National Microfinance Study of Sri Lanka: Survey of Practices and ...

National Microfinance Study of Sri Lanka: Survey of Practices and ...

National Microfinance Study of Sri Lanka: Survey of Practices and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

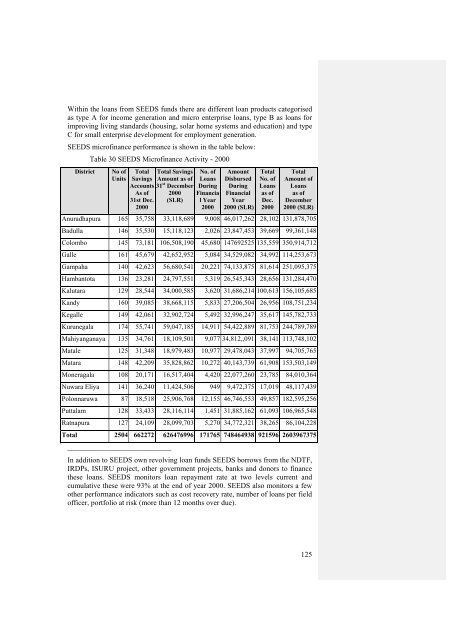

Within the loans from SEEDS funds there are different loan products categorised<br />

as type A for income generation <strong>and</strong> micro enterprise loans, type B as loans for<br />

improving living st<strong>and</strong>ards (housing, solar home systems <strong>and</strong> education) <strong>and</strong> type<br />

C for small enterprise development for employment generation.<br />

SEEDS micr<strong>of</strong>inance performance is shown in the table below:<br />

Table 30 SEEDS <strong>Micr<strong>of</strong>inance</strong> Activity - 2000<br />

District<br />

No <strong>of</strong><br />

Units<br />

Total<br />

Savings<br />

Accounts<br />

As <strong>of</strong><br />

31st Dec.<br />

2000<br />

Total Savings<br />

Amount as <strong>of</strong><br />

31 st December<br />

2000<br />

(SLR)<br />

No. <strong>of</strong><br />

Loans<br />

During<br />

Financia<br />

l Year<br />

2000<br />

Amount<br />

Disbursed<br />

During<br />

Financial<br />

Year<br />

2000 (SLR)<br />

Total<br />

No. <strong>of</strong><br />

Loans<br />

as <strong>of</strong><br />

Dec.<br />

2000<br />

Total<br />

Amount <strong>of</strong><br />

Loans<br />

as <strong>of</strong><br />

December<br />

2000 (SLR)<br />

Anuradhapura 165 35,758 33,118,689 9,008 46,017,262 28,102 131,878,705<br />

Badulla 146 35,530 15,118,123 2,026 23,847,453 39,669 99,361,148<br />

Colombo 145 73,181 106,508,190 45,680 147692525 135,559 350,914,712<br />

Galle 161 45,679 42,652,952 5,084 34,529,082 34,992 114,253,673<br />

Gampaha 140 42,623 56,680,541 20,221 74,133,875 81,614 251,095,375<br />

Hambantota 136 23,281 24,797,551 5,319 26,545,343 28,656 131,284,470<br />

Kalutara 129 28,544 34,000,585 3,620 31,686,214 100,613 156,105,685<br />

K<strong>and</strong>y 160 39,085 38,668,115 5,833 27,206,504 26,956 108,751,234<br />

Kegalle 149 42,061 32,902,724 5,492 32,996,247 35,617 145,782,733<br />

Kurunegala 174 55,741 59,047,185 14,911 54,422,889 81,753 244,789,789<br />

Mahiyanganaya 135 34,761 18,109,501 9,077 34,812,,091 38,141 113,748,102<br />

Matale 125 31,348 18,979,483 10,977 29,478,043 37,997 94,705,765<br />

Matara 148 42,209 35,828,862 10,272 40,143,739 61,908 153,503,149<br />

Moneragala 108 20,171 16,517,404 4,420 22,077,260 23,785 84,010,364<br />

Nuwara Eliya 141 36,240 11,424,506 949 9,472,375 17,019 48,117,439<br />

Polonnaruwa 87 18,518 25,906,768 12,155 46,746,553 49,857 182,595,256<br />

Puttalam 128 33,433 28,116,114 1,451 31,885,162 61,093 106,965,548<br />

Ratnapura 127 24,109 28,099,703 5,270 34,772,321 38,265 86,104,228<br />

Total 2504 662272 626476996 171765 748464938 921596 2603967375<br />

____________________________<br />

In addition to SEEDS own revolving loan funds SEEDS borrows from the NDTF,<br />

IRDPs, ISURU project, other government projects, banks <strong>and</strong> donors to finance<br />

these loans. SEEDS monitors loan repayment rate at two levels current <strong>and</strong><br />

cumulative these were 93% at the end <strong>of</strong> year 2000. SEEDS also monitors a few<br />

other performance indicators such as cost recovery rate, number <strong>of</strong> loans per field<br />

<strong>of</strong>ficer, portfolio at risk (more than 12 months over due).<br />

125