APR Constructions Limited - Saffron Capital

APR Constructions Limited - Saffron Capital

APR Constructions Limited - Saffron Capital

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Auditor of our Company on the audited financial information and the “Statement of Tax Benefits”, pursuant to the<br />

SEBI (ICDR) Regulations, we have not obtained any other expert opinions.<br />

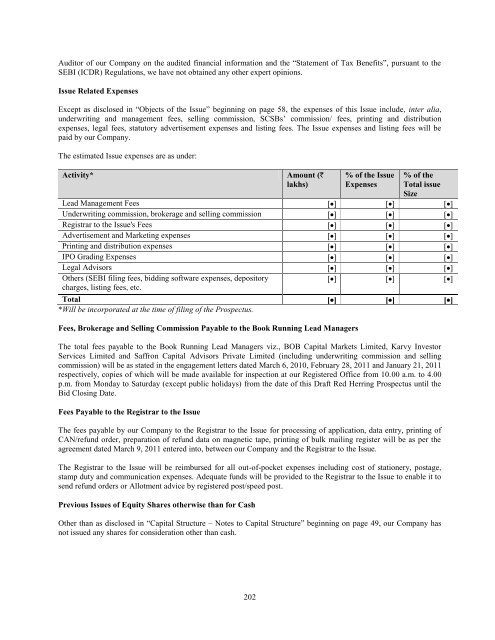

Issue Related Expenses<br />

Except as disclosed in “Objects of the Issue” beginning on page 58, the expenses of this Issue include, inter alia,<br />

underwriting and management fees, selling commission, SCSBs‟ commission/ fees, printing and distribution<br />

expenses, legal fees, statutory advertisement expenses and listing fees. The Issue expenses and listing fees will be<br />

paid by our Company.<br />

The estimated Issue expenses are as under:<br />

Activity* Amount (`<br />

lakhs)<br />

% of the Issue<br />

Expenses<br />

% of the<br />

Total issue<br />

Size<br />

Lead Management Fees [] [] []<br />

Underwriting commission, brokerage and selling commission [] [] []<br />

Registrar to the Issue's Fees [] [] []<br />

Advertisement and Marketing expenses [] [] []<br />

Printing and distribution expenses [] [] []<br />

IPO Grading Expenses [] [] []<br />

Legal Advisors [] [] []<br />

Others (SEBI filing fees, bidding software expenses, depository<br />

charges, listing fees, etc.<br />

[] [] []<br />

Total [] [] []<br />

*Will be incorporated at the time of filing of the Prospectus.<br />

Fees, Brokerage and Selling Commission Payable to the Book Running Lead Managers<br />

The total fees payable to the Book Running Lead Managers viz., BOB <strong>Capital</strong> Markets <strong>Limited</strong>, Karvy Investor<br />

Services <strong>Limited</strong> and <strong>Saffron</strong> <strong>Capital</strong> Advisors Private <strong>Limited</strong> (including underwriting commission and selling<br />

commission) will be as stated in the engagement letters dated March 6, 2010, February 28, 2011 and January 21, 2011<br />

respectively, copies of which will be made available for inspection at our Registered Office from 10.00 a.m. to 4.00<br />

p.m. from Monday to Saturday (except public holidays) from the date of this Draft Red Herring Prospectus until the<br />

Bid Closing Date.<br />

Fees Payable to the Registrar to the Issue<br />

The fees payable by our Company to the Registrar to the Issue for processing of application, data entry, printing of<br />

CAN/refund order, preparation of refund data on magnetic tape, printing of bulk mailing register will be as per the<br />

agreement dated March 9, 2011 entered into, between our Company and the Registrar to the Issue.<br />

The Registrar to the Issue will be reimbursed for all out-of-pocket expenses including cost of stationery, postage,<br />

stamp duty and communication expenses. Adequate funds will be provided to the Registrar to the Issue to enable it to<br />

send refund orders or Allotment advice by registered post/speed post.<br />

Previous Issues of Equity Shares otherwise than for Cash<br />

Other than as disclosed in “<strong>Capital</strong> Structure – Notes to <strong>Capital</strong> Structure” beginning on page 49, our Company has<br />

not issued any shares for consideration other than cash.<br />

202