Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

AMADEUS <strong>IT</strong> HOLDING, S.A. AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED ANNUAL ACCOUNTS FOR THE YEARS ENDED<br />

DECEMBER 31, 2011, AND 2010<br />

(EXPRESSED IN THOUSANDS OF EUROS - KEUR)<br />

5. FINANCIAL RISK AND CAP<strong>IT</strong>AL MANAGEMENT<br />

The Group has exposure, as a result of the normal course of its business activities, to<br />

foreign exchange, interest r<strong>at</strong>e, own shares price evolution, credit <strong>and</strong> liquidity risk.<br />

The goal of the Group is to identify measure <strong>and</strong> minimize these risks using the most<br />

effective <strong>and</strong> efficient methods to elimin<strong>at</strong>e, reduce, or transfer such exposures. With<br />

the purpose of managing these risks, in some occasions, the Group enters into<br />

hedging activities with deriv<strong>at</strong>ives <strong>and</strong> non-deriv<strong>at</strong>ive instruments.<br />

a) Foreign exchange r<strong>at</strong>e risk<br />

The reporting currency in the Group’s consolid<strong>at</strong>ed financial st<strong>at</strong>ements is the Euro<br />

(EUR). As a result of the multin<strong>at</strong>ional orient<strong>at</strong>ion of its business, the Group is subject<br />

to foreign exchange r<strong>at</strong>e risks derived from the fluctu<strong>at</strong>ions of many currencies. The<br />

target of the Group’s foreign exchange hedging str<strong>at</strong>egy is to reduce the vol<strong>at</strong>ility of<br />

the Euro value of the consolid<strong>at</strong>ed foreign currency denomin<strong>at</strong>ed cash flows. The<br />

instruments used to achieve this goal depend on the denomin<strong>at</strong>ion currency of the<br />

oper<strong>at</strong>ing cash flow to be hedged:<br />

� The str<strong>at</strong>egy for US Dollar (USD) exposures is fundamentally based on the<br />

use of n<strong>at</strong>ural hedges. This str<strong>at</strong>egy aims <strong>at</strong> reducing the exposure cre<strong>at</strong>ed<br />

by the USD denomin<strong>at</strong>ed oper<strong>at</strong>ing cash inflows of the Company with the<br />

USD payments of principals of the USD denomin<strong>at</strong>ed debt.<br />

� Aside from the USD, the foreign currency exposures are expenditures<br />

denomin<strong>at</strong>ed in a variety foreign currencies. The most significant of these<br />

exposures are denomin<strong>at</strong>ed in Sterling Pounds (GBP), Australian Dollars<br />

(AUD) <strong>and</strong> Swedish Kronas (SEK). For these exposures, a n<strong>at</strong>ural hedge<br />

str<strong>at</strong>egy is not possible. In order to hedge a significant portion of the<br />

aforementioned short exposures (net expenditures) the Group engages into<br />

deriv<strong>at</strong>ive contracts with banks: basically currency forwards, currency options<br />

<strong>and</strong> combin<strong>at</strong>ions of currency options.<br />

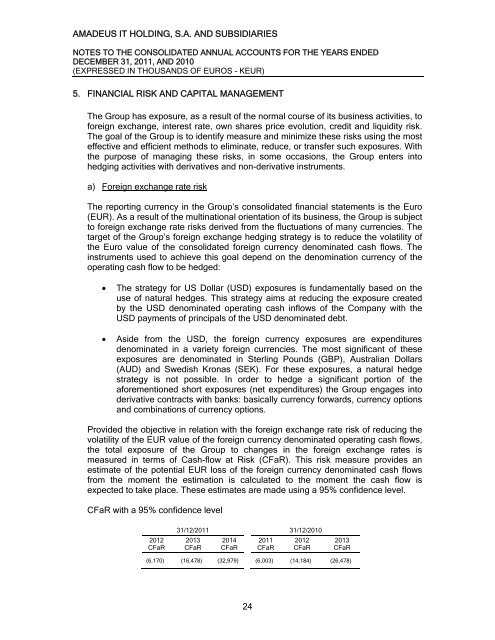

Provided the objective in rel<strong>at</strong>ion with the foreign exchange r<strong>at</strong>e risk of reducing the<br />

vol<strong>at</strong>ility of the EUR value of the foreign currency denomin<strong>at</strong>ed oper<strong>at</strong>ing cash flows,<br />

the total exposure of the Group to changes in the foreign exchange r<strong>at</strong>es is<br />

measured in terms of Cash-flow <strong>at</strong> Risk (CFaR). This risk measure provides an<br />

estim<strong>at</strong>e of the potential EUR loss of the foreign currency denomin<strong>at</strong>ed cash flows<br />

from the moment the estim<strong>at</strong>ion is calcul<strong>at</strong>ed to the moment the cash flow is<br />

expected to take place. These estim<strong>at</strong>es are made using a 95% confidence level.<br />

CFaR with a 95% confidence level<br />

2012<br />

CFaR<br />

31/12/2011 31/12/2010<br />

2013<br />

CFaR<br />

2014<br />

CFaR<br />

24<br />

2011<br />

CFaR<br />

2012<br />

CFaR<br />

2013<br />

CFaR<br />

(6,170) (16,478) (32,979) (6,003) (14,184) (26,478)