National Microfinance Study of Sri Lanka: Survey of Practices and ...

National Microfinance Study of Sri Lanka: Survey of Practices and ...

National Microfinance Study of Sri Lanka: Survey of Practices and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Credit Information Collection <strong>and</strong> Reporting<br />

A Credit Information Bureau has been in operation for twelve years <strong>and</strong> this helps<br />

to reduce credit risk <strong>and</strong> client indebtedness. Presently however it only serves<br />

lending institutions that are its shareholders, who are: CBSL, the commercial<br />

banks, the six licensed specialised banks, registered finance companies, regional<br />

development banks, <strong>and</strong> some leasing companies <strong>and</strong> merchant banks.<br />

The bureau currently doesn't address the needs <strong>of</strong> micr<strong>of</strong>inance institutions <strong>and</strong><br />

only loans in excess <strong>of</strong> SLR 100,000 are recorded. For the bureau to be useful<br />

from a micr<strong>of</strong>inance perspective, it would need to include reliable information on<br />

loans under SLR 100,000 (e.g. loans in the range <strong>of</strong> SLR 30,000-100,000) <strong>and</strong><br />

exp<strong>and</strong> its market to include large micr<strong>of</strong>inance wholesale <strong>and</strong> retailers.<br />

Banking Regulation <strong>and</strong> Supervision<br />

The CBSL is responsible for regulating <strong>and</strong> supervising commercial banks,<br />

licensed specialised banks, <strong>and</strong> licensed finance companies as set forth in the<br />

Monetary Law Act, the Banking Act <strong>and</strong> their amendments. Commercial banks<br />

require minimum initial capital <strong>of</strong> SLR 500 million each, the RDBs were<br />

launched with initial capital <strong>of</strong> SLR 150 million each, <strong>and</strong> savings <strong>and</strong><br />

development banks require SLR 100 million initial capital (ADB, 2000c: p. 297).<br />

St<strong>and</strong>ard international directives apply to regulated entities, covering areas such<br />

as loan classification, provisioning <strong>and</strong> reporting requirements as well as auditing<br />

st<strong>and</strong>ards. The SRR was recently lowered to 10%.<br />

The regulatory <strong>and</strong> supervision practices <strong>of</strong> the CBSL have been strengthened in<br />

recent years with regard to the entities under its jurisdiction. However, the bank<br />

has not kept up with the growth <strong>of</strong> semi-formal financial service provision <strong>and</strong><br />

does not effectively supervise or protect the assets <strong>of</strong> the relatively poor.<br />

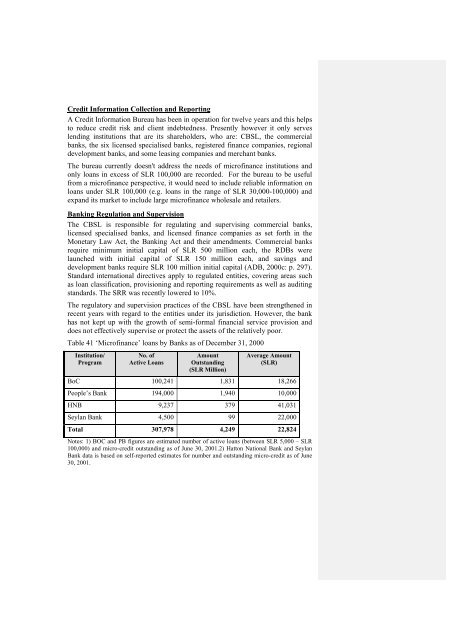

Table 41 ‘<strong>Micr<strong>of</strong>inance</strong>’ loans by Banks as <strong>of</strong> December 31, 2000<br />

Institution/<br />

Program<br />

No. <strong>of</strong><br />

Active Loans<br />

Amount<br />

Outst<strong>and</strong>ing<br />

(SLR Million)<br />

Average Amount<br />

(SLR)<br />

BoC 100,241 1,831 18,266<br />

People’s Bank 194,000 1,940 10,000<br />

HNB 9,237 379 41,031<br />

Seylan Bank 4,500 99 22,000<br />

Total 307,978 4,249 22,824<br />

Notes: 1) BOC <strong>and</strong> PB figures are estimated number <strong>of</strong> active loans (between SLR 5,000 – SLR<br />

100,000) <strong>and</strong> micro-credit outst<strong>and</strong>ing as <strong>of</strong> June 30, 2001.2) Hatton <strong>National</strong> Bank <strong>and</strong> Seylan<br />

Bank data is based on self-reported estimates for number <strong>and</strong> outst<strong>and</strong>ing micro-credit as <strong>of</strong> June<br />

30, 2001.