- Page 1 and 2:

APR Constructions Limited (Our Comp

- Page 3 and 4:

DEFINITIONS AND ABBREVIATIONS SECTI

- Page 5 and 6:

Term BOBCAPS Book Building Process

- Page 7 and 8:

Term Pay-in-Period Price Band Prici

- Page 9 and 10:

Abbreviation Full Form DP ID Deposi

- Page 11 and 12:

Industry/ Project Related Terms, De

- Page 13 and 14:

Financial Data PRESENTATION OF FINA

- Page 15 and 16:

SECTION II - RISK FACTORS RISK FACT

- Page 17 and 18:

qualification or shortlisting proce

- Page 19 and 20:

Our operations are currently geogra

- Page 21 and 22:

24. Our projects under development

- Page 23 and 24:

(` in Lakhs) Particulars Year Ended

- Page 25 and 26:

We propose to acquire plant and mac

- Page 27 and 28:

• Significant development in Indi

- Page 29 and 30:

13. Investors are advised to refer

- Page 31 and 32:

Key Highlights Government Investm

- Page 33 and 34:

In order to surmount strain in capa

- Page 35 and 36:

Our major clientele under different

- Page 37 and 38:

SUMMARY STATEMENT OF PROFIT AND LOS

- Page 39 and 40:

THE ISSUE Issue by our Company Of w

- Page 41 and 42:

Name, Designation, Occupation and D

- Page 43 and 44:

Statutory Auditor M/s J.B. Reddy &

- Page 45 and 46:

Sr. No. requirements and completion

- Page 47 and 48:

4) Ensure that the Bid-cum-Applicat

- Page 49 and 50:

Only Bids that are uploaded on the

- Page 51 and 52:

Notes to capital structure 1. Histo

- Page 53 and 54:

Date of allotment/ Transfer Number

- Page 55 and 56:

Regulations and in compliance with

- Page 57 and 58:

10. Shareholding pattern of our Com

- Page 59 and 60:

24. The Equity shares held by the P

- Page 61 and 62:

of the proceeds and increasing or d

- Page 63 and 64:

17 CATERPILLAR MOTOR GRADER MODEL C

- Page 65 and 66:

lakhs respectively. Other current a

- Page 67 and 68:

BASIS FOR ISSUE PRICE Investors sho

- Page 69 and 70:

STATEMENT OF TAX BENEFITS The Board

- Page 71 and 72:

7. The amount of tax paid under sec

- Page 73 and 74:

If the specified asset is transferr

- Page 75 and 76:

B. 2. Non-Resident Indians Further,

- Page 77 and 78:

months from the date of transfer in

- Page 79 and 80:

(Source:CRISIL Research, Indian Inf

- Page 81 and 82:

Operations and Maintenance (O&M) Co

- Page 83 and 84:

Major and Medium irrigation project

- Page 85 and 86:

Funding Sources Irrigation projects

- Page 87 and 88:

Up gradation/ strengthening of 5,00

- Page 89 and 90:

Rural roads PMGSY: Government‟s c

- Page 91 and 92:

Rural roads under the PMGSY are 100

- Page 93 and 94:

To realize this potential, the Indi

- Page 95 and 96:

In addition to above, private playe

- Page 97 and 98:

Our major clientele under different

- Page 99 and 100:

Having a pan-India presence by bidd

- Page 101 and 102:

