east liberty station: realizing the potential - City of Pittsburgh

east liberty station: realizing the potential - City of Pittsburgh

east liberty station: realizing the potential - City of Pittsburgh

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

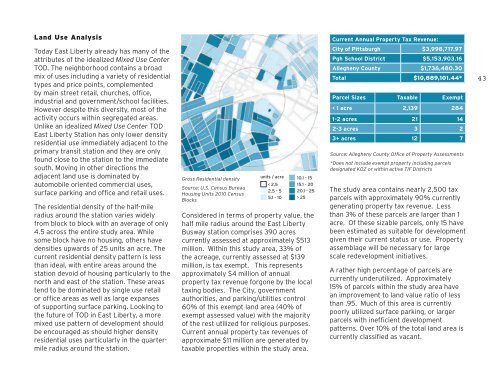

Land Use Analysis<br />

Current Annual Property Tax Revenue:<br />

Today East Liberty already has many <strong>of</strong> <strong>the</strong><br />

attributes <strong>of</strong> <strong>the</strong> idealized Mixed Use Center<br />

TOD. The neighborhood contains a broad<br />

mix <strong>of</strong> uses including a variety <strong>of</strong> residential<br />

types and price points, complemented<br />

by main street retail, churches, <strong>of</strong>fice,<br />

industrial and government/school facilities.<br />

However despite this diversity, most <strong>of</strong> <strong>the</strong><br />

activity occurs within segregated areas.<br />

Unlike an idealized Mixed Use Center TOD<br />

East Liberty Station has only lower density<br />

residential use immediately adjacent to <strong>the</strong><br />

primary transit <strong>station</strong> and <strong>the</strong>y are only<br />

found close to <strong>the</strong> <strong>station</strong> to <strong>the</strong> immediate<br />

south. Moving in o<strong>the</strong>r directions <strong>the</strong><br />

adjacent land use is dominated by<br />

automobile oriented commercial uses,<br />

surface parking and <strong>of</strong>fice and retail uses.<br />

The residential density <strong>of</strong> <strong>the</strong> half-mile<br />

radius around <strong>the</strong> <strong>station</strong> varies widely<br />

from block to block with an average <strong>of</strong> only<br />

4.5 across <strong>the</strong> entire study area. While<br />

some block have no housing, o<strong>the</strong>rs have<br />

densities upwards <strong>of</strong> 25 units an acre. The<br />

current residential density pattern is less<br />

than ideal, with entire areas around <strong>the</strong><br />

<strong>station</strong> devoid <strong>of</strong> housing particularly to <strong>the</strong><br />

north and <strong>east</strong> <strong>of</strong> <strong>the</strong> <strong>station</strong>. These areas<br />

tend to be dominated by single use retail<br />

or <strong>of</strong>fice areas as well as large expanses<br />

<strong>of</strong> supporting surface parking. Looking to<br />

<strong>the</strong> future <strong>of</strong> TOD in East Liberty, a more<br />

mixed use pattern <strong>of</strong> development should<br />

be encouraged as should higher density<br />

residential uses particularly in <strong>the</strong> quartermile<br />

radius around <strong>the</strong> <strong>station</strong>.<br />

Gross Residential density<br />

Source: U.S. Census Bureau<br />

Housing Units 2010 Census<br />

Blocks<br />

units / acre 10.1 - 15<br />

< 2.5<br />

2.5 - 5<br />

5.1 - 10<br />

15.1 - 20<br />

20.1 - 25<br />

> 25<br />

Considered in terms <strong>of</strong> property value, <strong>the</strong><br />

half mile radius around <strong>the</strong> East Liberty<br />

Busway <strong>station</strong> comprises 390 acres<br />

currently assessed at approximately $513<br />

million. Within this study area, 33% <strong>of</strong><br />

<strong>the</strong> acreage, currently assessed at $139<br />

million, is tax exempt. This represents<br />

approximately $4 million <strong>of</strong> annual<br />

property tax revenue forgone by <strong>the</strong> local<br />

taxing bodies. The <strong>City</strong>, government<br />

authorities, and parking/utilities control<br />

60% <strong>of</strong> this exempt land area (40% <strong>of</strong><br />

exempt assessed value) with <strong>the</strong> majority<br />

<strong>of</strong> <strong>the</strong> rest utilized for religious purposes.<br />

Current annual property tax revenues <strong>of</strong><br />

approximate $11 million are generated by<br />

taxable properties within <strong>the</strong> study area.<br />

<strong>City</strong> <strong>of</strong> <strong>Pittsburgh</strong> $3,998,717.97<br />

Pgh School District $5,153,903.16<br />

Allegheny County $1,736,480.30<br />

Total $10,889,101.44*<br />

Parcel Sizes Taxable Exempt<br />

< 1 acre 2,139 284<br />

1-2 acres 21 14<br />

2-3 acres 3 2<br />

3+ acres 12 7<br />

Source: Allegheny County Office <strong>of</strong> Property Assessments<br />

*Does not include exempt property including parcels<br />

designated KOZ or within active TIF Districts<br />

The study area contains nearly 2,500 tax<br />

parcels with approximately 90% currently<br />

generating property tax revenue. Less<br />

than 3% <strong>of</strong> <strong>the</strong>se parcels are larger than 1<br />

acre. Of <strong>the</strong>se sizable parcels, only 15 have<br />

been estimated as suitable for development<br />

given <strong>the</strong>ir current status or use. Property<br />

assemblage will be necessary for large<br />

scale redevelopment initiatives.<br />

A ra<strong>the</strong>r high percentage <strong>of</strong> parcels are<br />

currently underutilized. Approximately<br />

15% <strong>of</strong> parcels within <strong>the</strong> study area have<br />

an improvement to land value ratio <strong>of</strong> less<br />

than .95. Much <strong>of</strong> this area is currently<br />

poorly utilized surface parking, or larger<br />

parcels with inefficient development<br />

patterns. Over 10% <strong>of</strong> <strong>the</strong> total land area is<br />

currently classified as vacant.<br />

43