Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

AMADEUS <strong>IT</strong> HOLDING, S.A. AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED ANNUAL ACCOUNTS FOR THE YEARS ENDED<br />

DECEMBER 31, 2011, AND 2010<br />

(EXPRESSED IN THOUSANDS OF EUROS - KEUR)<br />

penalty clauses applicable if those objectives are not met. The useful life of<br />

contractual <strong>rel<strong>at</strong>ions</strong>hips, has been determined by taking into consider<strong>at</strong>ion<br />

the contractual-legal rights, the renewal period <strong>and</strong> the technological lock-in<br />

period for these intangible assets. It has been determined to range over a<br />

period of 1 to 15 years. A straight-line method of amortiz<strong>at</strong>ion is applied, <strong>and</strong><br />

tested for impairment to adjust the carrying amount to the achievement of the<br />

committed objectives (as indic<strong>at</strong>ed in paragraph g). And within this c<strong>at</strong>egory,<br />

those assets th<strong>at</strong> were acquired through the business combin<strong>at</strong>ion are<br />

amortized using a straight-line method over a period between 8 <strong>and</strong> 15 years.<br />

� Other intangible assets are amortized on a straight-line basis over 3 to 5<br />

years.<br />

Amortiz<strong>at</strong>ion expenses rel<strong>at</strong>ed to intangible assets are included in the<br />

“Depreci<strong>at</strong>ion <strong>and</strong> amortiz<strong>at</strong>ion” caption of the st<strong>at</strong>ement of comprehensive<br />

income.<br />

The Group receives tax incentives in the form of reduced liability for taxes in<br />

rel<strong>at</strong>ion to research <strong>and</strong> development costs incurred by the Group. These<br />

incentives are in substance government grants <strong>and</strong> are recognized when there is<br />

reasonable assurance th<strong>at</strong> the Group will comply with the relevant conditions <strong>and</strong><br />

the grant will be received. The incentives for the period are recognized as a lower<br />

research <strong>and</strong> development expenditure in the st<strong>at</strong>ement of comprehensive<br />

income. When the costs incurred first meet the intangible asset recognition<br />

criteria the incentive for the period which is <strong>at</strong>tributable from this point onwards is<br />

recognized as a lower intangible asset cost.<br />

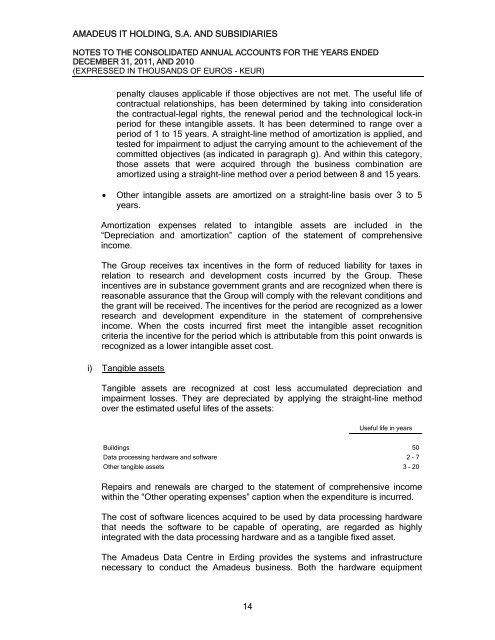

i) Tangible assets<br />

Tangible assets are recognized <strong>at</strong> cost less accumul<strong>at</strong>ed depreci<strong>at</strong>ion <strong>and</strong><br />

impairment losses. They are depreci<strong>at</strong>ed by applying the straight-line method<br />

over the estim<strong>at</strong>ed useful lifes of the assets:<br />

14<br />

Useful life in years<br />

Buildings 50<br />

D<strong>at</strong>a processing hardware <strong>and</strong> software 2 - 7<br />

Other tangible assets 3 - 20<br />

Repairs <strong>and</strong> renewals are charged to the st<strong>at</strong>ement of comprehensive income<br />

within the “Other oper<strong>at</strong>ing expenses” caption when the expenditure is incurred.<br />

The cost of software licences acquired to be used by d<strong>at</strong>a processing hardware<br />

th<strong>at</strong> needs the software to be capable of oper<strong>at</strong>ing, are regarded as highly<br />

integr<strong>at</strong>ed with the d<strong>at</strong>a processing hardware <strong>and</strong> as a tangible fixed asset.<br />

The <strong>Amadeus</strong> D<strong>at</strong>a Centre in Erding provides the systems <strong>and</strong> infrastructure<br />

necessary to conduct the <strong>Amadeus</strong> business. Both the hardware equipment