <strong>2008</strong> 3.3 46.6 17.5 (18.9) (24.4) 1.0 (6.4) (37.0) (26.3)<br />

Equity attributable to Group<br />

including share of net consolidated<br />

0.0 1.1 15.5 5.4 (3.6) (8.8) 0.4 (2.1) (5.1) (7.3)<br />

profi t / (loss) attributable to Group, for 0.0 0.6 3.1 3.7 (0.4) 3.9 0.0 (0.2) 1.7 (0.2)<br />

Goodwill net 6.7 15.1 10.7 0.0 0.0 0.0 0.0 0.0 0.0<br />

Value of investments in associates<br />

Carrying amount of shares in parent<br />

0.0 7.9 30.6 16.1 (3.6) (8.8) 0.4 (2.1) (5.1) (4.7)<br />

company accounts 6.5 6.2 38.1 108.0 0.2 1.8 0.4 0.0 0.7 0.0<br />

Original cost of shares<br />

Fair value of shareholdings (stock market<br />

6.2 27.1 20.2 0.2 1.8 0.4 0.0 0.7 0.0<br />

value at December <strong>2008</strong>)<br />

Other balance sheet information<br />

39.0<br />

Total assets / equity and liabilities 410.7 218.6 138.3 804.0 171.0 429.4 10.0 31.0 309.8 56.5<br />

Net debt at 31 December <strong>2008</strong><br />

Shareholder advances and<br />

(347.9) 198.4 (57.1) (323.4) (156.2) (285.2) 1.6 (17.1) (178.6) (66.6)<br />

interest-bearing loans (<strong>VINCI</strong> share) 5.9 2.9 0.0 0.1<br />

(*) Maliakos Kleidi (formerly Apion Kléos)<br />

16. Other non-current financial assets<br />

(in € millions) 31/12/<strong>2008</strong> 31/12/2007 (*)<br />

Available-for-sale fi nancial assets 302.6 393.5<br />

Loans and receivables at amortised cost 210.0 154.3<br />

including fi nancial assets under PPPs and concessions, for 116.9 64.0<br />

Fair value of derivative fi nancial instruments (non-current assets) (**) 109.8 72.0<br />

Other non-current fi nancial assets 622.4 619.8<br />

(*) Restated in accordance with the change of accounting policy described in Note A.1.3 “Change of accounting policy: IFRIC 12 Service Concession Arrangements”.<br />

(**) See Note E.23 “Management of fi nancial risks”.<br />

Available-for-sale fi nancial assets amounted to €302.6 million at 31 December <strong>2008</strong>, compared with €393.5 million at 31 December 2007. These<br />

comprise listed shareholdings for €182.9 million (including shares in ADP for €158.4 million) and unlisted shareholdings for €119.8 million, in<br />

subsidiaries that do not meet <strong>VINCI</strong>’s minimum fi nancial criteria for consolidation.<br />

Loans and receivables at amortised cost amounted to €210 million at 31 December <strong>2008</strong> compared with €154.3 million at 31 December 2007.<br />

They include, in addition to receivables connected with investments in associates and guarantee deposits for €78.9 million, fi nancial receivables<br />

connected with concession contracts and Public-Private Partnerships managed by Group subsidiaries for €116.9 million (see Note E.16.2<br />

“Financial receivables connected with concession and Public-Private Partnership contracts”).<br />

211