- Page 1:

National Microfinance Study of Sri

- Page 4 and 5:

(b) Lenders .......................

- Page 6 and 7:

Introduction into the pawning busin

- Page 8 and 9:

Microfinance Overview .............

- Page 10 and 11:

Savings ...........................

- Page 12 and 13:

List of Tables Table 1 Microfinance

- Page 14 and 15:

Table 70 Ratnapura District Microfi

- Page 16 and 17:

JBIC MFI MFN MIS MPCS MSME NCPPDP N

- Page 18 and 19:

Figure 1 Map of per Capita Value of

- Page 20 and 21:

Figure 3 Map of per Capita Value of

- Page 22 and 23:

Executive Summary This report provi

- Page 24 and 25:

Practitioner Microfinance Activity

- Page 26 and 27:

As a result the banks are moving aw

- Page 28 and 29:

The operating conditions of the con

- Page 30 and 31:

Donor Strategies There should be a

- Page 32 and 33:

Introduction to the Study The objec

- Page 34 and 35:

The survey does not claim to repres

- Page 36 and 37:

Introduction Socio-Economic Overvie

- Page 38 and 39:

These five years saw a spate of new

- Page 40 and 41:

The 'Economic Stream' Employment is

- Page 42 and 43:

Microfinance Clients and Beneficiar

- Page 44 and 45:

1. Funders of Microfinance in Sri L

- Page 46 and 47:

CIDA believes that microfinance act

- Page 48 and 49:

The Department For International De

- Page 50 and 51:

NOVIB Partnerships tend to be long

- Page 52 and 53:

HIVOS The HIVOS Desk concentrates o

- Page 54 and 55:

Over time SIDA noted that the loan

- Page 56 and 57:

Comment freely given from one of th

- Page 58 and 59:

the time period of the project, wit

- Page 60 and 61: Only a very small part of the US 50

- Page 62 and 63: The demand for loans from this fund

- Page 64 and 65: Without permanent access to institu

- Page 66 and 67: This broad strategy means that the

- Page 68 and 69: Beneficiary targeting was generally

- Page 70 and 71: The FCSs were developed the followi

- Page 72 and 73: CARE's new strategy commits the org

- Page 74 and 75: Each CBO determines the level of in

- Page 76 and 77: The project’s overall approach re

- Page 78 and 79: Figure 6 GTZ/JRP - Project Interact

- Page 80 and 81: The Social Development Foundation F

- Page 82 and 83: There are no sector-based quotas ap

- Page 84 and 85: Over the past five years SCN has as

- Page 86 and 87: UNDP in the North & East - The Jaff

- Page 88 and 89: In December 2001 a new UNDP Program

- Page 90 and 91: From previous experience and lesson

- Page 92 and 93: World Vision Lanka WVL believes tha

- Page 94 and 95: Membership Development 3500 3000 25

- Page 96 and 97: Table 14 World Vision - Gramashakth

- Page 98 and 99: ZOA works with community groups in

- Page 100 and 101: At the village society and bank lev

- Page 102 and 103: In Wayamba the sustainability of th

- Page 104 and 105: Table 15 Badulla IRDP - Summary Dat

- Page 106 and 107: DZPDP/WHRDA credit operations comme

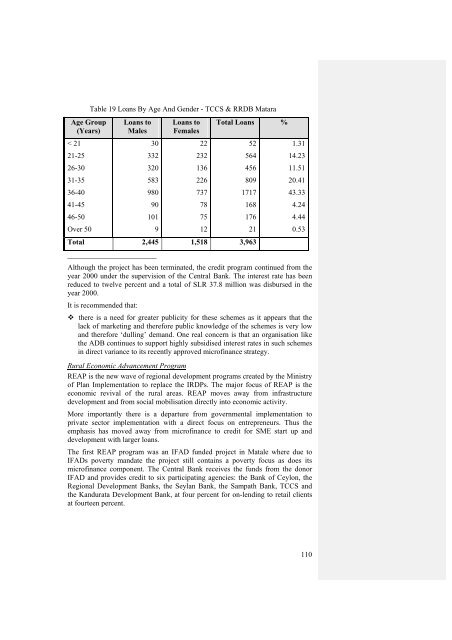

- Page 108 and 109: In the initial years they did not f

- Page 112 and 113: (c)Lender-Practitioners The Central

- Page 114 and 115: Society members have access to cred

- Page 116 and 117: The RDBs were re-structured in 1998

- Page 118 and 119: Table 25 Value of Loans Disbursed b

- Page 120 and 121: The total savings and credit issued

- Page 122 and 123: Table 29 Samurdhi - Loans by Distri

- Page 124 and 125: In 1998 SEEDS converted to a separa

- Page 126 and 127: Within the loans from SEEDS funds t

- Page 128 and 129: The Arthacharya Foundation practice

- Page 130 and 131: The program was assisted by some li

- Page 132 and 133: However in general the majority of

- Page 134 and 135: Table 33 Growth of MPCS CRBs -1990

- Page 136 and 137: As at the end of December, 2000 a s

- Page 138 and 139: Some 1,176 of the 1,476 Co-operativ

- Page 140 and 141: A total of 74 NGOs were identified

- Page 142 and 143: Finally only a small proportion of

- Page 144 and 145: Table 38 TCCS Active Societies and

- Page 146 and 147: District Unions - National Federati

- Page 148 and 149: 4. Facilitators a) National Level F

- Page 150 and 151: International Centre for the Traini

- Page 152 and 153: Funder-Practitioner Microfinance Ac

- Page 154 and 155: As practitioner experience increase

- Page 156 and 157: Introduction and Approach The major

- Page 158 and 159: State-Owned Banks The Bank of Ceylo

- Page 160 and 161:

