APR Constructions Limited - Saffron Capital

APR Constructions Limited - Saffron Capital

APR Constructions Limited - Saffron Capital

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

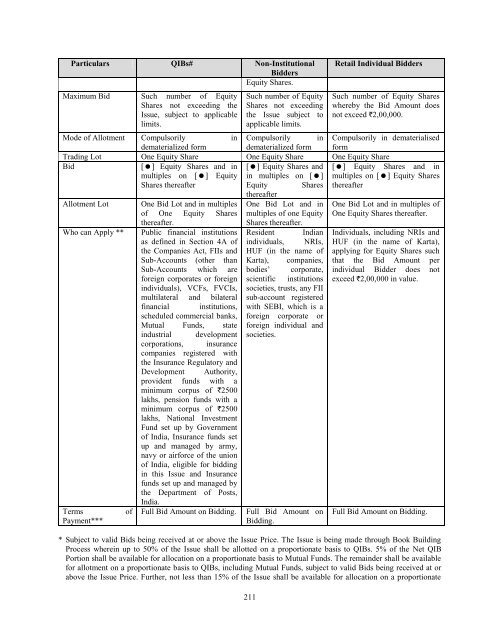

Particulars QIBs# Non-Institutional<br />

Bidders<br />

Equity Shares.<br />

Maximum Bid Such number of Equity<br />

Shares not exceeding the<br />

Issue, subject to applicable<br />

limits.<br />

Such number of Equity<br />

Shares not exceeding<br />

the Issue subject to<br />

applicable limits.<br />

211<br />

Retail Individual Bidders<br />

Such number of Equity Shares<br />

whereby the Bid Amount does<br />

not exceed `2,00,000.<br />

Mode of Allotment Compulsorily in Compulsorily in<br />

dematerialized form dematerialized form<br />

Trading Lot One Equity Share One Equity Share One Equity Share<br />

Bid<br />

[] Equity Shares and in [] Equity Shares and<br />

multiples on [] Equity in multiples on []<br />

Shares thereafter<br />

Equity Shares<br />

thereafter<br />

Allotment Lot One Bid Lot and in multiples One Bid Lot and in<br />

of One Equity Shares multiples of one Equity<br />

thereafter.<br />

Shares thereafter.<br />

Who can Apply **<br />

Terms<br />

Payment***<br />

of<br />

Public financial institutions<br />

as defined in Section 4A of<br />

the Companies Act, FIIs and<br />

Sub-Accounts (other than<br />

Sub-Accounts which are<br />

foreign corporates or foreign<br />

individuals), VCFs, FVCIs,<br />

multilateral and bilateral<br />

financial institutions,<br />

scheduled commercial banks,<br />

Mutual Funds, state<br />

industrial development<br />

corporations, insurance<br />

companies registered with<br />

the Insurance Regulatory and<br />

Development Authority,<br />

provident funds with a<br />

minimum corpus of `2500<br />

lakhs, pension funds with a<br />

minimum corpus of `2500<br />

lakhs, National Investment<br />

Fund set up by Government<br />

of India, Insurance funds set<br />

up and managed by army,<br />

navy or airforce of the union<br />

of India, eligible for bidding<br />

in this Issue and Insurance<br />

funds set up and managed by<br />

the Department of Posts,<br />

India.<br />

Full Bid Amount on Bidding.<br />

Resident Indian<br />

individuals, NRIs,<br />

HUF (in the name of<br />

Karta), companies,<br />

bodies‟ corporate,<br />

scientific institutions<br />

societies, trusts, any FII<br />

sub-account registered<br />

with SEBI, which is a<br />

foreign corporate or<br />

foreign individual and<br />

societies.<br />

Full Bid Amount on<br />

Bidding.<br />

Compulsorily in dematerialised<br />

form<br />

[] Equity Shares and in<br />

multiples on [] Equity Shares<br />

thereafter<br />

One Bid Lot and in multiples of<br />

One Equity Shares thereafter.<br />

Individuals, including NRIs and<br />

HUF (in the name of Karta),<br />

applying for Equity Shares such<br />

that the Bid Amount per<br />

individual Bidder does not<br />

exceed `2,00,000 in value.<br />

Full Bid Amount on Bidding.<br />

* Subject to valid Bids being received at or above the Issue Price. The Issue is being made through Book Building<br />

Process wherein up to 50% of the Issue shall be allotted on a proportionate basis to QIBs. 5% of the Net QIB<br />

Portion shall be available for allocation on a proportionate basis to Mutual Funds. The remainder shall be available<br />

for allotment on a proportionate basis to QIBs, including Mutual Funds, subject to valid Bids being received at or<br />

above the Issue Price. Further, not less than 15% of the Issue shall be available for allocation on a proportionate