APR Constructions Limited - Saffron Capital

APR Constructions Limited - Saffron Capital

APR Constructions Limited - Saffron Capital

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

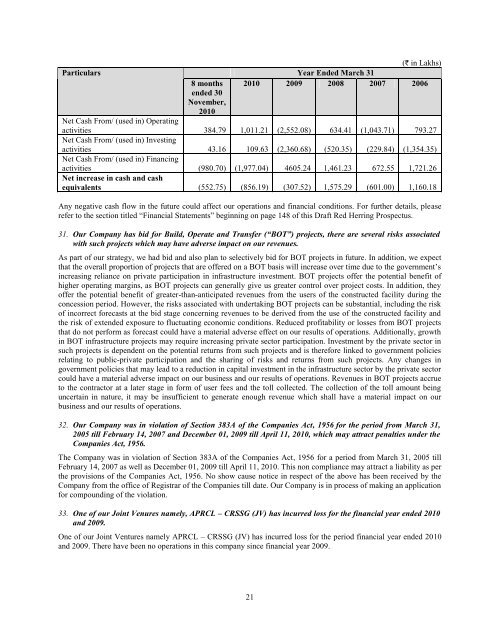

(` in Lakhs)<br />

Particulars Year Ended March 31<br />

8 months 2010 2009 2008 2007 2006<br />

ended 30<br />

November,<br />

2010<br />

Net Cash From/ (used in) Operating<br />

activities 384.79 1,011.21 (2,552.08) 634.41 (1,043.71) 793.27<br />

Net Cash From/ (used in) Investing<br />

activities 43.16 109.63 (2,360.68) (520.35) (229.84) (1,354.35)<br />

Net Cash From/ (used in) Financing<br />

activities (980.70) (1,977.04) 4605.24 1,461.23 672.55 1,721.26<br />

Net increase in cash and cash<br />

equivalents (552.75) (856.19) (307.52) 1,575.29 (601.00) 1,160.18<br />

Any negative cash flow in the future could affect our operations and financial conditions. For further details, please<br />

refer to the section titled “Financial Statements” beginning on page 148 of this Draft Red Herring Prospectus.<br />

31. Our Company has bid for Build, Operate and Transfer (“BOT”) projects, there are several risks associated<br />

with such projects which may have adverse impact on our revenues.<br />

As part of our strategy, we had bid and also plan to selectively bid for BOT projects in future. In addition, we expect<br />

that the overall proportion of projects that are offered on a BOT basis will increase over time due to the government‟s<br />

increasing reliance on private participation in infrastructure investment. BOT projects offer the potential benefit of<br />

higher operating margins, as BOT projects can generally give us greater control over project costs. In addition, they<br />

offer the potential benefit of greater-than-anticipated revenues from the users of the constructed facility during the<br />

concession period. However, the risks associated with undertaking BOT projects can be substantial, including the risk<br />

of incorrect forecasts at the bid stage concerning revenues to be derived from the use of the constructed facility and<br />

the risk of extended exposure to fluctuating economic conditions. Reduced profitability or losses from BOT projects<br />

that do not perform as forecast could have a material adverse effect on our results of operations. Additionally, growth<br />

in BOT infrastructure projects may require increasing private sector participation. Investment by the private sector in<br />

such projects is dependent on the potential returns from such projects and is therefore linked to government policies<br />

relating to public-private participation and the sharing of risks and returns from such projects. Any changes in<br />

government policies that may lead to a reduction in capital investment in the infrastructure sector by the private sector<br />

could have a material adverse impact on our business and our results of operations. Revenues in BOT projects accrue<br />

to the contractor at a later stage in form of user fees and the toll collected. The collection of the toll amount being<br />

uncertain in nature, it may be insufficient to generate enough revenue which shall have a material impact on our<br />

business and our results of operations.<br />

32. Our Company was in violation of Section 383A of the Companies Act, 1956 for the period from March 31,<br />

2005 till February 14, 2007 and December 01, 2009 till April 11, 2010, which may attract penalties under the<br />

Companies Act, 1956.<br />

The Company was in violation of Section 383A of the Companies Act, 1956 for a period from March 31, 2005 till<br />

February 14, 2007 as well as December 01, 2009 till April 11, 2010. This non compliance may attract a liability as per<br />

the provisions of the Companies Act, 1956. No show cause notice in respect of the above has been received by the<br />

Company from the office of Registrar of the Companies till date. Our Company is in process of making an application<br />

for compounding of the violation.<br />

33. One of our Joint Venures namely, <strong>APR</strong>CL – CRSSG (JV) has incurred loss for the financial year ended 2010<br />

and 2009.<br />

One of our Joint Ventures namely <strong>APR</strong>CL – CRSSG (JV) has incurred loss for the period financial year ended 2010<br />

and 2009. There have been no operations in this company since financial year 2009.<br />

21