As part of our commitment to rehabilitation of offenders, the ...

As part of our commitment to rehabilitation of offenders, the ...

As part of our commitment to rehabilitation of offenders, the ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

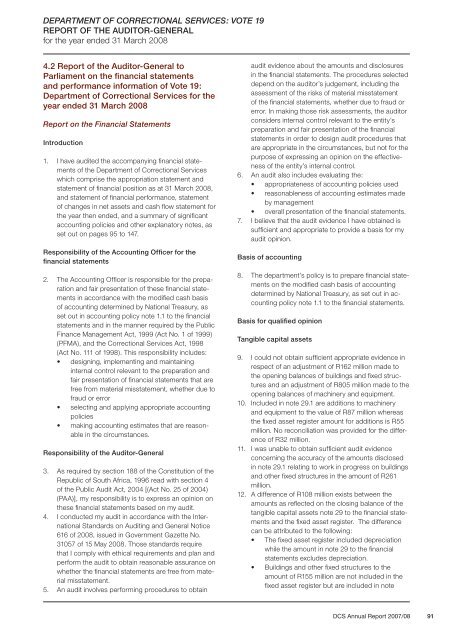

DEPARTMENT OF CORRECTIONAL SERVICES: VOTE 19<br />

REPORT OF THE AUDITOR-GENERAL<br />

for <strong>the</strong> year ended 31 March 2008<br />

4.2 Report <strong>of</strong> <strong>the</strong> Audi<strong>to</strong>r-General <strong>to</strong><br />

Parliament on <strong>the</strong> financial statements<br />

and performance information <strong>of</strong> Vote 19:<br />

De<strong>part</strong>ment <strong>of</strong> Correctional Services for <strong>the</strong><br />

year ended 31 March 2008<br />

Report on <strong>the</strong> Financial Statements<br />

Introduction<br />

1. I have audited <strong>the</strong> accompanying financial statements<br />

<strong>of</strong> <strong>the</strong> De<strong>part</strong>ment <strong>of</strong> Correctional Services<br />

which comprise <strong>the</strong> appropriation statement and<br />

statement <strong>of</strong> financial position as at 31 March 2008,<br />

and statement <strong>of</strong> financial performance, statement<br />

<strong>of</strong> changes in net assets and cash flow statement for<br />

<strong>the</strong> year <strong>the</strong>n ended, and a summary <strong>of</strong> significant<br />

accounting policies and o<strong>the</strong>r explana<strong>to</strong>ry notes, as<br />

set out on pages 95 <strong>to</strong> 147.<br />

Responsibility <strong>of</strong> <strong>the</strong> Accounting Officer for <strong>the</strong><br />

financial statements<br />

2. The Accounting Officer is responsible for <strong>the</strong> preparation<br />

and fair presentation <strong>of</strong> <strong>the</strong>se financial statements<br />

in accordance with <strong>the</strong> modified cash basis<br />

<strong>of</strong> accounting determined by National Treasury, as<br />

set out in accounting policy note 1.1 <strong>to</strong> <strong>the</strong> financial<br />

statements and in <strong>the</strong> manner required by <strong>the</strong> Public<br />

Finance Management Act, 1999 (Act No. 1 <strong>of</strong> 1999)<br />

(PFMA), and <strong>the</strong> Correctional Services Act, 1998<br />

(Act No. 111 <strong>of</strong> 1998). This responsibility includes:<br />

• designing, implementing and maintaining<br />

internal control relevant <strong>to</strong> <strong>the</strong> preparation and<br />

fair presentation <strong>of</strong> financial statements that are<br />

free from material misstatement, whe<strong>the</strong>r due <strong>to</strong><br />

fraud or error<br />

• selecting and applying appropriate accounting<br />

policies<br />

• making accounting estimates that are reasonable<br />

in <strong>the</strong> circumstances.<br />

Responsibility <strong>of</strong> <strong>the</strong> Audi<strong>to</strong>r-General<br />

3. <strong>As</strong> required by section 188 <strong>of</strong> <strong>the</strong> Constitution <strong>of</strong> <strong>the</strong><br />

Republic <strong>of</strong> South Africa, 1996 read with section 4<br />

<strong>of</strong> <strong>the</strong> Public Audit Act, 2004 [(Act No. 25 <strong>of</strong> 2004)<br />

