AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

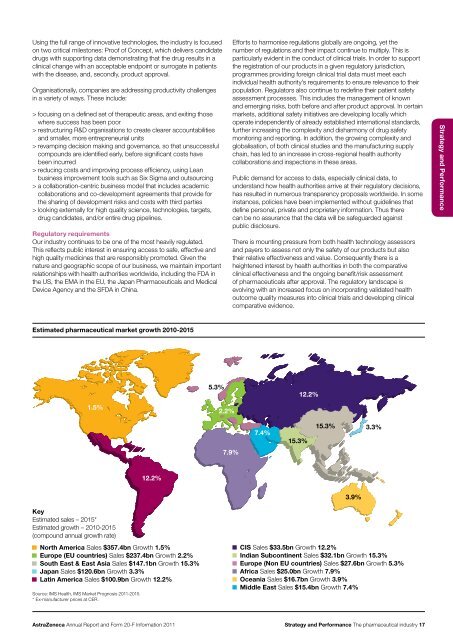

Using the full range of innovative technologies, the industry is focusedon two critical milestones: Proof of Concept, which delivers c<strong>and</strong>idatedrugs with supporting data demonstrating that the drug results in aclinical change with an acceptable endpoint or surrogate in patientswith the disease, <strong>and</strong>, secondly, product approval.Organisationally, companies are addressing productivity challengesin a variety of ways. These include:> focusing on a defined set of therapeutic areas, <strong>and</strong> exiting thosewhere success has been poor> restructuring R&D organisations to create clearer accountabilities<strong>and</strong> smaller, more entrepreneurial units> revamping decision making <strong>and</strong> governance, so that unsuccessfulcompounds are identified early, before significant costs havebeen incurred> reducing costs <strong>and</strong> improving process efficiency, using Leanbusiness improvement tools such as Six Sigma <strong>and</strong> outsourcing> a collaboration-centric business model that includes academiccollaborations <strong>and</strong> co-development agreements that provide forthe sharing of development risks <strong>and</strong> costs with third parties> looking externally for high quality science, technologies, targets,drug c<strong>and</strong>idates, <strong>and</strong>/or entire drug pipelines.Regulatory requirementsOur industry continues to be one of the most heavily regulated.This reflects public interest in ensuring access to safe, effective <strong>and</strong>high quality medicines that are responsibly promoted. Given thenature <strong>and</strong> geographic scope of our business, we maintain importantrelationships with health authorities worldwide, including the FDA inthe US, the EMA in the EU, the Japan Pharmaceuticals <strong>and</strong> MedicalDevice Agency <strong>and</strong> the SFDA in China.Efforts to harmonise regulations globally are ongoing, yet thenumber of regulations <strong>and</strong> their impact continue to multiply. This isparticularly evident in the conduct of clinical trials. In order to supportthe registration of our products in a given regulatory jurisdiction,programmes providing foreign clinical trial data must meet eachindividual health authority’s requirements to ensure relevance to theirpopulation. Regulators also continue to redefine their patient safetyassessment processes. This includes the management of known<strong>and</strong> emerging risks, both before <strong>and</strong> after product approval. In certainmarkets, additional safety initiatives are developing locally whichoperate independently of already established international st<strong>and</strong>ards,further increasing the complexity <strong>and</strong> disharmony of drug safetymonitoring <strong>and</strong> reporting. In addition, the growing complexity <strong>and</strong>globalisation, of both clinical studies <strong>and</strong> the manufacturing supplychain, has led to an increase in cross-regional health authoritycollaborations <strong>and</strong> inspections in these areas.Public dem<strong>and</strong> for access to data, especially clinical data, tounderst<strong>and</strong> how health authorities arrive at their regulatory decisions,has resulted in numerous transparency proposals worldwide. In someinstances, policies have been implemented without guidelines thatdefine personal, private <strong>and</strong> proprietary information. Thus therecan be no assurance that the data will be safeguarded againstpublic disclosure.There is mounting pressure from both health technology assessors<strong>and</strong> payers to assess not only the safety of our products but alsotheir relative effectiveness <strong>and</strong> value. Consequently there is aheightened interest by health authorities in both the comparativeclinical effectiveness <strong>and</strong> the ongoing benefit/risk assessmentof pharmaceuticals after approval. The regulatory l<strong>and</strong>scape isevolving with an increased focus on incorporating validated healthoutcome quality measures into clinical trials <strong>and</strong> developing clinicalcomparative evidence.Strategy <strong>and</strong> PerformanceEstimated pharmaceutical market growth <strong>20</strong>10-<strong>20</strong>155.3%12.2%1.5%2.2%7.4%15.3%15.3%3.3%7.9%12.2%3.9%KeyEstimated sales – <strong>20</strong>15*Estimated growth – <strong>20</strong>10-<strong>20</strong>15(compound annual growth rate)North America Sales $357.4bn Growth 1.5%Europe (EU countries) Sales $237.4bn Growth 2.2%South East & East Asia Sales $147.1bn Growth 15.3%Japan Sales $1<strong>20</strong>.6bn Growth 3.3%Latin America Sales $100.9bn Growth 12.2%Source: IMS Health, IMS Market Prognosis <strong>20</strong>11-<strong>20</strong>15.* Ex-manufacturer prices at CER.CIS Sales $33.5bn Growth 12.2%Indian Subcontinent Sales $32.1bn Growth 15.3%Europe (Non EU countries) Sales $27.6bn Growth 5.3%Africa Sales $25.0bn Growth 7.9%Oceania Sales $16.7bn Growth 3.9%Middle East Sales $15.4bn Growth 7.4%<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11Strategy <strong>and</strong> Performance The pharmaceutical industry 17