Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Amadeus IT Holding, S.A. and Subsidiaries - Investor relations at ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

AMADEUS <strong>IT</strong> HOLDING, S.A. AND SUBSIDIARIES<br />

NOTES TO THE CONSOLIDATED ANNUAL ACCOUNTS FOR THE YEARS ENDED<br />

DECEMBER 31, 2011, AND 2010<br />

(EXPRESSED IN THOUSANDS OF EUROS - KEUR)<br />

The retirement in goodwill during the year 2010 is due to the divestiture of 100% of<br />

the equity stake in Hospitality Group as described in note 14.<br />

“Assets classified as held for sale” in the year 2010 presents the transfer of the<br />

goodwill alloc<strong>at</strong>ed to our cash-gener<strong>at</strong>ing unit Opodo Group to this line in the<br />

consolid<strong>at</strong>ed st<strong>at</strong>ement of financial position. Opodo Group has been sold during the<br />

year 2011 as explained in note 14.<br />

Transfers in 2010 rel<strong>at</strong>e to the completion of the purchase price alloc<strong>at</strong>ion exercise<br />

for the business combin<strong>at</strong>ion with Perez Inform<strong>at</strong>ique, S.A. <strong>and</strong> subsidiaries <strong>and</strong><br />

Pixell Online Marketing GmbH.<br />

Goodwill derived from any acquisition is alloc<strong>at</strong>ed, based on <strong>Amadeus</strong>’<br />

organiz<strong>at</strong>ional structure <strong>and</strong> oper<strong>at</strong>ions, to the cash-gener<strong>at</strong>ing unit th<strong>at</strong> is expected<br />

to benefit from the acquisition th<strong>at</strong> origin<strong>at</strong>ed the goodwill. The cash-gener<strong>at</strong>ing units<br />

are the lowest level within the Group <strong>at</strong> which goodwill is monitored for internal<br />

management purposes.<br />

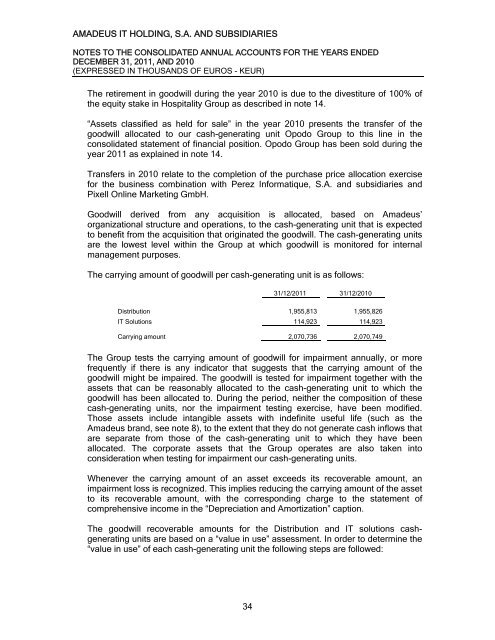

The carrying amount of goodwill per cash-gener<strong>at</strong>ing unit is as follows:<br />

34<br />

31/12/2011 31/12/2010<br />

Distribution 1,955,813 1,955,826<br />

<strong>IT</strong> Solutions 114,923 114,923<br />

Carrying amount 2,070,736 2,070,749<br />

The Group tests the carrying amount of goodwill for impairment annually, or more<br />

frequently if there is any indic<strong>at</strong>or th<strong>at</strong> suggests th<strong>at</strong> the carrying amount of the<br />

goodwill might be impaired. The goodwill is tested for impairment together with the<br />

assets th<strong>at</strong> can be reasonably alloc<strong>at</strong>ed to the cash-gener<strong>at</strong>ing unit to which the<br />

goodwill has been alloc<strong>at</strong>ed to. During the period, neither the composition of these<br />

cash-gener<strong>at</strong>ing units, nor the impairment testing exercise, have been modified.<br />

Those assets include intangible assets with indefinite useful life (such as the<br />

<strong>Amadeus</strong> br<strong>and</strong>, see note 8), to the extent th<strong>at</strong> they do not gener<strong>at</strong>e cash inflows th<strong>at</strong><br />

are separ<strong>at</strong>e from those of the cash-gener<strong>at</strong>ing unit to which they have been<br />

alloc<strong>at</strong>ed. The corpor<strong>at</strong>e assets th<strong>at</strong> the Group oper<strong>at</strong>es are also taken into<br />

consider<strong>at</strong>ion when testing for impairment our cash-gener<strong>at</strong>ing units.<br />

Whenever the carrying amount of an asset exceeds its recoverable amount, an<br />

impairment loss is recognized. This implies reducing the carrying amount of the asset<br />

to its recoverable amount, with the corresponding charge to the st<strong>at</strong>ement of<br />

comprehensive income in the “Depreci<strong>at</strong>ion <strong>and</strong> Amortiz<strong>at</strong>ion” caption.<br />

The goodwill recoverable amounts for the Distribution <strong>and</strong> <strong>IT</strong> solutions cashgener<strong>at</strong>ing<br />

units are based on a “value in use” assessment. In order to determine the<br />

“value in use” of each cash-gener<strong>at</strong>ing unit the following steps are followed: