National Microfinance Study of Sri Lanka: Survey of Practices and ...

National Microfinance Study of Sri Lanka: Survey of Practices and ...

National Microfinance Study of Sri Lanka: Survey of Practices and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

collateral. Over time, probably due to the entry <strong>of</strong> others the Bank has shifted its<br />

focus from the poor to rural entrepreneurs who may include people that are in the<br />

middle class. This shift is most likely due to the wider range <strong>of</strong> subsidised actors<br />

entering micr<strong>of</strong>inance such as Samurdhi.<br />

The shift to entrepreneurs parallels the Ministry <strong>of</strong> Plan Implementation’s focus<br />

on Rural Economic Advancement Program that also targets entrepreneurs leaving<br />

poverty alleviation to Samurdhi <strong>and</strong> other programs.<br />

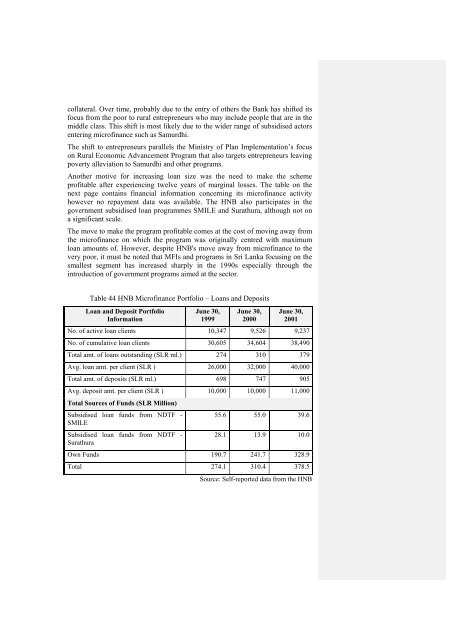

Another motive for increasing loan size was the need to make the scheme<br />

pr<strong>of</strong>itable after experiencing twelve years <strong>of</strong> marginal losses. The table on the<br />

next page contains financial information concerning its micr<strong>of</strong>inance activity<br />

however no repayment data was available. The HNB also participates in the<br />

government subsidised loan programmes SMILE <strong>and</strong> Surathura, although not on<br />

a significant scale.<br />

The move to make the program pr<strong>of</strong>itable comes at the cost <strong>of</strong> moving away from<br />

the micr<strong>of</strong>inance on which the program was originally centred with maximum<br />

loan amounts <strong>of</strong>. However, despite HNB's move away from micr<strong>of</strong>inance to the<br />

very poor, it must be noted that MFIs <strong>and</strong> programs in <strong>Sri</strong> <strong>Lanka</strong> focusing on the<br />

smallest segment has increased sharply in the 1990s especially through the<br />

introduction <strong>of</strong> government programs aimed at the sector.<br />

Table 44 HNB <strong>Micr<strong>of</strong>inance</strong> Portfolio – Loans <strong>and</strong> Deposits<br />

Loan <strong>and</strong> Deposit Portfolio<br />

Information<br />

June 30,<br />

1999<br />

June 30,<br />

2000<br />

June 30,<br />

2001<br />

No. <strong>of</strong> active loan clients 10,347 9,526 9,237<br />

No. <strong>of</strong> cumulative loan clients 30,605 34,604 38,490<br />

Total amt. <strong>of</strong> loans outst<strong>and</strong>ing (SLR ml.) 274 310 379<br />

Avg. loan amt. per client (SLR ) 26,000 32,000 40,000<br />

Total amt. <strong>of</strong> deposits (SLR ml.) 698 747 905<br />

Avg. deposit amt. per client (SLR ) 10,000 10,000 11,000<br />

Total Sources <strong>of</strong> Funds (SLR Million)<br />

Subsidised loan funds from NDTF -<br />

SMILE<br />

55.6 55.0 39.6<br />

Subsidised loan funds from NDTF -<br />

Surathura<br />

28.1 13.9 10.0<br />

Own Funds 190.7 241.7 328.9<br />

Total 274.1 310.4 378.5<br />

Source: Self-reported data from the HNB