Starting in 1994, the NCRCS is aime

- Page 162 and 163:

The Seylan Bank The Seylan Bank ent

- Page 164 and 165:

Figure 9 Linking of the RBIP Tools

- Page 166 and 167:

People's Fast reduces loan processi

- Page 168 and 169:

In addition, RBIP monitors the impl

- Page 170 and 171:

The Hatton National Bank Case Study

- Page 172 and 173:

Seylan Bank Case Study The Seylan B

- Page 174 and 175:

Until 1961 private pawnbrokers were

- Page 176 and 177:

Bank officials stated that PSC staf

- Page 178 and 179:

The urban PSCs have on average more

- Page 180 and 181:

The lack of flexibility has induced

- Page 182 and 183:

From the borrowers perspective not

- Page 184 and 185:

The Peoples Bank, on the other hand

- Page 186 and 187:

Introduction and Approach Internati

- Page 188 and 189:

Displaced populations are dependent

- Page 190 and 191:

Large tracts of land have become to

- Page 192 and 193:

Public markets, shops, guest houses

- Page 194 and 195:

The previous thriving local economy

- Page 196 and 197:

The Wanni Access to the area known

- Page 198 and 199:

Remembering that these intervention

- Page 200 and 201:

This type of situation is seen thro

- Page 202 and 203:

People IDPs in welfare centres, sho

- Page 204 and 205:

World Vision has been working in al

- Page 206 and 207:

small entrepreneurs have received t

- Page 208 and 209:

The exception to this is a governme

- Page 210 and 211:

There has been some continued acces

- Page 212 and 213:

Introduction and Approach A distric

- Page 214 and 215:

The MPCSs were equally disrupted an

- Page 216 and 217:

The main body of the survey is pres

- Page 218 and 219:

Local NGOs 11 NGOs were identified

- Page 220 and 221:

Local NGOs 1 NGO was identified in

- Page 222 and 223:

Local NGOs 1 NGO was identified in

- Page 224 and 225:

Local NGOs 2 NGOs were identified i

- Page 226 and 227:

Local NGOs No NGOs were identified

- Page 228 and 229:

Gampaha District Microfinance Overv

- Page 230 and 231:

Hambantota District Microfinance Ov

- Page 232 and 233:

Jaffna District Microfinance Overvi

- Page 234 and 235:

Staring in 1998 each DS received SL

- Page 236 and 237:

Local NGOs 7 NGOs were identified i

- Page 238 and 239:

Local NGOs 6 NGOs were identified i

- Page 240 and 241:

Local NGOs 3 NGOs were identified i

- Page 242 and 243:

Local NGOs 2 NGOs were identified i

- Page 244 and 245:

Matale District Microfinance Overvi

- Page 246 and 247:

Matara District Microfinance Overvi

- Page 248 and 249:

Moneragala District Microfinance Ov

- Page 250 and 251:

Nuwara Eliya District Microfinance

- Page 252 and 253:

Polonnaruwa District Microfinance O

- Page 254 and 255:

Puttalam District Microfinance Over

- Page 256 and 257:

Ratnapura District Microfinance Ove

- Page 258 and 259:

Trincomalee District Microfinance O

- Page 260 and 261:

Vavuniya district Microfinance Over

- Page 262 and 263:

The Wanni Area Microfinance Overvie

- Page 264 and 265:

Summary Microfinance Activity by Ac

- Page 266 and 267:

The NGO questionnaire survey identi

- Page 268 and 269:

World Vision Lanka works in 5 distr

- Page 270 and 271:

Given that these figures do not inc

- Page 272 and 273:

Overall, 13 of districts had levels

- Page 274 and 275:

Averages Value of Loans Table 78 Av

- Page 276 and 277:

Volume and Number of Loans The surv

- Page 278 and 279:

Findings The key and main findings

- Page 280 and 281:

Service Providers The service provi

- Page 282 and 283:

those incapacitated by conflict, wi

- Page 284 and 285:

Cultures of Dependency in Microfina

- Page 286 and 287:

Strategic Recommendations The key s

- Page 288 and 289:

Conclusion The study found that the

- Page 290 and 291:

Charitoneko, S. and D de Silva (200

- Page 292 and 293:

Remenyi, J (1991). Where Credit is

- Page 294:

Technical Appendix