Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

AMADEUS <strong>IT</strong> HOLDING, S.A. AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED ANNUAL ACCOUNTS FOR THE YEARS ENDED<br />

DECEMBER 31, 2011, AND 2010<br />

(EXPRESSED IN THOUSANDS OF EUROS - KEUR)<br />

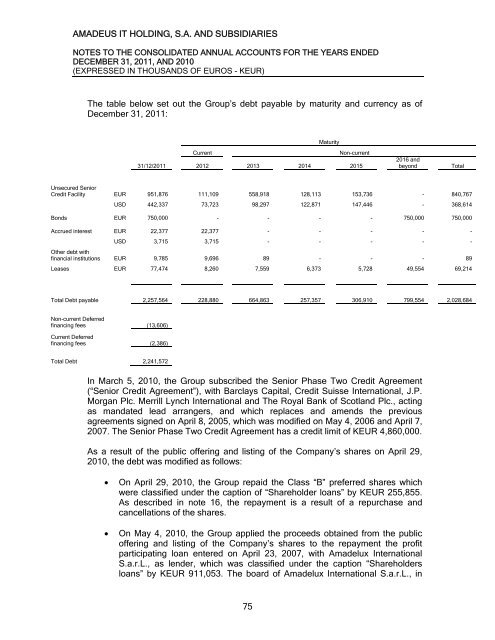

The table below set out the Group’s debt payable by m<strong>at</strong>urity <strong>and</strong> currency as of<br />

December 31, 2011:<br />

31/12/2011<br />

75<br />

M<strong>at</strong>urity<br />

Current Non-current<br />

2012 2013 2014 2015<br />

2016 <strong>and</strong><br />

beyond Total<br />

Unsecured Senior<br />

Credit Facility EUR 951,876 111,109 558,918 128,113 153,736 - 840,767<br />

USD 442,337 73,723 98,297 122,871 147,446 - 368,614<br />

Bonds EUR 750,000 - - - - 750,000 750,000<br />

Accrued interest EUR 22,377 22,377 - - - - -<br />

Other debt with<br />

USD 3,715 3,715 - - - - -<br />

financial institutions EUR 9,785 9,696 89 - - - 89<br />

Leases EUR 77,474 8,260 7,559 6,373 5,728 49,554 69,214<br />

Total Debt payable 2,257,564 228,880 664,863 257,357 306,910 799,554 2,028,684<br />

Non-current Deferred<br />

financing fees<br />

Current Deferred<br />

(13,606)<br />

financing fees (2,386)<br />

Total Debt 2,241,572<br />

In March 5, 2010, the Group subscribed the Senior Phase Two Credit Agreement<br />

(“Senior Credit Agreement”), with Barclays Capital, Credit Suisse Intern<strong>at</strong>ional, J.P.<br />

Morgan Plc. Merrill Lynch Intern<strong>at</strong>ional <strong>and</strong> The Royal Bank of Scotl<strong>and</strong> Plc., acting<br />

as m<strong>and</strong><strong>at</strong>ed lead arrangers, <strong>and</strong> which replaces <strong>and</strong> amends the previous<br />

agreements signed on April 8, 2005, which was modified on May 4, 2006 <strong>and</strong> April 7,<br />

2007. The Senior Phase Two Credit Agreement has a credit limit of KEUR 4,860,000.<br />

As a result of the public offering <strong>and</strong> listing of the Company’s shares on April 29,<br />

2010, the debt was modified as follows:<br />

� On April 29, 2010, the Group repaid the Class “B” preferred shares which<br />

were classified under the caption of “Shareholder loans” by KEUR 255,855.<br />

As described in note 16, the repayment is a result of a repurchase <strong>and</strong><br />

cancell<strong>at</strong>ions of the shares.<br />

� On May 4, 2010, the Group applied the proceeds obtained from the public<br />

offering <strong>and</strong> listing of the Company’s shares to the repayment the profit<br />

particip<strong>at</strong>ing loan entered on April 23, 2007, with Amadelux Intern<strong>at</strong>ional<br />

S.a.r.L., as lender, which was classified under the caption “Shareholders<br />

loans” by KEUR 911,053. The board of Amadelux Intern<strong>at</strong>ional S.a.r.L., in