AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

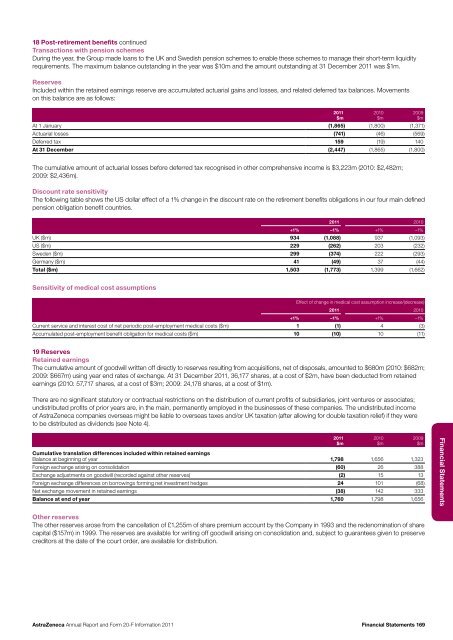

18 Post-retirement benefits continuedTransactions with pension schemesDuring the year, the Group made loans to the UK <strong>and</strong> Swedish pension schemes to enable these schemes to manage their short-term liquidityrequirements. The maximum balance outst<strong>and</strong>ing in the year was $10m <strong>and</strong> the amount outst<strong>and</strong>ing at 31 December <strong>20</strong>11 was $1m.ReservesIncluded within the retained earnings reserve are accumulated actuarial gains <strong>and</strong> losses, <strong>and</strong> related deferred tax balances. Movementson this balance are as follows:At 1 January (1,865) (1,800) (1,371)Actuarial losses (741) (46) (569)Deferred tax 159 (19) 140At 31 December (2,447) (1,865) (1,800)<strong>20</strong>11$m<strong>20</strong>10$m<strong>20</strong>09$mThe cumulative amount of actuarial losses before deferred tax recognised in other comprehensive income is $3,223m (<strong>20</strong>10: $2,482m;<strong>20</strong>09: $2,436m).Discount rate sensitivityThe following table shows the US dollar effect of a 1% change in the discount rate on the retirement benefits obligations in our four main definedpension obligation benefit countries.<strong>20</strong>11 <strong>20</strong>10+1% –1% +1% –1%UK ($m) 934 (1,088) 937 (1,093)US ($m) 229 (262) <strong>20</strong>3 (232)Sweden ($m) 299 (374) 222 (293)Germany ($m) 41 (49) 37 (44)Total ($m) 1,503 (1,773) 1,399 (1,662)Sensitivity of medical cost assumptionsEffect of change in medical cost assumption increase/(decrease)<strong>20</strong>11 <strong>20</strong>10+1% –1% +1% –1%Current service <strong>and</strong> interest cost of net periodic post-employment medical costs ($m) 1 (1) 4 (3)Accumulated post-employment benefit obligation for medical costs ($m) 10 (10) 10 (11)19 ReservesRetained earningsThe cumulative amount of goodwill written off directly to reserves resulting from acquisitions, net of disposals, amounted to $680m (<strong>20</strong>10: $682m;<strong>20</strong>09: $667m) using year end rates of exchange. At 31 December <strong>20</strong>11, 36,177 shares, at a cost of $2m, have been deducted from retainedearnings (<strong>20</strong>10: 57,717 shares, at a cost of $3m; <strong>20</strong>09: 24,178 shares, at a cost of $1m).There are no significant statutory or contractual restrictions on the distribution of current profits of subsidiaries, joint ventures or associates;undistributed profits of prior years are, in the main, permanently employed in the businesses of these companies. The undistributed incomeof <strong>AstraZeneca</strong> companies overseas might be liable to overseas taxes <strong>and</strong>/or UK taxation (after allowing for double taxation relief) if they wereto be distributed as dividends (see Note 4).Cumulative translation differences included within retained earningsBalance at beginning of year 1,798 1,656 1,323Foreign exchange arising on consolidation (60) 26 388Exchange adjustments on goodwill (recorded against other reserves) (2) 15 13Foreign exchange differences on borrowings forming net investment hedges 24 101 (68)Net exchange movement in retained earnings (38) 142 333Balance at end of year 1,760 1,798 1,656<strong>20</strong>11$m<strong>20</strong>10$m<strong>20</strong>09$mFinancial StatementsOther reservesThe other reserves arose from the cancellation of £1,255m of share premium account by the Company in 1993 <strong>and</strong> the redenomination of sharecapital ($157m) in 1999. The reserves are available for writing off goodwill arising on consolidation <strong>and</strong>, subject to guarantees given to preservecreditors at the date of the court order, are available for distribution.<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11 Financial Statements 169