National Microfinance Study of Sri Lanka: Survey of Practices and ...

National Microfinance Study of Sri Lanka: Survey of Practices and ...

National Microfinance Study of Sri Lanka: Survey of Practices and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

As <strong>of</strong> December 31, 2000, the bank had written <strong>of</strong>f micr<strong>of</strong>inance loans amounting<br />

to SLR 271 million equalling amount some 27% <strong>of</strong> their total micr<strong>of</strong>inance loan<br />

portfolio. The bank estimates that as <strong>of</strong> August 31, 2001, the net loss <strong>of</strong> its<br />

micr<strong>of</strong>inance activities was SLR 43.7 million.<br />

The Bank is currently restructuring its micr<strong>of</strong>inance products, terminating those<br />

that have become obsolete <strong>and</strong> unpr<strong>of</strong>itable <strong>and</strong> replacing these with a more<br />

focused range <strong>of</strong> micr<strong>of</strong>inance credit products under the government’s ‘100 days’<br />

action programme.<br />

The People’s Bank<br />

The Peoples Bank started providing micr<strong>of</strong>inance <strong>and</strong> mobilising rural savings<br />

from its inception in 1961 but similar to the Bank <strong>of</strong> Ceylon, these were dictated<br />

by government directives. As <strong>of</strong> June 30, 2001, the Bank estimates that the<br />

outst<strong>and</strong>ing loans provided by them between SLR 10,000 – SLR 100,000 each<br />

(their definition <strong>of</strong> micr<strong>of</strong>inance) numbered 194,200. No value for total<br />

micr<strong>of</strong>inance loans outst<strong>and</strong>ing was available but the bank estimated their average<br />

micr<strong>of</strong>inance loan to be about SLR 10,000 as <strong>of</strong> June 30, 2001. The interest rate<br />

charged on loans was between 10–14% per annum, on a monthly declining<br />

balance, depending on micr<strong>of</strong>inance product. Interestingly, the bank is in the<br />

process <strong>of</strong> setting up a micr<strong>of</strong>inance division.<br />

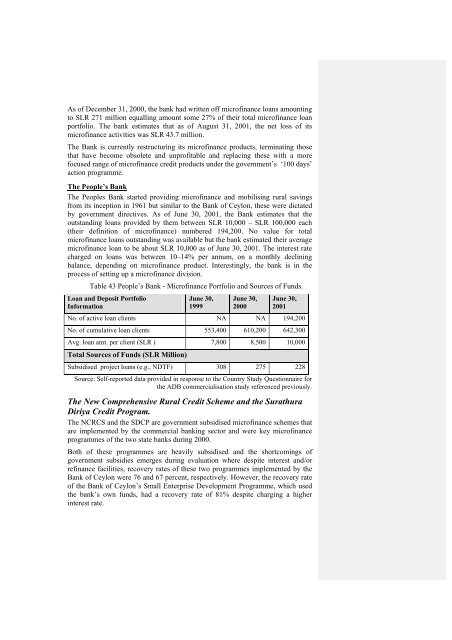

Table 43 People’s Bank - <strong>Micr<strong>of</strong>inance</strong> Portfolio <strong>and</strong> Sources <strong>of</strong> Funds.<br />

Loan <strong>and</strong> Deposit Portfolio<br />

Information<br />

June 30,<br />

1999<br />

June 30,<br />

2000<br />

June 30,<br />

2001<br />

No. <strong>of</strong> active loan clients NA NA 194,200<br />

No. <strong>of</strong> cumulative loan clients 553,400 610,200 642,300<br />

Avg. loan amt. per client (SLR ) 7,800 8,500 10,000<br />

Total Sources <strong>of</strong> Funds (SLR Million)<br />

Subsidised project loans (e.g., NDTF) 308 275 228<br />

Source: Self-reported data provided in response to the Country <strong>Study</strong> Questionnaire for<br />

the ADB commercialisation study referenced previously.<br />

The New Comprehensive Rural Credit Scheme <strong>and</strong> the Surathura<br />

Diriya Credit Program.<br />

The NCRCS <strong>and</strong> the SDCP are government subsidised micr<strong>of</strong>inance schemes that<br />

are implemented by the commercial banking sector <strong>and</strong> were key micr<strong>of</strong>inance<br />

programmes <strong>of</strong> the two state banks during 2000.<br />

Both <strong>of</strong> these programmes are heavily subsidised <strong>and</strong> the shortcomings <strong>of</strong><br />

government subsidies emerges during evaluation where despite interest <strong>and</strong>/or<br />

refinance facilities, recovery rates <strong>of</strong> these two programmes implemented by the<br />

Bank <strong>of</strong> Ceylon were 76 <strong>and</strong> 67 percent, respectively. However, the recovery rate<br />

<strong>of</strong> the Bank <strong>of</strong> Ceylon’s Small Enterprise Development Programme, which used<br />

the bank’s own funds, had a recovery rate <strong>of</strong> 81% despite charging a higher<br />

interest rate.