Daniel l. Rubinfeld

Daniel l. Rubinfeld

Daniel l. Rubinfeld

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

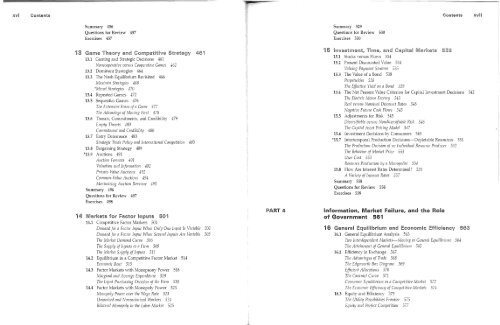

xvi<br />

Contents<br />

Contents<br />

xvii<br />

Summary 456<br />

Questions for Review 457<br />

Exercises 457<br />

13 461<br />

13.1 Gaming and Strategic Decisions 461<br />

Noncooperative versus Cooperative Games 462<br />

13.2 Dominant Strategies 464<br />

13.3 The Nash Equilibrium Revisited 466<br />

Maximin Strategies 468<br />

'Mixed Strategies 470<br />

13.4 Repeated Garnes 472<br />

13.5 Sequential Garnes 476<br />

The Extellsive Form of a Game 477<br />

The Advantage of Moving First 478<br />

13.6 Threats, Commitments, and Credibility 479<br />

Empty Threats 480<br />

Commitment and Credibility 480<br />

13.7 Entry Deterrence 483<br />

Strategic Trade Policy and International Competition 485<br />

13.8 Bargaining Strategy 489<br />

*13.9 Auctions 491<br />

Auction Formats 491<br />

Valuatioll alld Informatioll 492<br />

Private-Value Auctions 492<br />

Common-Value Auctions 494<br />

Maximizing Auction Revenue 495<br />

Summary 496<br />

Questions for Review 497<br />

Exercises 498<br />

14 Marh:.ets for factor Inputs 501<br />

14.1 Competitive Factor Markets 501<br />

Demalldfor a Factor Input Wilen Only One Input Is Variable 502<br />

Demand for a Factor Input lr\fllen Several Inputs Are Variable 505<br />

The Market Demand Curve 506<br />

The Supply of Inputs to a Firm 509<br />

The iVlarket Supply of Inputs 511<br />

14.2 Equilibrium in a Competitive Factor Market 514<br />

Economic Rent 515<br />

14.3 Factor Markets with Monopsony Power 518<br />

Marginal alld Average Expellditure 519<br />

The Input Purchasing Decision of the Firm 520<br />

14.4 Factor Markets with Monopoly Power 523<br />

Monopoly Power over the Wage Rate 523<br />

Uniollized and Nonllllionized Workers 524<br />

Bilateral Monopoly in the Labor Market 525<br />

PART 4<br />

15<br />

Summary 529<br />

Questions for Review 530<br />

Exercises 530<br />

15.1 Stocks versus Flows 534<br />

15.2 Present Discounted Value 534<br />

Valuing Payment Streams 535<br />

15.3 The Value of a Bond 538<br />

Perpetuities 538<br />

The Effective Yield Oil a BOlld 539<br />

15.4 The Net Present Value Criterion for Capital In\"estment Decisions 542<br />

The Electric Motor Factory 543<br />

Real versus Nominal Discoullt Rates 543<br />

Negatiz1e Future Cash Flows 545<br />

15.5 Adjustments for Risk 545<br />

Dh1ersifiable versus Nondiversifiable Risk 546<br />

The Capital Asset Pricing Model 547<br />

15.6 Investment Decisions bv Consumers 549<br />

*15.7 Intertemporal Production Decisions-Depletable Resources 551<br />

The Production Decisioll of all Individual Resource Producer 552<br />

The Behavior of Market Price 553<br />

User Cost 553<br />

Resource Productioll by a Monopolist 554<br />

15.8 How Are Interest Rates Determined 555<br />

A Variety of Interest Rates 557<br />

Summary 558<br />

Questions for Review 558<br />

Exercises 559<br />

Information, Market Failure, and the Role<br />

of Government 561<br />

16 General Equilibrium and Economic Efficiency 563<br />

16.1 General Equilibrium Analysis 563<br />

Two Interdependent Markets-Moping to General Equilibrium 564<br />

The Attainment of General Equilibrium 565<br />

16.2 Efficiency in Exchange 567<br />

The Adz1alltages of Trade 568<br />

TIle Edgeworth Box Diagram 569<br />

Efficient Allocations 570<br />

The Contract Curve 571<br />

Consumer Equilibrium in a Competitive Market 572<br />

The Ecollomic Efficiellcy of Competith1e Markets 574<br />

16.3 Equity and Efficiency 575<br />

The Utility Possibilities Frolltier 575<br />

Equity and Pelfect Competitioll 577