Indent Source identification Collec

- Page 103 and 104: . Construction of Canals including

- Page 105 and 106: Project & Location Construction of

- Page 107 and 108: Project & Location Value of Project

- Page 109 and 110: Project & Location Waghur Dam, Maha

- Page 111 and 112: B. Earth Works: 1. Excavator/ Back

- Page 113 and 114: We obtain specialized insurance for

- Page 115 and 116: KEY REGULATIONS AND POLICIES Our Co

- Page 117 and 118: 8. Local Shops and Establishments L

- Page 119 and 120: HISTORY AND OTHER CORPORATE MATTERS

- Page 121 and 122: imports and exports, purchases, mar

- Page 123 and 124: Of the two, APRCL-CRSSG (JV) was aw

- Page 125 and 126: awarded the contract to the JV vide

- Page 127 and 128: OUR MANAGEMENT Our Company is curre

- Page 129 and 130: years, Special Silver Award and The

- Page 131 and 132: Sitting Fees payable to Non Executi

- Page 133 and 134: 3. Monitoring transfers, transmissi

- Page 135 and 136: Management Organisational Structure

- Page 137 and 138: Employees As on February 28, 2011 o

- Page 139 and 140: Promoter and Promoter Group Matrix

- Page 141 and 142: BIL has made an application dated S

- Page 143 and 144: 2. Prarthana Inns Private Limited (

- Page 145 and 146: Shareholding Pattern Sr. No. Name o

- Page 147 and 148: Shareholding Pattern Sr. No. Name o

- Page 149 and 150: DIVIDEND POLICY Our Company has no

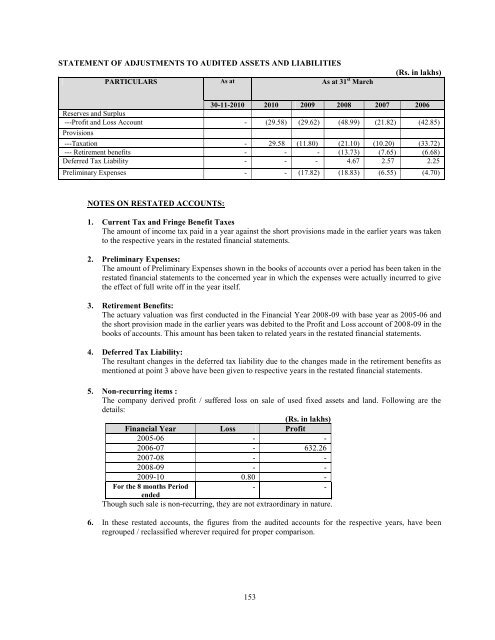

- Page 151 and 152: B. Other Financial Information: We

- Page 153: ANNEXURE II SUMMARY STATEMENT OF AS

- Page 157 and 158: e. Inventories: Materials, Stores a

- Page 159 and 160: 5. Managerial Remuneration: Sr. No.

- Page 161 and 162: ANNEXURE - V SUMMARY STATEMENT OF C

- Page 163 and 164: I. Primary Securityto Karnataka Ban

- Page 165 and 166: ANNEXURE- IX STATEMENT OF LOANS AND

- Page 167 and 168: ANNEXURE- XII Detail of Related Par

- Page 169 and 170: Sreenivasa Associates (Project Work

- Page 171 and 172: ANNEXURE -XVII STATEMENT OF INVESTM

- Page 173 and 174: MANAGEMENT‟S DISCUSSION AND ANALY

- Page 175 and 176: Work Expenditure Work expenditure c

- Page 177 and 178: Interest and Finance charges and De

- Page 179 and 180: Interest & Finance Charges Interest

- Page 181 and 182: 3. Known trends or uncertainties th

- Page 183 and 184: c d Residential plots Nos 4 &5in su

- Page 185 and 186: SECTION VI - LEGAL AND OTHER INFORM

- Page 187 and 188: paid by the NBCC and that the Sub c

- Page 189 and 190: 8376/2008 of Delhi, New Delhi Const

- Page 191 and 192: PART 4: LITIGATION RELATING TO OUR

- Page 193 and 194: GOVERNMENT AND OTHER APPROVALS Our

- Page 195 and 196: 5. Special Class Contractor Registr

- Page 197 and 198: OTHER REGULATORY AND STATUTORY DISC

- Page 199 and 200: 1. “WE HAVE EXAMINED VARIOUS DOCU

- Page 201 and 202: 14. WE ENCLOSE A NOTE EXPLAINING HO

- Page 203 and 204: Filing A copy of this Draft Red Her

- Page 205 and 206:

Public Issues in the Last Three Yea

- Page 207 and 208:

SECTION VII - ISSUE RELATED INFORMA

- Page 209 and 210:

applicant would prevail. If the inv

- Page 211 and 212:

The Equity Shares have not been and

- Page 213 and 214:

Particulars QIBs# Non-Institutional

- Page 215 and 216:

ISSUE PROCEDURE This section applie

- Page 217 and 218:

Foreign venture capital investors r

- Page 219 and 220:

Subject to compliance with all appl

- Page 221 and 222:

and conditions that our Company and

- Page 223 and 224:

circulation and also by indicating

- Page 225 and 226:

SHARES, IF THEY SO DESIRE, AS PER T

- Page 227 and 228:

Stock Exchanges; nor does it in any

- Page 229 and 230:

(e) Allocation to Eligible NRIs or

- Page 231 and 232:

Notice to QIBs: Allotment/Transfer

- Page 233 and 234:

number of shares that can be held b

- Page 235 and 236:

The Bidders should note that the es

- Page 237 and 238:

Other Instructions Joint Bids in th

- Page 239 and 240:

20) In case no corresponding record

- Page 241 and 242:

shall be punishable with imprisonme

- Page 243 and 244:

i. Each successful Bidder shall be

- Page 245 and 246:

1. Direct Credit - Applicants havin

- Page 247 and 248:

ASBA Bids within eight Working Days

- Page 249 and 250:

RESTRICTIONS ON FOREIGN OWNERSHIP O

- Page 251 and 252:

6. MODIFICATION OF RIGHTS Whenever

- Page 253 and 254:

In the case of debentures or loans

- Page 255 and 256:

29. DIRECTORS MAY EXTEND TIME The B

- Page 257 and 258:

affect and the direction shall be e

- Page 259 and 260:

(1) Notwithstanding anything to the

- Page 261 and 262:

previous financial year or years ar

- Page 263 and 264:

141. INDEMNITY (1) If the Company s

- Page 265 and 266:

12. Application dated [•] for in-