APR Constructions Limited - Saffron Capital

APR Constructions Limited - Saffron Capital

APR Constructions Limited - Saffron Capital

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

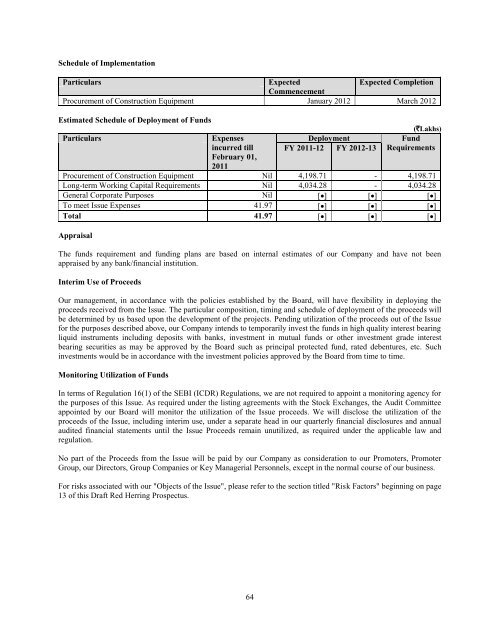

Schedule of Implementation<br />

Particulars<br />

Expected<br />

Expected Completion<br />

Commencement<br />

Procurement of Construction Equipment January 2012 March 2012<br />

Estimated Schedule of Deployment of Funds<br />

Particulars<br />

Expenses<br />

incurred till<br />

February 01,<br />

2011<br />

Deployment<br />

FY 2011-12 FY 2012-13<br />

(`Lakhs)<br />

Fund<br />

Requirements<br />

Procurement of Construction Equipment Nil 4,198.71 - 4,198.71<br />

Long-term Working <strong>Capital</strong> Requirements Nil 4,034.28 - 4,034.28<br />

General Corporate Purposes Nil [] [] []<br />

To meet Issue Expenses 41.97 [] [] []<br />

Total 41.97 [] [] []<br />

Appraisal<br />

The funds requirement and funding plans are based on internal estimates of our Company and have not been<br />

appraised by any bank/financial institution.<br />

Interim Use of Proceeds<br />

Our management, in accordance with the policies established by the Board, will have flexibility in deploying the<br />

proceeds received from the Issue. The particular composition, timing and schedule of deployment of the proceeds will<br />

be determined by us based upon the development of the projects. Pending utilization of the proceeds out of the Issue<br />

for the purposes described above, our Company intends to temporarily invest the funds in high quality interest bearing<br />

liquid instruments including deposits with banks, investment in mutual funds or other investment grade interest<br />

bearing securities as may be approved by the Board such as principal protected fund, rated debentures, etc. Such<br />

investments would be in accordance with the investment policies approved by the Board from time to time.<br />

Monitoring Utilization of Funds<br />

In terms of Regulation 16(1) of the SEBI (ICDR) Regulations, we are not required to appoint a monitoring agency for<br />

the purposes of this Issue. As required under the listing agreements with the Stock Exchanges, the Audit Committee<br />

appointed by our Board will monitor the utilization of the Issue proceeds. We will disclose the utilization of the<br />

proceeds of the Issue, including interim use, under a separate head in our quarterly financial disclosures and annual<br />

audited financial statements until the Issue Proceeds remain unutilized, as required under the applicable law and<br />

regulation.<br />

No part of the Proceeds from the Issue will be paid by our Company as consideration to our Promoters, Promoter<br />

Group, our Directors, Group Companies or Key Managerial Personnels, except in the normal course of our business.<br />

For risks associated with our "Objects of the Issue", please refer to the section titled "Risk Factors" beginning on page<br />

13 of this Draft Red Herring Prospectus.<br />

64