AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

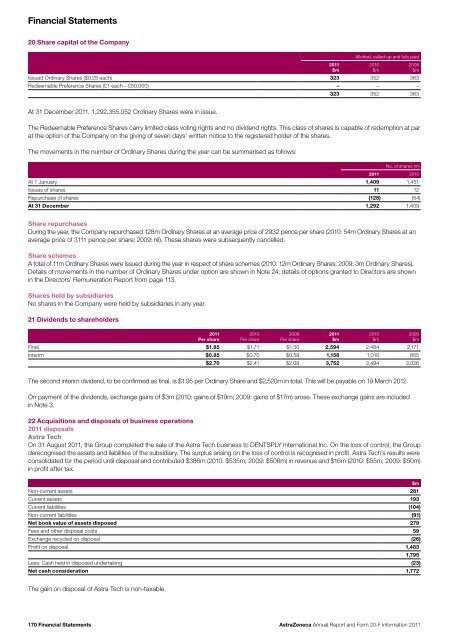

Financial Statements<strong>20</strong> Share capital of the Company<strong>20</strong>11$mAllotted, called-up <strong>and</strong> fully paidIssued Ordinary Shares ($0.25 each) 323 352 363Redeemable Preference Shares (£1 each – £50,000) – – –<strong>20</strong>10$m<strong>20</strong>09$m323 352 363At 31 December <strong>20</strong>11, 1,292,355,052 Ordinary Shares were in issue.The Redeemable Preference Shares carry limited class voting rights <strong>and</strong> no dividend rights. This class of shares is capable of redemption at parat the option of the Company on the giving of seven days’ written notice to the registered holder of the shares.The movements in the number of Ordinary Shares during the year can be summarised as follows:No. of shares (m)<strong>20</strong>11 <strong>20</strong>10At 1 January 1,409 1,451Issues of shares 11 12Repurchase of shares (128) (54)At 31 December 1,292 1,409Share repurchasesDuring the year, the Company repurchased 128m Ordinary Shares at an average price of 2932 pence per share (<strong>20</strong>10: 54m Ordinary Shares at anaverage price of 3111 pence per share; <strong>20</strong>09: nil). These shares were subsequently cancelled.Share schemesA total of 11m Ordinary Shares were issued during the year in respect of share schemes (<strong>20</strong>10: 12m Ordinary Shares; <strong>20</strong>09: 3m Ordinary Shares).Details of movements in the number of Ordinary Shares under option are shown in Note 24; details of options granted to Directors are shownin the Directors’ Remuneration <strong>Report</strong> from page 113.Shares held by subsidiariesNo shares in the Company were held by subsidiaries in any year.21 Dividends to shareholders<strong>20</strong>11Per share<strong>20</strong>10Per share<strong>20</strong>09Per shareFinal $1.85 $1.71 $1.50 2,594 2,484 2,171Interim $0.85 $0.70 $0.59 1,158 1,010 855$2.70 $2.41 $2.09 3,752 3,494 3,026<strong>20</strong>11$m<strong>20</strong>10$m<strong>20</strong>09$mThe second interim dividend, to be confirmed as final, is $1.95 per Ordinary Share <strong>and</strong> $2,5<strong>20</strong>m in total. This will be payable on 19 March <strong>20</strong>12.On payment of the dividends, exchange gains of $3m (<strong>20</strong>10: gains of $19m; <strong>20</strong>09: gains of $17m) arose. These exchange gains are includedin Note 3.22 Acquisitions <strong>and</strong> disposals of business operations<strong>20</strong>11 disposalsAstra TechOn 31 August <strong>20</strong>11, the Group completed the sale of the Astra Tech business to DENTSPLY International Inc. On the loss of control, the Groupderecognised the assets <strong>and</strong> liabilities of the subsidiary. The surplus arising on the loss of control is recognised in profit. Astra Tech’s results wereconsolidated for the period until disposal <strong>and</strong> contributed $386m (<strong>20</strong>10: $535m; <strong>20</strong>09: $506m) in revenue <strong>and</strong> $16m (<strong>20</strong>10: $55m; <strong>20</strong>09: $50m)in profit after tax.$mNon-current assets 281Current assets 193Current liabilities (104)Non-current liabilities (91)Net book value of assets disposed 279Fees <strong>and</strong> other disposal costs 59Exchange recycled on disposal (26)Profit on disposal 1,4831,795Less: Cash held in disposed undertaking (23)Net cash consideration 1,772The gain on disposal of Astra Tech is non-taxable.170 Financial Statements<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11