AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

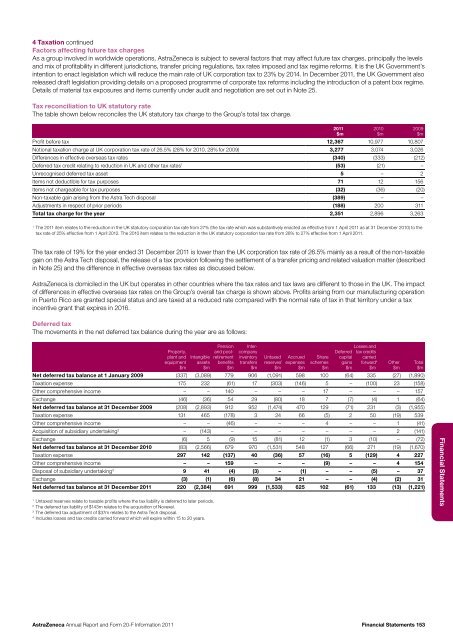

4 Taxation continuedFactors affecting future tax chargesAs a group involved in worldwide operations, <strong>AstraZeneca</strong> is subject to several factors that may affect future tax charges, principally the levels<strong>and</strong> mix of profitability in different jurisdictions, transfer pricing regulations, tax rates imposed <strong>and</strong> tax regime reforms. It is the UK Government’sintention to enact legislation which will reduce the main rate of UK corporation tax to 23% by <strong>20</strong>14. In December <strong>20</strong>11, the UK Government alsoreleased draft legislation providing details on a proposed programme of corporate tax reforms including the introduction of a patent box regime.Details of material tax exposures <strong>and</strong> items currently under audit <strong>and</strong> negotiation are set out in Note 25.Tax reconciliation to UK statutory rateThe table shown below reconciles the UK statutory tax charge to the Group’s total tax charge.Profit before tax 12,367 10,977 10,807Notional taxation charge at UK corporation tax rate of 26.5% (28% for <strong>20</strong>10, 28% for <strong>20</strong>09) 3,277 3,074 3,026Differences in effective overseas tax rates (340) (333) (212)Deferred tax credit relating to reduction in UK <strong>and</strong> other tax rates 1 (53) (21) –Unrecognised deferred tax asset 5 – 2Items not deductible for tax purposes 71 12 156Items not chargeable for tax purposes (32) (36) (<strong>20</strong>)Non-taxable gain arising from the Astra Tech disposal (389) – –Adjustments in respect of prior periods (188) <strong>20</strong>0 311Total tax charge for the year 2,351 2,896 3,263<strong>20</strong>11$m<strong>20</strong>10$m<strong>20</strong>09$m1The <strong>20</strong>11 item relates to the reduction in the UK statutory corporation tax rate from 27% (the tax rate which was substantively enacted as effective from 1 April <strong>20</strong>11 as at 31 December <strong>20</strong>10) to thetax rate of 25% effective from 1 April <strong>20</strong>12. The <strong>20</strong>10 item relates to the reduction in the UK statutory corporation tax rate from 28% to 27% effective from 1 April <strong>20</strong>11.The tax rate of 19% for the year ended 31 December <strong>20</strong>11 is lower than the UK corporation tax rate of 26.5% mainly as a result of the non-taxablegain on the Astra Tech disposal, the release of a tax provision following the settlement of a transfer pricing <strong>and</strong> related valuation matter (describedin Note 25) <strong>and</strong> the difference in effective overseas tax rates as discussed below.<strong>AstraZeneca</strong> is domiciled in the UK but operates in other countries where the tax rates <strong>and</strong> tax laws are different to those in the UK. The impactof differences in effective overseas tax rates on the Group’s overall tax charge is shown above. Profits arising from our manufacturing operationin Puerto Rico are granted special status <strong>and</strong> are taxed at a reduced rate compared with the normal rate of tax in that territory under a taxincentive grant that expires in <strong>20</strong>16.Deferred taxThe movements in the net deferred tax balance during the year are as follows:Property,plant <strong>and</strong>equipment$mIntangibleassets$mPension<strong>and</strong> postretirementbenefits$mIntercompanyinventorytransfers$mUntaxedreserves 1$mAccruedexpenses$mShareschemes$mDeferredcapitalgains$mLosses <strong>and</strong>tax creditscarriedforward 4$mNet deferred tax balance at 1 January <strong>20</strong>09 (337) (3,089) 779 906 (1,091) 598 100 (64) 335 (27) (1,890)Taxation expense 175 232 (61) 17 (303) (146) 5 – (100) 23 (158)Other comprehensive income – – 140 – – – 17 – – – 157Exchange (46) (36) 54 29 (80) 18 7 (7) (4) 1 (64)Net deferred tax balance at 31 December <strong>20</strong>09 (<strong>20</strong>8) (2,893) 912 952 (1,474) 470 129 (71) 231 (3) (1,955)Taxation expense 131 465 (178) 3 24 66 (5) 2 50 (19) 539Other comprehensive income – – (46) – – – 4 – – 1 (41)Acquisition of subsidiary undertaking 2 – (143) – – – – – – – 2 (141)Exchange (6) 5 (9) 15 (81) 12 (1) 3 (10) – (72)Net deferred tax balance at 31 December <strong>20</strong>10 (83) (2,566) 679 970 (1,531) 548 127 (66) 271 (19) (1,670)Taxation expense 297 142 (137) 40 (36) 57 (16) 5 (129) 4 227Other comprehensive income – – 159 – – – (9) – – 4 154Disposal of subsidiary undertaking 3 9 41 (4) (3) – (1) – – (5) – 37Exchange (3) (1) (6) (8) 34 21 – – (4) (2) 31Net deferred tax balance at 31 December <strong>20</strong>11 2<strong>20</strong> (2,384) 691 999 (1,533) 625 102 (61) 133 (13) (1,221)1Untaxed reserves relate to taxable profits where the tax liability is deferred to later periods.2The deferred tax liability of $143m relates to the acquisition of Novexel.3The deferred tax adjustment of $37m relates to the Astra Tech disposal.4Includes losses <strong>and</strong> tax credits carried forward which will expire within 15 to <strong>20</strong> years.Other$mTotal$mFinancial Statements<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11 Financial Statements 153