Daniel l. Rubinfeld

Daniel l. Rubinfeld

Daniel l. Rubinfeld

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

268 Part 2 Producers, Consumers, and Competitive Markets<br />

8 Profit Maximization and Competitive Supply 269<br />

I<br />

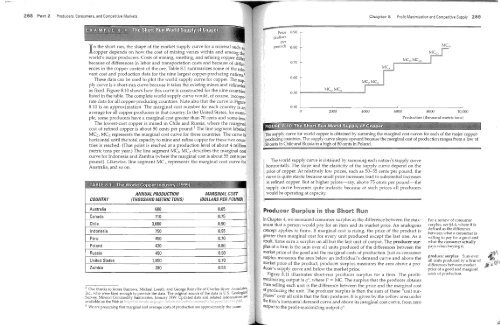

n the short run, the shape of the market supply curve for a mineral such as<br />

copper depends on how the cost of mining varies within and among the<br />

world's major producers. Costs of mining, smelting, and refining copper differ<br />

because of differences in labor and h'ansportation costs and because of differ_<br />

ences in the copper content of the ore. Table 8.1 summarizes some of the relevant<br />

cost and production data for the nine largest copper-producing nations.4<br />

These ~ata Cill1 be used to plot the ,:orld supply ~u~ve fo~' copper, The supply<br />

curve IS a short-run curve because It takes the eXisting mmes and refineries<br />

as fixed. Figure 8.10 shows how this curve is consh'ucted for the nine countries<br />

listed in the table. The complete world supply curve would, of course, incorporate<br />

data for all copper-producing cOlUltries. Note also that the curve in Figure<br />

8.10 is an approximation. The marginal cost number for each country is an<br />

average for all copper producers in that COurltry. In the United States, for example,<br />

some producers have a marginal cost greater than 70 cents and some less.<br />

The lowest-cost copper is mined in Chile and Russia, where the marginal<br />

cost of refined copper is about 50 cents per pound. 5 The line segment labeled<br />

MCc, MC R represents the marginal cost curve for these counh·ies. The curve is<br />

horizontal until the total capacity to mine and refine copper for these hvo countries<br />

is reached. (That point is reached at a production level of about 4 million<br />

metric tons per year.) The line segment MC I , MCz describes the marginal cost<br />

curve for Indonesia and Zambia (where the marginal cost is about 55 cents per<br />

pound). Likewise, line segment MC A represents the marginal cost curve for<br />

Australia, and so on.<br />

ANNUAL PRODUCTION<br />

MARGINAL COST<br />

COUNTRY (THOUSAND METRIC TONS) (DOLLARS PER POUND)<br />

Price<br />

(dollars<br />

per<br />

pound) 0.80<br />

0..70<br />

0.60<br />

050<br />

OAO<br />

o 2000 4000 6000 8000 10,000<br />

Production (thousand metric tons)<br />

The supply curve for world is obtained by summing the marginal cost curves for each of the major copperproducing<br />

cow1tries. The cwve slopes upward because the marginal cost of production ranges from a low of<br />

50 cents in Chile and Russia to a of 80 cents in Poland.<br />

The vvodd supply curve is obtained by summing each nation's supply curve<br />

horizontally. The slope and the elasticity of the supply curve depend on the<br />

price of copper. At relatively low prices, such as 50-55 cents per pound, the<br />

curve is quite elastic because small price increases lead to substantial increases<br />

in refined copper. But at higher prices-say, above 75 cents pel' pound-the<br />

supply curve becomes quite inelastic because at such prices all producers<br />

would be operating at capacity.<br />

Australia 600 0.65<br />

Canada 710 0.75<br />

Chile 3,660 0.50<br />

Indonesia 750 0.55<br />

Peru 450 0.70<br />

Poland 420 0.80<br />

Russia 450 0.50<br />

United States 1,850 0.70<br />

Zambia 280 0.55<br />

J Our thanks to James Burrows, Michael Loreth, and George Rainville of Charles River Associates,<br />

Inc, who were kind enough to provide the data. The original source of the data is US. Geological<br />

Survey, Mineral Commodity Summaries, January 1999 .. Updated data and related information are<br />

available on the \"1eb at htip:!/rnincrzd~< Irninera:::l/pub:-:/(OrnIl1odit:\,<br />

5 We are presuming that marginal and average costs of production are approximately the same.<br />

Producer Surplus in<br />

Short<br />

In Chapter 4, vve measured consumer surplus as the difference between the maximum<br />

that a person would pay for an item and its market price. An analogous<br />

concept applies to firms. If marginal cost is rising, the price of the product is<br />

greater than marginal cost for e\'ery unit produced except the last one. As a<br />

result, firms earn a surplus on all but the last unit of output. The producer surplus<br />

of a firm is the sum over all units produced of the differences between the<br />

market price of the good and the marginal costs of production. Just as consumer<br />

surplus measures the area below an individual's demand curve and above the<br />

market price of the product, producer surplus measures the area abo\'e a producer's<br />

supply CUl've and below the market price.<br />

Figure 8.11 illustrates short-run producer surplus for a finn. The profitmaximizing<br />

output is q*, where P = Me. The surplus that the producer obtains<br />

frm selling each unit is the difference bet\'\'een the price and the marginal cost<br />

ot producing the unit. The producer surplus is then the sum of these "unit surpluses"<br />

over alllmits that the firm produces. It is aiven bv the vellow area under<br />

the firm's horizontal demand curve and above its ~nargir;al co;t curve, from zero<br />

output to the profit-maximizing output q*.<br />

For a review of consumer<br />

surplus, see §4A, where it is<br />

defined as the difference<br />

behveen what a consumer is<br />

willing to pay for a good and<br />

what the consumer actually<br />

pays when buying it<br />

producer surplus Sum over<br />

all units produced by a firm of<br />

differences behveen market<br />

price of a good and marginal<br />

costs of production.