AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

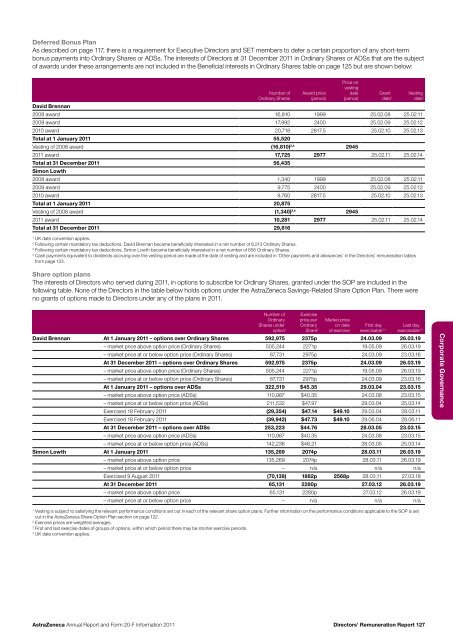

Deferred Bonus PlanAs described on page 117, there is a requirement for Executive Directors <strong>and</strong> SET members to defer a certain proportion of any short-termbonus payments into Ordinary Shares or ADSs. The interests of Directors at 31 December <strong>20</strong>11 in Ordinary Shares or ADSs that are the subjectof awards under these arrangements are not included in the Beneficial interests in Ordinary Shares table on page 125 but are shown below:Number ofOrdinary SharesAward price(pence)David Brennan<strong>20</strong>08 award 16,810 1999 25.02.08 25.02.11<strong>20</strong>09 award 17,992 2400 25.02.09 25.02.12<strong>20</strong>10 award <strong>20</strong>,718 2817.5 25.02.10 25.02.13Total at 1 January <strong>20</strong>11 55,5<strong>20</strong>Vesting of <strong>20</strong>08 award (16,810) 2,4 2945<strong>20</strong>11 award 17,725 2977 25.02.11 25.02.14Total at 31 December <strong>20</strong>11 56,435Simon Lowth<strong>20</strong>08 award 1,340 1999 25.02.08 25.02.11<strong>20</strong>09 award 9,775 2400 25.02.09 25.02.12<strong>20</strong>10 award 9,760 2817.5 25.02.10 25.02.13Total at 1 January <strong>20</strong>11 <strong>20</strong>,875Vesting of <strong>20</strong>08 award (1,340) 3,4 2945<strong>20</strong>11 award 10,281 2977 25.02.11 25.02.14Total at 31 December <strong>20</strong>11 29,8161UK date convention applies.2Following certain m<strong>and</strong>atory tax deductions, David Brennan became beneficially interested in a net number of 8,213 Ordinary Shares.3Following certain m<strong>and</strong>atory tax deductions, Simon Lowth became beneficially interested in a net number of 656 Ordinary Shares.4Cash payments equivalent to dividends accruing over the vesting period are made at the date of vesting <strong>and</strong> are included in ‘Other payments <strong>and</strong> allowances’ in the Directors’ remuneration tablesfrom page 123.Share option plansThe interests of Directors who served during <strong>20</strong>11, in options to subscribe for Ordinary Shares, granted under the SOP are included in thefollowing table. None of the Directors in the table below holds options under the <strong>AstraZeneca</strong> Savings-Related Share Option Plan. There wereno grants of options made to Directors under any of the plans in <strong>20</strong>11.Price onvestingdate(pence)Grantdate 1Vestingdate 1Number ofOrdinaryShares underoption 1Exerciseprice perOrdinaryShare 2Market priceon dateof exerciseFirst dayexercisable 3,4Last dayexercisable 3,4David Brennan At 1 January <strong>20</strong>11 – options over Ordinary Shares 592,975 2375p 24.03.09 26.03.19– market price above option price (Ordinary Shares) 505,244 2271p 19.05.09 26.03.19– market price at or below option price (Ordinary Shares) 87,731 2975p 24.03.09 23.03.16At 31 December <strong>20</strong>11 – options over Ordinary Shares 592,975 2375p 24.03.09 26.03.19– market price above option price (Ordinary Shares) 505,244 2271p 19.05.09 26.03.19– market price at or below option price (Ordinary Shares) 87,731 2975p 24.03.09 23.03.16At 1 January <strong>20</strong>11 – options over ADSs 322,519 $45.35 29.03.04 23.03.15– market price above option price (ADSs) 110,987 $40.35 24.03.08 23.03.15– market price at or below option price (ADSs) 211,532 $47.97 29.03.04 25.03.14Exercised 18 February <strong>20</strong>11 (29,354) $47.14 $49.10 29.03.04 28.03.11Exercised 18 February <strong>20</strong>11 (39,942) $47.73 $49.10 29.06.04 28.06.11At 31 December <strong>20</strong>11 – options over ADSs 253,223 $44.76 28.03.05 23.03.15– market price above option price (ADSs) 110,987 $40.35 24.03.08 23.03.15– market price at or below option price (ADSs) 142,236 $48.21 28.03.05 25.03.14Simon Lowth At 1 January <strong>20</strong>11 135,269 <strong>20</strong>74p 28.03.11 26.03.19– market price above option price 135,269 <strong>20</strong>74p 28.03.11 26.03.19– market price at or below option price – n/a n/a n/aExercised 9 August <strong>20</strong>11 (70,138) 1882p 2568p 28.03.11 27.03.18At 31 December <strong>20</strong>11 65,131 2280p 27.03.12 26.03.19– market price above option price 65,131 2280p 27.03.12 26.03.19– market price at or below option price – n/a n/a n/aCorporate Governance1Vesting is subject to satisfying the relevant performance conditions set out in each of the relevant share option plans. Further information on the performance conditions applicable to the SOP is setout in the <strong>AstraZeneca</strong> Share Option Plan section on page 122.2Exercise prices are weighted averages.3First <strong>and</strong> last exercise dates of groups of options, within which period there may be shorter exercise periods.4UK date convention applies.<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11Directors’ Remuneration <strong>Report</strong> 127