2013-vinci-annual-report

2013-vinci-annual-report

2013-vinci-annual-report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

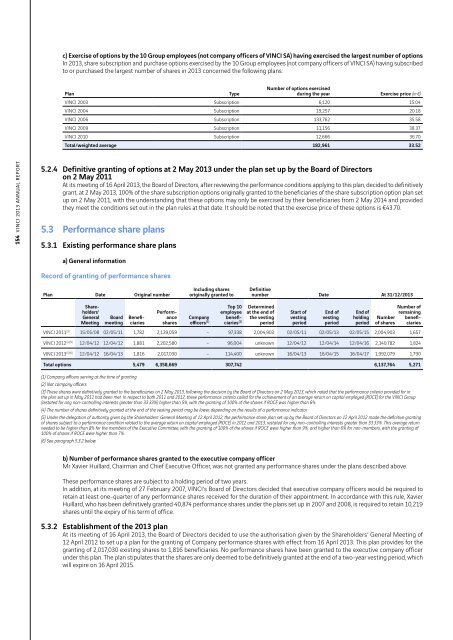

c) Exercise of options by the 10 Group employees (not company officers of VINCI SA) having exercised the largest number of options<br />

In <strong>2013</strong>, share subscription and purchase options exercised by the 10 Group employees (not company officers of VINCI SA) having subscribed<br />

to or purchased the largest number of shares in <strong>2013</strong> concerned the following plans:<br />

Plan<br />

Type<br />

Number of options exercised<br />

during the year Exercise price (in €)<br />

VINCI 2003 Subscription 6,120 15.04<br />

VINCI 2004 Subscription 19,257 20.18<br />

VINCI 2006 Subscription 133,762 35.58<br />

VINCI 2009 Subscription 11,156 38.37<br />

VINCI 2010 Subscription 12,666 36.70<br />

Total/weighted average 182,961 33.52<br />

154 VINCI <strong>2013</strong> ANNUAL REPORT<br />

5.2.4 Definitive granting of options at 2 May <strong>2013</strong> under the plan set up by the Board of Directors<br />

on 2 May 2011<br />

At its meeting of 16 April <strong>2013</strong>, the Board of Directors, after reviewing the performance conditions applying to this plan, decided to definitively<br />

grant, at 2 May <strong>2013</strong>, 100% of the share subscription options originally granted to the beneficiaries of the share subscription option plan set<br />

up on 2 May 2011, with the understanding that these options may only be exercised by their beneficiaries from 2 May 2014 and provided<br />

they meet the conditions set out in the plan rules at that date. It should be noted that the exercise price of these options is €43.70.<br />

5.3 Performance share plans<br />

5.3.1 Existing performance share plans<br />

a) General information<br />

Record of granting of performance shares<br />

Plan Date Original number<br />

Including shares<br />

originally granted to<br />

Definitive<br />

number Date At 31/12/<strong>2013</strong><br />

Shareholders’<br />

General<br />

Meeting<br />

Board<br />

meeting<br />

Beneficiaries<br />

Performance<br />

shares<br />

Top 10<br />

employee<br />

Company benefiofficers<br />

(1) ciaries (2)<br />

Determined<br />

at the end of<br />

the vesting<br />

period<br />

Start of<br />

vesting<br />

period<br />

End of<br />

vesting<br />

period<br />

End of<br />

holding<br />

period<br />

Number<br />

of shares<br />

Number of<br />

remaining<br />

beneficiaries<br />

VINCI 2011 (3) 15/05/08 02/05/11 1,782 2,139,059 – 97,338 2,004,903 02/05/11 02/05/13 02/05/15 2,004,903 1,657<br />

VINCI 2012 (4) (5) 12/04/12 12/04/12 1,881 2,202,580 – 96,004 unknown 12/04/12 12/04/14 12/04/16 2,140,782 1,824<br />

VINCI <strong>2013</strong> (4) (6) 12/04/12 16/04/13 1,816 2,017,030 – 114,400 unknown 16/04/13 16/04/15 16/04/17 1,992,079 1,790<br />

Total options 5,479 6,358,669 307,742 6,137,764 5,271<br />

(1) Company officers serving at the time of granting.<br />

(2) Not company officers.<br />

(3) These shares were definitively granted to the beneficiaries on 2 May <strong>2013</strong>, following the decision by the Board of Directors on 2 May <strong>2013</strong>, which noted that the performance criteria provided for in<br />

the plan set up in May 2011 had been met. In respect to both 2011 and 2012, these performance criteria called for the achievement of an average return on capital employed (ROCE) for the VINCI Group<br />

(restated for any non-controlling interests greater than 33.33%) higher than 5%, with the granting of 100% of the shares if ROCE was higher than 6%.<br />

(4) The number of shares definitively granted at the end of the vesting period may be lower, depending on the results of a performance indicator.<br />

(5) Under the delegation of authority given by the Shareholders’ General Meeting of 12 April 2012, the performance share plan set up by the Board of Directors on 12 April 2012 made the definitive granting<br />

of shares subject to a performance condition related to the average return on capital employed (ROCE) in 2012 and <strong>2013</strong>, restated for any non-controlling interests greater than 33.33%. This average return<br />

needed to be higher than 8% for the members of the Executive Committee, with the granting of 100% of the shares if ROCE were higher than 9%; and higher than 6% for non-members, with the granting of<br />

100% of shares if ROCE were higher than 7%.<br />

(6) See paragraph 5.3.2 below.<br />

b) Number of performance shares granted to the executive company officer<br />

Mr Xavier Huillard, Chairman and Chief Executive Officer, was not granted any performance shares under the plans described above.<br />

These performance shares are subject to a holding period of two years.<br />

In addition, at its meeting of 27 February 2007, VINCI’s Board of Directors decided that executive company officers would be required to<br />

retain at least one-quarter of any performance shares received for the duration of their appointment. In accordance with this rule, Xavier<br />

Huillard, who has been definitively granted 40,874 performance shares under the plans set up in 2007 and 2008, is required to retain 10,219<br />

shares until the expiry of his term of office.<br />

5.3.2 Establishment of the <strong>2013</strong> plan<br />

At its meeting of 16 April <strong>2013</strong>, the Board of Directors decided to use the authorisation given by the Shareholders’ General Meeting of<br />

12 April 2012 to set up a plan for the granting of Company performance shares with effect from 16 April <strong>2013</strong>. This plan provides for the<br />

granting of 2,017,030 existing shares to 1,816 beneficiaries. No performance shares have been granted to the executive company officer<br />

under this plan. The plan stipulates that the shares are only deemed to be definitively granted at the end of a two-year vesting period, which<br />

will expire on 16 April 2015.