National Microfinance Study of Sri Lanka: Survey of Practices and ...

National Microfinance Study of Sri Lanka: Survey of Practices and ...

National Microfinance Study of Sri Lanka: Survey of Practices and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Finally only a small proportion <strong>of</strong> NGOs recognised that their micr<strong>of</strong>inance<br />

activities were affected by competition from other organisation. Those<br />

organisations that did cited SEEDS, Samurdhi, SANASA <strong>and</strong> the Regional<br />

Development Banks.<br />

Private Companies<br />

A few private companies practice micr<strong>of</strong>inance. Ceylinco Grameen Co. Ltd., for<br />

example, started micr<strong>of</strong>inance operations in April 2000 focusing on the urban<br />

slum areas <strong>of</strong> Colombo. The company has reached 1,774 clients disbursing SLR<br />

21 million in loans. Ceylinco Grameen follows the Grameen banking model<br />

closely <strong>and</strong> seeks to fund its micr<strong>of</strong>inance activities largely through the<br />

acquisition <strong>of</strong> grant in aid funding. Elsewhere, the NGO survey identified 3<br />

private companies all operating in the district <strong>of</strong> Polonnaruwa. All three stated<br />

that their primary reason for undertaking micr<strong>of</strong>inance was for pr<strong>of</strong>it.<br />

Unfortunately none <strong>of</strong> the companies revealed detailed information on the number<br />

<strong>and</strong> volume <strong>of</strong> their savings <strong>and</strong> credit activities.<br />

TCCS<br />

The first institutional micro credit agency in <strong>Sri</strong> <strong>Lanka</strong> was the Thrift <strong>and</strong> Credit<br />

C-operative Societies set up in 1906 however in the beginning the growth <strong>of</strong> these<br />

societies was slow <strong>and</strong> by end <strong>of</strong> 1913 there were only three registered societies.<br />

This was despite the Co-operative Credit Societies Ordinance No 7 <strong>of</strong> 1911 that<br />

gave legal status to these societies.<br />

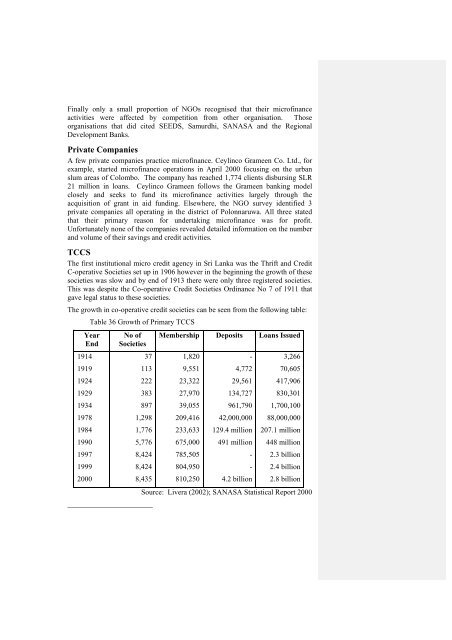

The growth in co-operative credit societies can be seen from the following table:<br />

Table 36 Growth <strong>of</strong> Primary TCCS<br />

Year<br />

End<br />

1914<br />

1919<br />

1924<br />

1929<br />

1934<br />

1978<br />

1984<br />

1990<br />

1997<br />

1999<br />

2000<br />

_______________________<br />

No <strong>of</strong><br />

Societies<br />

Membership Deposits Loans Issued<br />

37 1,820<br />

- 3,266<br />

113 9,551 4,772 70,605<br />

222 23,322 29,561 417,906<br />

383 27,970 134,727 830,301<br />

897 39,055 961,790 1,700,100<br />

1,298 209,416 42,000,000 88,000,000<br />

1,776 233,633 129.4 million 207.1 million<br />

5,776 675,000 491 million 448 million<br />

8,424 785,505<br />

- 2.3 billion<br />

8,424 804,950<br />

- 2.4 billion<br />

8,435 810,250 4.2 billion 2.8 billion<br />

Source: Livera (2002); SANASA Statistical Report 2000