National Microfinance Study of Sri Lanka: Survey of Practices and ...

National Microfinance Study of Sri Lanka: Survey of Practices and ...

National Microfinance Study of Sri Lanka: Survey of Practices and ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The current laws do not permit NGO’s to take deposits even from its members as<br />

the Banking <strong>and</strong> Finance Act <strong>of</strong> 1998 restricts deposits to only Banks <strong>and</strong> Finance<br />

Companies. This prohibition covers all aspects <strong>of</strong> savings whether it is from<br />

members or non-members or whether it is as a guarantee for a loan or not. If<br />

NGO’s take any deposits, then they must deposit them in turn in a regulated<br />

financial institution <strong>and</strong> are not permitted to lend even a part <strong>of</strong> them.<br />

In spite <strong>of</strong> these restrictions, this is sometimes ignored not just by the NGO’s but<br />

also by the government itself. For example NDTF a government body <strong>and</strong> Small<br />

Farmers <strong>and</strong> L<strong>and</strong>less Credit Program -also a government program, insist that<br />

NGO’s have savings deposits. Also, some NGO’s <strong>and</strong> Co-operative Societies<br />

that have no assets at all except members’ savings take on savings even <strong>of</strong> nonmembers<br />

without any reserve requirements. Still others loan the entire savings.<br />

Part <strong>of</strong> this study involves surveying existing NGO <strong>and</strong> co-operative activity.<br />

However it is first worth discussing what is meant by the term micr<strong>of</strong>inance.<br />

Definition <strong>of</strong> <strong>Micr<strong>of</strong>inance</strong><br />

The Asian Development Bank has defined micr<strong>of</strong>inance as:<br />

“The provision <strong>of</strong> a broad range <strong>of</strong> financial services that includes services<br />

such as deposits, loans, payment services <strong>and</strong> insurance to poor <strong>and</strong> low<br />

income households <strong>and</strong> their micro enterprises.” (ADB, 2000)<br />

Typically, micr<strong>of</strong>inance services are provided through three sources, these are: 1)<br />

Formal institutions, such as banks, rural banks, government projects <strong>and</strong> cooperatives;<br />

2) Semi formal institutions, such as NGOs; <strong>and</strong>, 3) Informal sources,<br />

such as moneylenders <strong>and</strong> shopkeepers.<br />

Institutional micr<strong>of</strong>inance is thus defined to include micr<strong>of</strong>inance services<br />

provided by formal <strong>and</strong> semi-formal institutions while micr<strong>of</strong>inance institutions<br />

are defined as institutions "whose major business is the provision <strong>of</strong> micr<strong>of</strong>inance<br />

services.” (ibid.)<br />

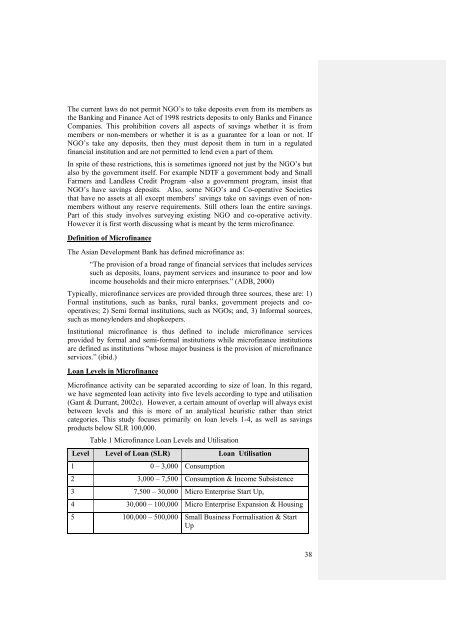

Loan Levels in <strong>Micr<strong>of</strong>inance</strong><br />

<strong>Micr<strong>of</strong>inance</strong> activity can be separated according to size <strong>of</strong> loan. In this regard,<br />

we have segmented loan activity into five levels according to type <strong>and</strong> utilisation<br />

(Gant & Durrant, 2002c). However, a certain amount <strong>of</strong> overlap will always exist<br />

between levels <strong>and</strong> this is more <strong>of</strong> an analytical heuristic rather than strict<br />

categories. This study focuses primarily on loan levels 1-4, as well as savings<br />

products below SLR 100,000.<br />

Table 1 <strong>Micr<strong>of</strong>inance</strong> Loan Levels <strong>and</strong> Utilisation<br />

Level Level <strong>of</strong> Loan (SLR) Loan Utilisation<br />

1 0 – 3,000 Consumption<br />

2 3,000 – 7,500 Consumption & Income Subsistence<br />

3 7,500 – 30,000 Micro Enterprise Start Up,<br />

4 30,000 – 100,000 Micro Enterprise Expansion & Housing<br />

5 100,000 – 500,000 Small Business Formalisation & Start<br />

Up<br />

38