(PAA)], my responsibility is <strong>to</strong> express an opinion on<br />

<strong>the</strong>se financial statements based on my audit.<br />

4. I conducted my audit in accordance with <strong>the</strong> International<br />

Standards on Auditing and General Notice<br />

616 <strong>of</strong> 2008, issued in Government Gazette No.<br />

31057 <strong>of</strong> 15 May 2008. Those standards require<br />

that I comply with ethical requirements and plan and<br />

perform <strong>the</strong> audit <strong>to</strong> obtain reasonable assurance on<br />

whe<strong>the</strong>r <strong>the</strong> financial statements are free from material<br />

misstatement.<br />

5. An audit involves performing procedures <strong>to</strong> obtain<br />

audit evidence about <strong>the</strong> amounts and disclosures<br />

in <strong>the</strong> financial statements. The procedures selected<br />

depend on <strong>the</strong> audi<strong>to</strong>r’s judgement, including <strong>the</strong><br />

assessment <strong>of</strong> <strong>the</strong> risks <strong>of</strong> material misstatement<br />

<strong>of</strong> <strong>the</strong> financial statements, whe<strong>the</strong>r due <strong>to</strong> fraud or<br />

error. In making those risk assessments, <strong>the</strong> audi<strong>to</strong>r<br />

considers internal control relevant <strong>to</strong> <strong>the</strong> entity’s<br />

preparation and fair presentation <strong>of</strong> <strong>the</strong> financial<br />

statements in order <strong>to</strong> design audit procedures that<br />

are appropriate in <strong>the</strong> circumstances, but not for <strong>the</strong><br />

purpose <strong>of</strong> expressing an opinion on <strong>the</strong> effectiveness<br />

<strong>of</strong> <strong>the</strong> entity’s internal control.<br />

6. An audit also includes evaluating <strong>the</strong>:<br />

•<br />

•<br />

•<br />

appropriateness <strong>of</strong> accounting policies used<br />

reasonableness <strong>of</strong> accounting estimates made<br />

by management<br />

overall presentation <strong>of</strong> <strong>the</strong> financial statements.<br />

7. I believe that <strong>the</strong> audit evidence I have obtained is<br />

sufficient and appropriate <strong>to</strong> provide a basis for my<br />

audit opinion.<br />

Basis <strong>of</strong> accounting<br />

8. The de<strong>part</strong>ment’s policy is <strong>to</strong> prepare financial statements<br />

on <strong>the</strong> modified cash basis <strong>of</strong> accounting<br />

determined by National Treasury, as set out in accounting<br />

policy note 1.1 <strong>to</strong> <strong>the</strong> financial statements.<br />

Basis for qualified opinion<br />

Tangible capital assets<br />

9. I could not obtain sufficient appropriate evidence in<br />

respect <strong>of</strong> an adjustment <strong>of</strong> R162 million made <strong>to</strong><br />

<strong>the</strong> opening balances <strong>of</strong> buildings and fixed structures<br />

and an adjustment <strong>of</strong> R805 million made <strong>to</strong> <strong>the</strong><br />

opening balances <strong>of</strong> machinery and equipment.<br />

10. Included in note 29.1 are additions <strong>to</strong> machinery<br />

and equipment <strong>to</strong> <strong>the</strong> value <strong>of</strong> R87 million whereas<br />

<strong>the</strong> fixed asset register amount for additions is R55<br />

million. No reconciliation was provided for <strong>the</strong> difference<br />

<strong>of</strong> R32 million.<br />

11. I was unable <strong>to</strong> obtain sufficient audit evidence<br />

concerning <strong>the</strong> accuracy <strong>of</strong> <strong>the</strong> amounts disclosed<br />

in note 29.1 relating <strong>to</strong> work in progress on buildings<br />

and o<strong>the</strong>r fixed structures in <strong>the</strong> amount <strong>of</strong> R261<br />

million.<br />

12. A difference <strong>of</strong> R108 million exists between <strong>the</strong><br />

amounts as reflected on <strong>the</strong> closing balance <strong>of</strong> <strong>the</strong><br />

tangible capital assets note 29 <strong>to</strong> <strong>the</strong> financial statements<br />

and <strong>the</strong> fixed asset register. The difference<br />

can be attributed <strong>to</strong> <strong>the</strong> following:<br />

• The fixed asset register included depreciation<br />

while <strong>the</strong> amount in note 29 <strong>to</strong> <strong>the</strong> financial<br />

statements excludes depreciation.<br />

• Buildings and o<strong>the</strong>r fixed structures <strong>to</strong> <strong>the</strong><br />

amount <strong>of</strong> R155 million are not included in <strong>the</strong><br />

fixed asset register but are included in note<br />

DCS Annual Report 2007/08 91