AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

AstraZeneca Annual Report and Form 20-F Information 2011

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

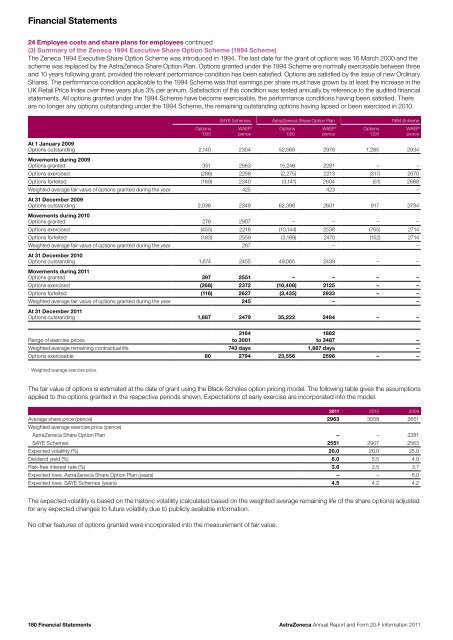

Financial Statements24 Employee costs <strong>and</strong> share plans for employees continued(3) Summary of the Zeneca 1994 Executive Share Option Scheme (1994 Scheme)The Zeneca 1994 Executive Share Option Scheme was introduced in 1994. The last date for the grant of options was 16 March <strong>20</strong>00 <strong>and</strong> thescheme was replaced by the <strong>AstraZeneca</strong> Share Option Plan. Options granted under the 1994 Scheme are normally exercisable between three<strong>and</strong> 10 years following grant, provided the relevant performance condition has been satisfied. Options are satisfied by the issue of new OrdinaryShares. The performance condition applicable to the 1994 Scheme was that earnings per share must have grown by at least the increase in theUK Retail Price Index over three years plus 3% per annum. Satisfaction of this condition was tested annually by reference to the audited financialstatements. All options granted under the 1994 Scheme have become exercisable, the performance conditions having been satisfied. Thereare no longer any options outst<strong>and</strong>ing under the 1994 Scheme, the remaining outst<strong>and</strong>ing options having lapsed or been exercised in <strong>20</strong>10.Options’000SAYE Schemes <strong>AstraZeneca</strong> Share Option Plan 1994 SchemeWAEP 1penceOptions’000WAEP 1penceOptions’000WAEP 1penceAt 1 January <strong>20</strong>09Options outst<strong>and</strong>ing 2,140 2304 52,568 2978 1,285 2934Movements during <strong>20</strong>09Options granted 351 2563 15,246 2281 – –Options exercised (286) 2258 (2,275) 2213 (317) 2670Options forfeited (169) 2340 (3,141) 2604 (51) 2688Weighted average fair value of options granted during the year 425 423 –At 31 December <strong>20</strong>09Options outst<strong>and</strong>ing 2,036 2349 62,398 2601 917 2734Movements during <strong>20</strong>10Options granted 276 2907 – – – –Options exercised (455) 2216 (10,144) 2538 (765) 2714Options forfeited (183) 2559 (3,189) 2470 (152) 2714Weighted average fair value of options granted during the year 267 – –At 31 December <strong>20</strong>10Options outst<strong>and</strong>ing 1,674 2455 49,065 2439 – –Movements during <strong>20</strong>11Options granted 397 2551 – – – –Options exercised (268) 2372 (10,408) 2125 – –Options forfeited (116) 2627 (3,435) 2933 – –Weighted average fair value of options granted during the year 245 – –At 31 December <strong>20</strong>11Options outst<strong>and</strong>ing 1,687 2479 35,222 2484 – –Range of exercise prices2164to 30011882to 3487 –Weighted average remaining contractual life 743 days 1,887 days –Options exercisable 80 2794 23,556 2598 – –1Weighted average exercise price.The fair value of options is estimated at the date of grant using the Black-Scholes option pricing model. The following table gives the assumptionsapplied to the options granted in the respective periods shown. Expectations of early exercise are incorporated into the model.<strong>20</strong>11 <strong>20</strong>10 <strong>20</strong>09Average share price (pence) 2963 3058 2651Weighted average exercise price (pence)<strong>AstraZeneca</strong> Share Option Plan – – 2281SAYE Schemes 2551 2907 2563Expected volatility (%) <strong>20</strong>.0 <strong>20</strong>.0 25.0Dividend yield (%) 6.0 5.5 4.0Risk-free interest rate (%) 3.6 2.5 3.7Expected lives: <strong>AstraZeneca</strong> Share Option Plan (years) – – 6.0Expected lives: SAYE Schemes (years) 4.5 4.2 4.2The expected volatility is based on the historic volatility (calculated based on the weighted average remaining life of the share options) adjustedfor any expected changes to future volatility due to publicly available information.No other features of options granted were incorporated into the measurement of fair value.180 Financial Statements<strong>AstraZeneca</strong> <strong>Annual</strong> <strong>Report</strong> <strong>and</strong> <strong>Form</strong> <strong>20</strong>-F <strong>Information</strong> <strong>20</strong>11