Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

AMADEUS <strong>IT</strong> HOLDING, S.A. AND SUBSIDIARIES<br />

DIRECTORS’ REPORT FOR THE YEAR ENDED DECEMBER 31, 2011<br />

the levels of 2010, <strong>and</strong> (ii) a 26.0% increase in investment in intangible assets, driven by an<br />

increase in software capitalis<strong>at</strong>ions <strong>and</strong> higher signing bonuses paid to travel agencies in the<br />

period vs. the same period in 2010.<br />

For the full year 2011, the growth in capital expenditure is driven by the payment of a signing<br />

bonus in rel<strong>at</strong>ion to the 10 year distribution agreement with the entity resulting from the<br />

merger of GoVoyages, eDreams <strong>and</strong> Opodo, as well as the increased capitalis<strong>at</strong>ions during<br />

the period (both direct <strong>and</strong> indirect capitalis<strong>at</strong>ions as described elsewhere in this document),<br />

as a result of the increased R&D.<br />

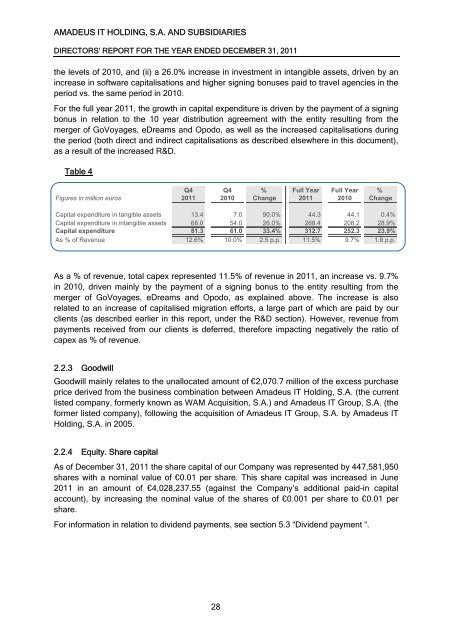

Table 4<br />

Q4 Q4 % Full Year Full Year %<br />

Figures in million euros 2011 2010 Change 2011 2010 Change<br />

Capital expenditure in tangible assets 13.4 7.0 90.0% 44.3 44.1 0.4%<br />

Capital expenditure in intangible assets 68.0 54.0 26.0% 268.4 208.2 28.9%<br />

Capital expenditure 81.3 61.0 33.4% 312.7 252.3 23.9%<br />

As % of Revenue 12.6% 10.0% 2.5 p.p. 11.5% 9.7% 1.8 p.p.<br />

As a % of revenue, total capex represented 11.5% of revenue in 2011, an increase vs. 9.7%<br />

in 2010, driven mainly by the payment of a signing bonus to the entity resulting from the<br />

merger of GoVoyages, eDreams <strong>and</strong> Opodo, as explained above. The increase is also<br />

rel<strong>at</strong>ed to an increase of capitalised migr<strong>at</strong>ion efforts, a large part of which are paid by our<br />

clients (as described earlier in this report, under the R&D section). However, revenue from<br />

payments received from our clients is deferred, therefore impacting neg<strong>at</strong>ively the r<strong>at</strong>io of<br />

capex as % of revenue.<br />

2.2.3 Goodwill<br />

Goodwill mainly rel<strong>at</strong>es to the unalloc<strong>at</strong>ed amount of €2,070.7 million of the excess purchase<br />

price derived from the business combin<strong>at</strong>ion between <strong>Amadeus</strong> <strong>IT</strong> <strong>Holding</strong>, S.A. (the current<br />

listed company, formerly known as WAM Acquisition, S.A.) <strong>and</strong> <strong>Amadeus</strong> <strong>IT</strong> Group, S.A. (the<br />

former listed company), following the acquisition of <strong>Amadeus</strong> <strong>IT</strong> Group, S.A. by <strong>Amadeus</strong> <strong>IT</strong><br />

<strong>Holding</strong>, S.A. in 2005.<br />

2.2.4 Equity. Share capital<br />

As of December 31, 2011 the share capital of our Company was represented by 447,581,950<br />

shares with a nominal value of €0.01 per share. This share capital was increased in June<br />

2011 in an amount of €4,028,237.55 (against the Company’s additional paid-in capital<br />

account), by increasing the nominal value of the shares of €0.001 per share to €0.01 per<br />

share.<br />

For inform<strong>at</strong>ion in rel<strong>at</strong>ion to dividend payments, see section 5.3 “Dividend payment “.<br />

28