AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

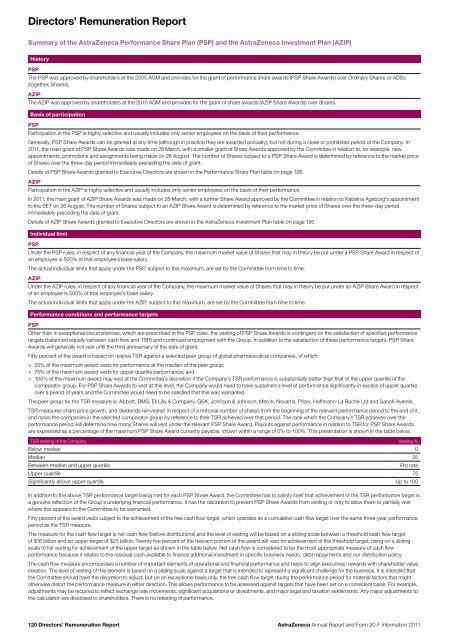

Directors’ Remuneration <strong>Report</strong>Summary of the <strong>AstraZeneca</strong> Performance Share Plan (PSP) <strong>and</strong> the <strong>AstraZeneca</strong> Investment Plan (AZIP)HistoryPSPThe PSP was approved by shareholders at the <strong>20</strong>05 AGM <strong>and</strong> provides for the grant of performance share awards (PSP Share Awards) over Ordinary Shares or ADSs(together, Shares).AZIPThe AZIP was approved by shareholders at the <strong>20</strong>10 AGM <strong>and</strong> provides for the grant of share awards (AZIP Share Awards) over Shares.Basis of participationPSPParticipation in the PSP is highly selective <strong>and</strong> usually includes only senior employees on the basis of their performance.Generally, PSP Share Awards can be granted at any time (although in practice they are awarded annually), but not during a close or prohibited period of the Company. In<strong>20</strong>11, the main grant of PSP Share Awards was made on 28 March, with a smaller grant of Share Awards approved by the Committee in relation to, for example, newappointments, promotions <strong>and</strong> assignments being made on 26 August. The number of Shares subject to a PSP Share Award is determined by reference to the market priceof Shares over the three-day period immediately preceding the date of grant.Details of PSP Share Awards granted to Executive Directors are shown in the Performance Share Plan table on page 126.AZIPParticipation in the AZIP is highly selective <strong>and</strong> usually includes only senior employees on the basis of their performance.In <strong>20</strong>11, the main grant of AZIP Share Awards was made on 28 March, with a further Share Award approved by the Committee in relation to Katarina Ageborg’s appointmentto the SET on 26 August. The number of Shares subject to an AZIP Share Award is determined by reference to the market price of Shares over the three-day periodimmediately preceding the date of grant.Details of AZIP Share Awards granted to Executive Directors are shown in the <strong>AstraZeneca</strong> Investment Plan table on page 126.Individual limitPSPUnder the PSP rules, in respect of any financial year of the Company, the maximum market value of Shares that may in theory be put under a PSP Share Award in respect ofan employee is 500% of that employee’s base salary.The actual individual limits that apply under the PSP, subject to this maximum, are set by the Committee from time to time.AZIPUnder the AZIP rules, in respect of any financial year of the Company, the maximum market value of Shares that may in theory be put under an AZIP Share Award in respectof an employee is 500% of that employee’s base salary.The actual individual limits that apply under the AZIP, subject to this maximum, are set by the Committee from time to time.Performance conditions <strong>and</strong> performance targetsPSPOther than in exceptional circumstances, which are prescribed in the PSP rules, the vesting of PSP Share Awards is contingent on the satisfaction of specified performancetargets (balanced equally between cash flow <strong>and</strong> TSR) <strong>and</strong> continued employment with the Group. In addition to the satisfaction of these performance targets, PSP ShareAwards will generally not vest until the third anniversary of the date of grant.Fifty percent of the award is based on relative TSR against a selected peer group of global pharmaceutical companies, of which:> 25% of the maximum award vests for performance at the median of the peer group;> 75% of the maximum award vests for upper quartile performance; <strong>and</strong>> 100% of the maximum award may vest at the Committee’s discretion if the Company’s TSR performance is substantially better than that of the upper quartile of thecomparator group. For PSP Share Awards to vest at this level, the Company would need to have sustained a level of performance significantly in excess of upper quartileover a period of years <strong>and</strong> the Committee would need to be satisfied that this was warranted.The peer group for the TSR measure is: Abbott, BMS, Eli Lilly & Company, GSK, Johnson & Johnson, Merck, Novartis, Pfizer, Hoffmann-La Roche Ltd <strong>and</strong> Sanofi-Aventis.TSR measures share price growth, <strong>and</strong> dividends reinvested in respect of a notional number of shares from the beginning of the relevant performance period to the end of it,<strong>and</strong> ranks the companies in the selected comparator group by reference to their TSR achieved over that period. The rank which the Company’s TSR achieves over theperformance period will determine how many Shares will vest under the relevant PSP Share Award. Payouts against performance in relation to TSR for PSP Share Awardsare expressed as a percentage of the maximum PSP Share Award currently payable, shown within a range of 0% to 100%. This presentation is shown in the table below.TSR ranking of the Company Vesting %Below median 0Median 25Between median <strong>and</strong> upper quartilePro rataUpper quartile 75Significantly above upper quartile Up to 100In addition to the above TSR performance target being met for each PSP Share Award, the Committee has to satisfy itself that achievement of the TSR performance target isa genuine reflection of the Group’s underlying financial performance. It has the discretion to prevent PSP Share Awards from vesting or only to allow them to partially vestwhere this appears to the Committee to be warranted.Fifty percent of the award vests subject to the achievement of the free cash flow target, which operates as a cumulative cash flow target over the same three-year performanceperiod as the TSR measure.The measure for the cash flow target is net cash flow (before distributions) <strong>and</strong> the level of vesting will be based on a sliding scale between a threshold cash flow targetof $16 billion <strong>and</strong> an upper target of $23 billion. Twenty five percent of the relevant portion of the award will vest for achievement of the threshold target, rising on a slidingscale to full vesting for achievement of the upper target as shown in the table below. Net cash flow is considered to be the most appropriate measure of cash flowperformance because it relates to the residual cash available to finance additional investment in specific business needs, debt repayments <strong>and</strong> our distribution policy.The cash flow measure encompasses a number of important elements of operational <strong>and</strong> financial performance <strong>and</strong> helps to align executives’ rewards with shareholder valuecreation. The level of vesting of this element is based on a sliding scale against a target that is intended to represent a significant challenge for the business. It is intended thatthe Committee should have the discretion to adjust, but on an exceptional basis only, the free cash flow target during the performance period for material factors that mightotherwise distort the performance measure in either direction. This allows performance to be assessed against targets that have been set on a consistent basis. For example,adjustments may be required to reflect exchange rate movements, significant acquisitions or divestments, <strong>and</strong> major legal <strong>and</strong> taxation settlements. Any major adjustments tothe calculation are disclosed to shareholders. There is no retesting of performance.1<strong>20</strong> Directors’ Remuneration <strong>Report</strong><strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11