AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

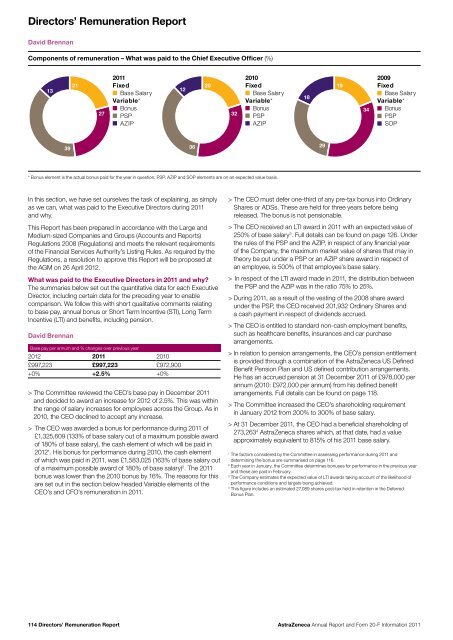

Directors’ Remuneration <strong>Report</strong>David BrennanComponents of remuneration – What was paid to the Chief Executive Officer (%)132127<strong>20</strong>11FixedBase SalaryVariable*BonusPSPAZIP12<strong>20</strong>32<strong>20</strong>10FixedBase SalaryVariable*BonusPSPAZIP181934<strong>20</strong>09FixedBase SalaryVariable*BonusPSPSOP393629* Bonus element is the actual bonus paid for the year in question. PSP, AZIP <strong>and</strong> SOP elements are on an expected value basis.In this section, we have set ourselves the task of explaining, as simplyas we can, what was paid to the Executive Directors during <strong>20</strong>11<strong>and</strong> why.This <strong>Report</strong> has been prepared in accordance with the Large <strong>and</strong>Medium-sized Companies <strong>and</strong> Groups (Accounts <strong>and</strong> <strong>Report</strong>s)Regulations <strong>20</strong>08 (Regulations) <strong>and</strong> meets the relevant requirementsof the Financial Services Authority’s Listing Rules. As required by theRegulations, a resolution to approve this <strong>Report</strong> will be proposed atthe AGM on 26 April <strong>20</strong>12.What was paid to the Executive Directors in <strong>20</strong>11 <strong>and</strong> why?The summaries below set out the quantitative data for each ExecutiveDirector, including certain data for the preceding year to enablecomparison. We follow this with short qualitative comments relatingto base pay, annual bonus or Short Term Incentive (STI), Long TermIncentive (LTI) <strong>and</strong> benefits, including pension.David BrennanBase pay per annum <strong>and</strong> % changes over previous year<strong>20</strong>12 <strong>20</strong>11 <strong>20</strong>10£997,223 £997,223 £972,900+0% +2.5% +0%> The Committee reviewed the CEO’s base pay in December <strong>20</strong>11<strong>and</strong> decided to award an increase for <strong>20</strong>12 of 2.5%. This was withinthe range of salary increases for employees across the Group. As in<strong>20</strong>10, the CEO declined to accept any increase.> The CEO was awarded a bonus for performance during <strong>20</strong>11 of£1,325,609 (133% of base salary out of a maximum possible awardof 180% of base salary), the cash element of which will be paid in<strong>20</strong>12 1 . His bonus for performance during <strong>20</strong>10, the cash elementof which was paid in <strong>20</strong>11, was £1,583,025 (163% of base salary outof a maximum possible award of 180% of base salary) 2 . The <strong>20</strong>11bonus was lower than the <strong>20</strong>10 bonus by 16%. The reasons for thisare set out in the section below headed Variable elements of theCEO’s <strong>and</strong> CFO’s remuneration in <strong>20</strong>11.> The CEO must defer one-third of any pre-tax bonus into OrdinaryShares or ADSs. These are held for three years before beingreleased. The bonus is not pensionable.> The CEO received an LTI award in <strong>20</strong>11 with an expected value of250% of base salary 3 . Full details can be found on page 126. Underthe rules of the PSP <strong>and</strong> the AZIP, in respect of any financial yearof the Company, the maximum market value of shares that may intheory be put under a PSP or an AZIP share award in respect ofan employee, is 500% of that employee’s base salary.> In respect of the LTI award made in <strong>20</strong>11, the distribution betweenthe PSP <strong>and</strong> the AZIP was in the ratio 75% to 25%.> During <strong>20</strong>11, as a result of the vesting of the <strong>20</strong>08 share awardunder the PSP, the CEO received <strong>20</strong>1,932 Ordinary Shares <strong>and</strong>a cash payment in respect of dividends accrued.> The CEO is entitled to st<strong>and</strong>ard non-cash employment benefits,such as healthcare benefits, insurances <strong>and</strong> car purchasearrangements.> In relation to pension arrangements, the CEO’s pension entitlementis provided through a combination of the <strong>AstraZeneca</strong> US DefinedBenefit Pension Plan <strong>and</strong> US defined contribution arrangements.He has an accrued pension at 31 December <strong>20</strong>11 of £978,000 perannum (<strong>20</strong>10: £972,000 per annum) from his defined benefitarrangements. Full details can be found on page 118.> The Committee increased the CEO’s shareholding requirementin January <strong>20</strong>12 from <strong>20</strong>0% to 300% of base salary.> At 31 December <strong>20</strong>11, the CEO had a beneficial shareholding of273,263 4 <strong>AstraZeneca</strong> shares which, at that date, had a valueapproximately equivalent to 815% of his <strong>20</strong>11 base salary.1The factors considered by the Committee in assessing performance during <strong>20</strong>11 <strong>and</strong>determining the bonus are summarised on page 116.2Each year in January, the Committee determines bonuses for performance in the previous year<strong>and</strong> these are paid in February.3The Company estimates the expected value of LTI awards taking account of the likelihood ofperformance conditions <strong>and</strong> targets being achieved.4This figure includes an estimated 27,089 shares post-tax held in retention in the DeferredBonus Plan.114 Directors’ Remuneration <strong>Report</strong><strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11